How to make money with crypto by yield farming

How to make money with crypto by yield farming How to make money with crypto by yield farming

Yield farming is the staking or lending of crypto assets in order to generate returns or rewards in the form of more cryptocurrency.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

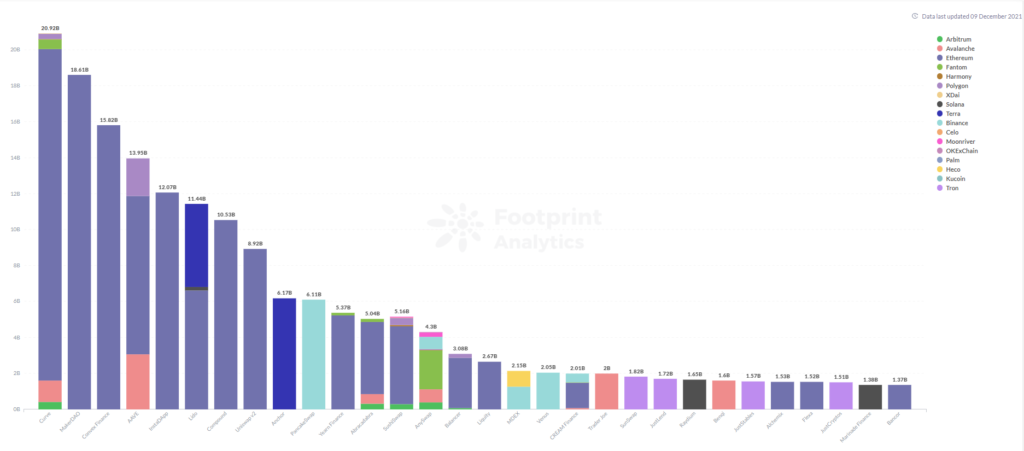

The DeFi world is rapidly expanding, and as the global financial system continues its transformation towards digitalization, DeFi has very large growth potential, attracting the attention of over 3 million investors worldwide. Hence, it is essential to understand the assets, markets, investment approaches, etc.

We have covered the basics of DeFi in the previous article. In this one we will dive into:

- 3 Major DeFi investment categories

- How investors earn passive income by participating in DeFi investment

- Current risks of DeFi projects

- 7 perspectives to evaluate a DeFi project

2 ways of investing in cryptocurrencies

Referring to investment types in cryptocurrencies, they can be divided into fiat and token-based.

Fiat-based Investment

- Cryptocurrencies (also called tokens) are regarded as stocks, then CEX or DEX is a stock exchange.

- Alex, an investor, can buy and sell cryptocurrencies on CEX or DEX, selling high and buying low to earn the difference and gain revenue, referred to as “speculation”.

- In this case, all Alex cares about is the price changes of cryptocurrencies, using ROI (Return on Investment) to the evaluation indicator.

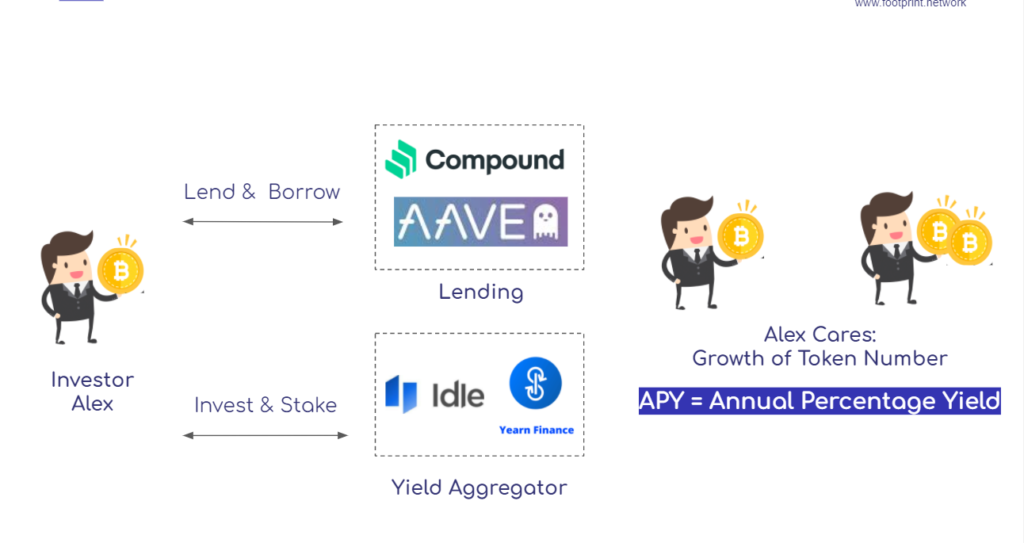

Token-based (or Yield Farming)

- When investors are bullish on certain cryptocurrencies over the long term, the easiest investment strategy is to “Hold” them; while a smarter strategy is to make better use of them by creating greater passive income.

