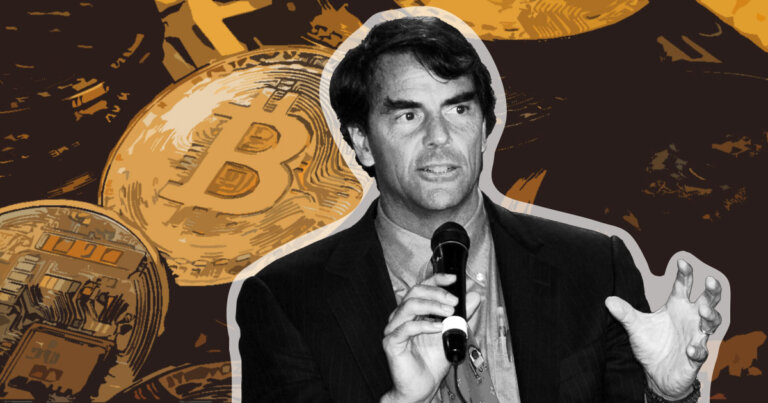

Billionaire Tim Draper tells businesses to hold Bitcoin in the SVB aftermath

Billionaire Tim Draper tells businesses to hold Bitcoin in the SVB aftermath Billionaire Tim Draper tells businesses to hold Bitcoin in the SVB aftermath

Draper said cryptocurrencies are a good option to hold excess cash as it needs to be a long-term holding that is easily saleable in times of crisis.

JD Lasica / CC BY 2.0 / Wikimedia. Remixed by CryptoSlate

Billionaire venture capitalist Tim Draper believes businesses should hold “at least two payrolls worth of cash” in Bitcoin (BTC) and other cryptocurrencies.

Draper did not specify the percentage allocated to Bitcoin versus altcoins. However, he called BTC a hedge against deteriorating economic conditions.

Bitcoin is a hedge

Draper said that the collapse of banks like Silicon Valley and Silvergate shows the need for contingency plans to ensure that a business always has cash at hand to be able to sustain itself and its employees. He added that governments have been over-regulating and micromanaging the banking sector, harming its long-term health.

He said businesses need to diversify and decentralize to remain sustainable in the current economic conditions. Such bank collapses will become more likely if governments continue over-printing money and whipsawing the interest rate to contend with the resulting inflation.

Draper said that state takeovers and lenders’ bailouts are making governments susceptible to insolvency, and Bitcoin offers a potential solution. He said:

“Bitcoin is a hedge against a ‘domino’ run on the banks and on poor over-controlling governance.”

He added that cryptocurrencies are an excellent option to hold excess cash as they need to be a long-term holding readily saleable in times of crisis.

Suggestions for cash management

Holding excess cash in crypto was one of many suggestions he shared on cash management for businesses contending with the collapse of multiple U.S. banks in recent weeks.

Draper advised businesses to diversify their risk and hold their short-term cash in two banks — one local and one global. He said the amount should be enough to sustain the business for at least six months.

Additionally, he advised businesses to incorporate yield and capital appreciation into their plans as interest rates are high now, but so is inflation — so returns on a company’s cash holdings can be “mission critical.” He said:

“Normally a company’s treasury department is mostly meant to preserve cash, but these are not normal times.”

He also recommended that businesses ensure the clients and suppliers it works with are healthy and will not cause unforeseen issues. Draper advised having “frank and honest” discussions with relevant parties.

Other suggestions included being wary of hacking and phishing and protocol tips on what to do in case it happens.

Draper also recommended businesses embrace decentralization and move away from the corporate ladder by setting up redundancies to ensure decisions are made efficiently.