What now for stablecoins following the Terra UST disaster?

What now for stablecoins following the Terra UST disaster? What now for stablecoins following the Terra UST disaster?

The Terra implosion provoked a backlash from lawmakers who say tougher rules on stablecoins are needed to govern the space.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It’s been over a week since Terra UST de-pegged, triggering a massive market drawdown.

UST’s market cap plummeted from $18.7 billion to $1.15 billion at writing. Similarly, the Terra LUNA token dropped from $21 billion to $236 million at its lowest point on May 13. The event was a wake-up call for investors who were blindsided by the severity of the losses, the repercussions of which will be felt years from now.

Previously, the UK had expressed interest in recognizing stablecoins, even proposing greater legacy integration. But now, the mere mention of them is enough to make anyone nervous. Has anything changed?

How Terra UST maintains price stability

The first sign of trouble came on May 9 as UST broke its 1:1 peg with the dollar. Unlike other stablecoins such as Tether, UST maintains its peg through an algorithmic process that moderates supply and demand in conjunction with the LUNA token.

If UST demand is high and the supply is low, the UST price increases. Likewise, the UST price decreases when demand is low, and supply is high.

Controlling this process and tying UST close to its $1 peg, the Terra ecosystem operates through the interaction of two pools of UST and LUNA. By minting one while burning an equivalent value in the other, the pools contract and expand in proportion to one another.

“To maintain the price of Terra, the Luna supply pool adds to or subtracts from Terra’s supply. Users burn Luna to mint Terra and burn Terra to mint Luna, all incentivized by the protocol’s algorithmic market module.”

When the UST price is too high relative to $1, the protocol incentivizes users to mint UST and burn LUNA. The added UST supply makes the UST pool bigger and drops its price. This action also contracts the LUNA supply and acts as a mechanism to increase the LUNA price.

The opposite situation is when the UST price is too low relative to $1, this means there is more supply than the demand. The protocol incentivizes users to mint LUNA and burns UST in this instance. The contracting UST supply increases scarcity and pushes the price higher towards the peg price. At the same time, the LUNA price drops due to the additional supply available.

Underpinning this is the market module that incentivizes users to perform the appropriate action by supplying arbitrage opportunities. Through the Terra Station Wallet, users can perform market swaps to mint and burn tokens accordingly and profit in doing so.

Recap on Terra UST stablecoin disaster

Weeks before, UST had climbed to the third-biggest stablecoin by market cap ranking. A significant factor behind this was the generous staking rewards on offer, with up to 20% available to token holders.

However, to move towards sustainability, Anchor Protocol, Terra’s lending and borrowing platform, had begun discussions to implement ‘a semi-dynamic earn rate.’ This proposed increasing or decreasing the interest rate, in increments of 1.5%, based on Anchor’s reserves increasing or decreasing by 5%, respectively.