- For example, investor Alex can deposit cryptocurrencies to the lending platform Compound or yield aggregator Idle for interest income.

- In this case, all investor Alex cares about is the growth in the number of cryptocurrencies and the APY earned through Yield Farming.

We will further our discussion in Yield Farming by introducing the 3 Major DeFi investment categories, which are: AMM DEX, Lending, and Yield Aggregator.

DEX: Uniswap as an example

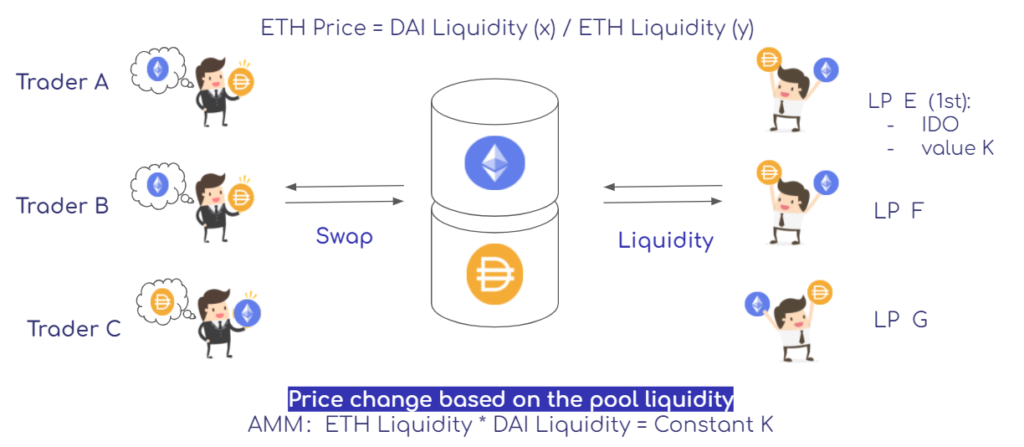

Uniswap is built on Ethereum as the decentralized exchange and supports all cryptocurrencies on this network. Unlike traditional orderbook exchanges, it uses an AMM (Automated Market Maker) algorithm to allow users to exchange various ERC-20 tokens with higher efficiency.

In Uniswap’s AMM model, a liquidity provider (abbreviated as LP) is required to create a pool of liquidity for traders to swap the required tokens.

There are 2 scenarios included.

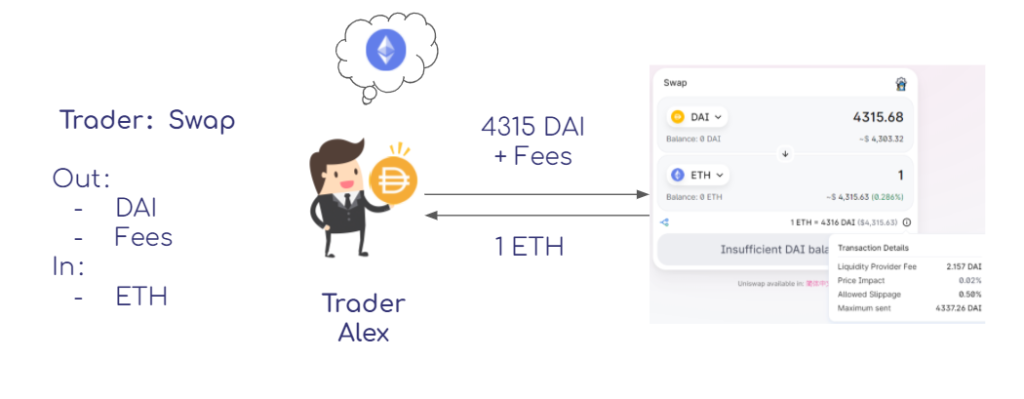

For traders, they swap.

Suppose 1 ETH is equal to 2220 DAI, and trader Alex wants to swap his DAI for ETH. He needs to pay 2220 DAI plus a trading fee (for easy understanding, all scenarios in this article ignore gas fee) to get 1 ETH.

