Binance sees peak derivatives trading activity during US hours despite CFTC case – Kaiko

Binance sees peak derivatives trading activity during US hours despite CFTC case – Kaiko Binance sees peak derivatives trading activity during US hours despite CFTC case – Kaiko

Derivatives trading account for nearly 80% of all trading activities on centralized exchanges globally.

COVER ART/ILLUSTRATION VIA CRYPTOSLATE. IMAGE INCLUDES COMBINED CONTENT WHICH MAY INCLUDE AI GENERATED CONTENT.

Binance’s derivatives trading volume remains strong during U.S. trading hours despite the ongoing legal action by the Commodity Futures Trading Commission (CFTC), according to Paris-based crypto data provider Kaiko.

Derivatives are financial instruments whose value is determined by an underlying asset, like Bitcoin. Popular derivatives include futures contracts, forwards, options, and swaps. These instruments allow investors to hedge, leverage, and speculate on the markets.

In March, the CFTC filed a legal complaint against Binance, alleging that the exchange illegally facilitated trading derivative orders on commodities for U.S. citizens. While the lawsuit immediately impacted Binance’s share of perpetual futures trading during U.S. hours, that trend appears to have evaporated six months later.

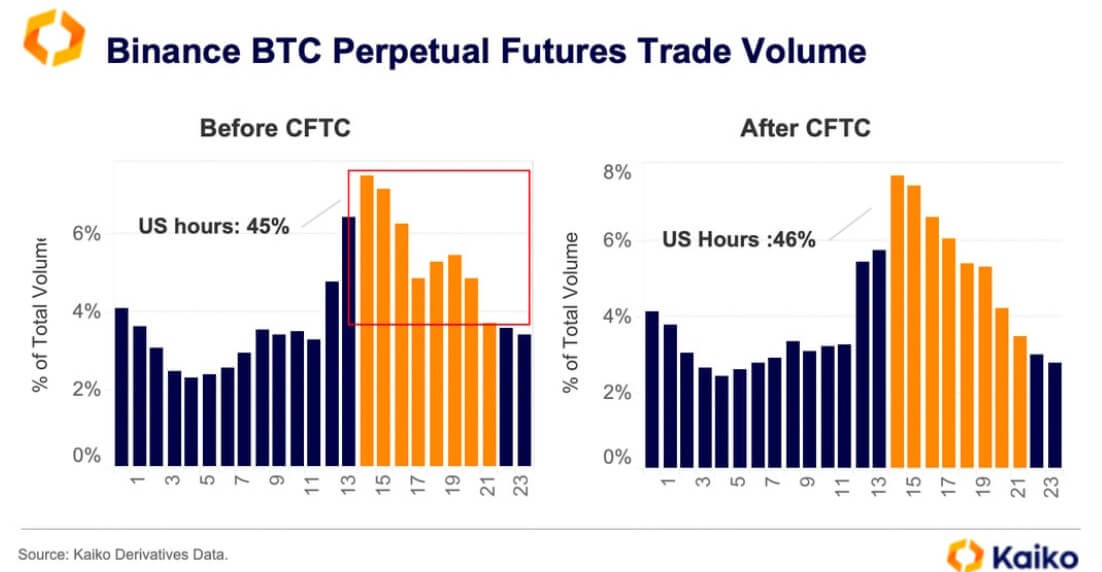

In its recent data analysis, Kaiko pointed out that the exchange’s trading volume in the hours preceding the lawsuit accounted for approximately 45% of its daily average volume. However, six months after the CFTC lawsuit, trading during these hours has increased to 46% of the total daily volume.

“[Binance’s] Volume still peaks at the opening of U.S. trading hours, which in total account for 46% of daily average volume,” Kaiko said.

Data from the crypto analytics platform CCData showed that derivatives trading activities climbed to a new all-time high of nearly 80% of all trading on centralized exchanges. Binance controls more than 50% of this market.

Binance, the largest crypto exchange by trading volume, has faced significant headwinds over the past months across several jurisdictions, including the U.K., Nigeria, and several European countries. Additionally, the exchange has had to deal with the continued exodus of several top executives amid the regulatory issues it faces across these places.

Meanwhile, Kaiko noted the challenge of identifying the geographical origins of crypto traders, given the inherent market anonymity. As a workaround, they employed U.S. trading hours as a proxy to estimate trader locations.

CryptoQuant

CryptoQuant