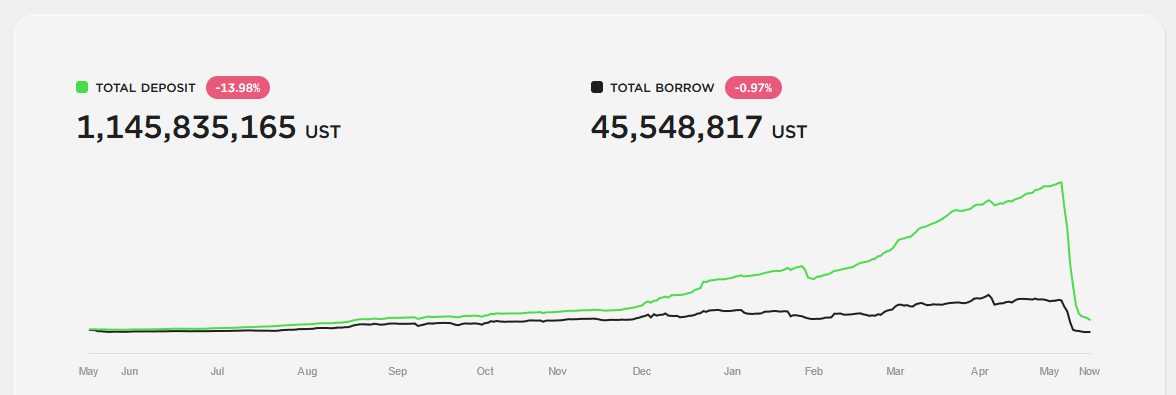

Word soon spread that the generous staking rate may not be available for much longer, triggering an exodus of users. On Friday, May 6, Anchor had approximately 14 billion UST on deposit. By Sunday, May 8, this had dropped to 11.8 billion UST.

After the Sunday, a near-vertical drop in deposits occurred as users took flight.

@0xHamz documented a flood of UST supply hitting Binance on May 7. Binance handles the most UST volume out of all providers, responsible for around 20% of total UST trades.

At the time, no one knew what was about to unfold. However, @0xHamz noted a 25 basis point drop in the UST peg price on the exchange and labeled the event non-sensical.

It means there's a bunch of supply in a place that doesn't make sense

Therefore that supply needs to exit to a place that make sense or swap into something else

Options are

– Deposit UST into Anchor

– Swap UST for USDT/USDC— 0xHamZ (@0xHamz) May 7, 2022

UST flight soon spread, putting more downward pressure on the token. One investor dumped over 85 million UST on Curve for USDC. This accelerated the de-peg with seemingly no one absorbing the supply to rebalance the pool.

Rumors exist that the collapse resulted from an orchestrated attack to bring down the Terra ecosystem. While possible, it’s equally probable that the likelihood of falling rates triggered an exodus of users leading to a cascade of more users leaving.

The world took stock over the following days as UST and LUNA sunk further into the abyss.

The fallout

In the immediate aftermath, US Treasury Secretary Janet Yellen called for new regulations to oversee stablecoins. She added that her department was actively working on a report of the incident.

Soon after, US Securities and Exchange Commission Hester Peirce reiterated Yellen’s call, adding that the events at Terra have accelerated the work towards bringing stablecoin regulation.

Although not explicitly stated by Yellen or Peirce, the general mood towards stablecoins, algorithmic or not, had soured significantly, at least from the standpoint of US authorities.

Commenting on the situation, Massachusetts Representative Jake Auchincloss proposed stablecoins be federally audited, come under the oversight of a federal bureau, such as the Comptroller of the Currency, show proof of 90-day liquid reserves (although this would be irrelevant for algorithmic stablecoins, and have insurance for customers.

Similarly, the Bank of France Governor, Francois Villeroy de Galhau, said crypto-assets threaten legacy finance if they are not regulated and made interoperable across all jurisdictions. In response, EU lawmakers propose hastening the rollout of an EU central bank digital currency.

The UK sets itself apart from the herd

Last month, UK Chancellor Rishi Sunak announced plans to turn the UK into a cryptoasset technology hub. This entails a raft of pro-crypto reforms such as recognizing stablecoins as a valid payment method, financial sandboxing, development of an industry body to interface with government, and re-examining tax rules.

Seemingly unfazed by the Terra turmoil, the UK has recently signaled its intent to press ahead with pro-crypto legislation, specifically, recognizing stablecoins as a means of payment under the Financial Services and Markets Bill.

However, a Ministry of Finance spokesperson said the proposed legislation does not cover algorithmic stablecoins.

The UK Treasury said the above reforms would foster opportunities for growth while, at the same time, allowing for financial stability as the nascent digital asset market develops.

Clear divergence is taking place

Although the US and EU have taken the Terra collapse as an opportunity to get heavy-handed, the UK is going the other way and embracing the opportunity being presented.

This signifies a clear divergence in policy, which is set to end in one way only – capital flight to crypto-friendly jurisdictions.

Moreover, this divergence will become more apparent over the coming months as nations “pick a side.” The question is, who will join the UK?

CoinGlass

CoinGlass

Farside Investors

Farside Investors