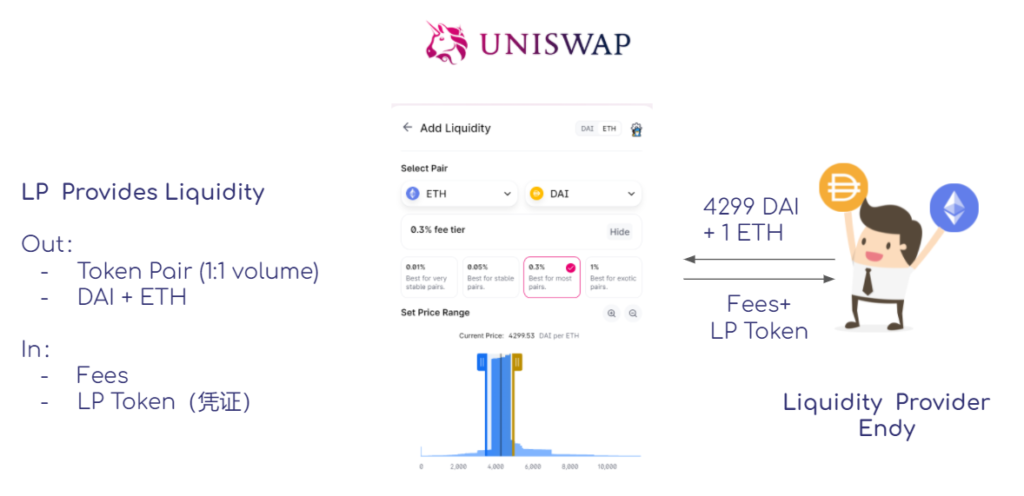

For LPs, they provide liquidity.

Endy as LP needs to provide a pair of two tokens (e.g. DAI+ETH) to the liquidity pool with equal value. In return, he will receive a partition of the trading fees from the trading activities. Also, he will receive an LP token, which is the credential for providing liquidity and represents his share of the overall liquidity pool.

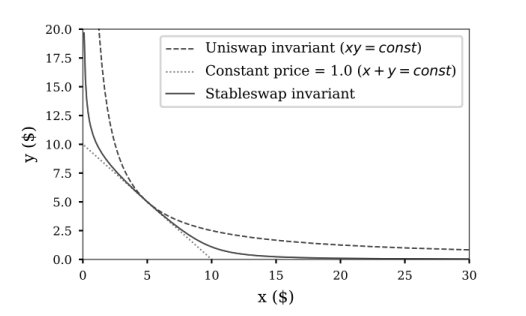

How does it realize the automatic pricing? This brings us to the “constant product market maker” model behind Uniswap’s AMM mechanism. The formula for this model is: x*y=k, where x and y represent the liquidity of each, k is a constant.

It is worth noting that the model does not vary linearly. In fact, the larger the relative amount of the order, the larger the magnitude of the imbalance between x and y. That is, the price of a large order increases exponentially compared to a small order, leading to an increasing sliding spread.

In the process of providing liquidity, LPs need to be aware of impermanent losses.

What is impermanent loss (IL)? Here is an example:

Assuming Endy holds 2000 DAI and 1 ETH (1 ETH= 2000 DAI), he has 2 options.

Option 1: as liquidity provider (LP)

- Provide 2000DAI + 1 ETH to form a token pair to the liquidity pool

- When the price changes: ETH = 4000DAI (outside DEX), arbitrageurs will buy ETH at Uniswap (cheaper), and sell to other DEX with a higher price

- This will result in a decrease in the number of ETH in the pool and an increase in the price of ETH until it equals to 4000DAI. (arbitrage opportunity disappears)

- At this point, Endy’s LP Token is worth 2828 DAI + 0.71 ETH, which is equivalent to holding 5657 DAI.

Option 2: just hold them

- When the ETH price changes to 4000DAI, Endy’s assets are equivalent to holding 6000DAI.

Under the same conditions, “Option 1 provides liquidity” is 343 DAI less than “Option 2 just holds”, or a 5.72% drawdown. This loss is called Impermanent Loss. When ETH recovers 2000 DAI, this impermanent loss will disappear.

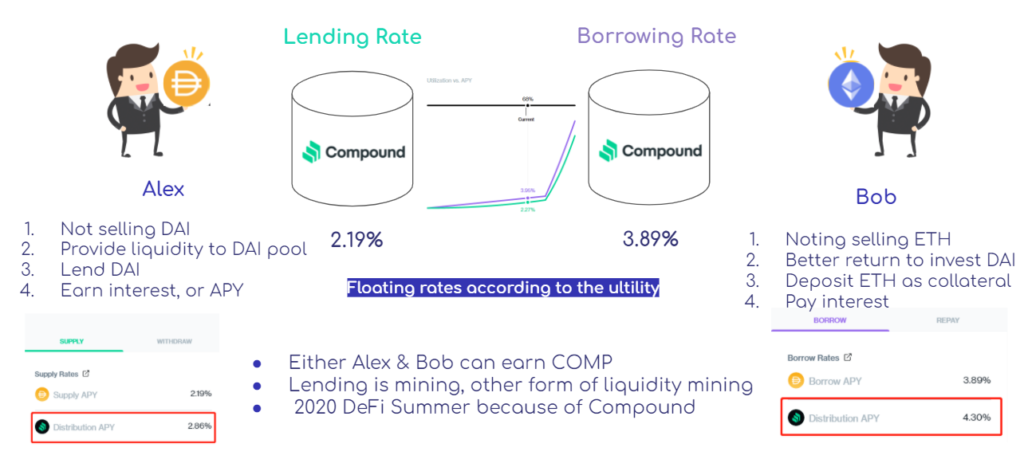

Lending: Compound as an example

In DeFi’s lending platform, an investor provides a crypto asset in the pool to earn interest; if this deposit is collateralized, the investor is able to borrow another crypto asset. Currently, DeFi’s lending platform typically uses “over-collateralization”, where the borrower provides assets worth more than the actual loan in case of default.

Example:

- Alex, the investor, with DAI that he doesn’t want to sell, so he puts it into the pool as a lender to lend it to people in need, thus earning interest

- Bob knows a good investment opportunity in DAI, but he doesn’t want to sell the ETH he has, so he uses ETH as collateral to borrow DAI and pays interest.

- In this process, both Alex and Bob are rewarded with COMP platform tokens, which is what we call Liquidity Mining.

Yield Aggregator: Idle & yEarn

Nowadays, DeFi projects are popping up all over the place. Investors might face the following problems:

- Too many platforms with different interest rates: how to choose the best?

- Interest rates are always changing, so are the prices:

- Borrowers might be accidentally liquidated, what to do?

- Lenders might need to keep changing the protocols for better interest rates, causing high gas fees

- Investors can’t keep an eye on the market 24 hours a day.

DeFi’s Yield Aggregators can somehow solve the above troubles, where the value of a specific asset provides a complex investment strategy that combines lending, pledging, and trading to maximize profits.

- Idle: It is an ethereum-based protocol that allows users to get the best interest by investing in a single asset. It currently supports the financial services of Maker, Compound, dYdX, Aave, Fulcrum and other protocols. When depositing with Idle, you will receive a complex APY, consisting of the APR from the token you deposited, the platform token IDLE and COMP.

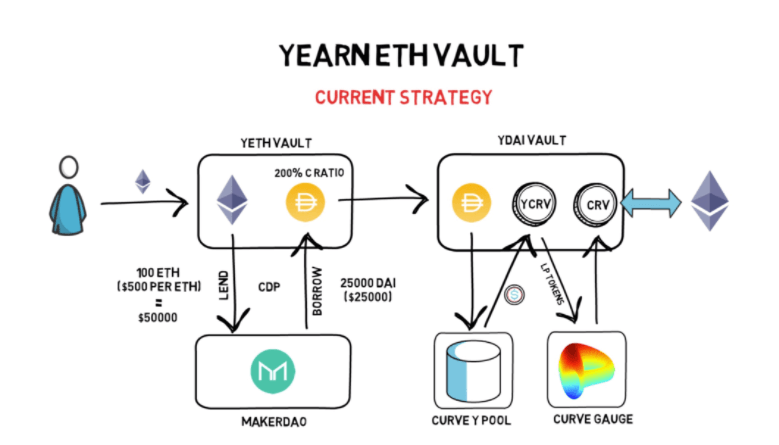

- yEarn: It is also a protocol on Ethereum with the main goal of generating the highest return for the tokens deposited. It features programmatic asset management to deploy the best strategy.

Take the ETH Vault as an example.

- The Investor deposits ETH into the ETH Vault, which will deposit ETH into MakerDao as collateral to borrow stablecoin DAI.

- The borrowed DAI is deposited into Curve Finance’s liquidity pool, receiving LP tokens in return and trading fees in the form of basic APYs. LP token can be staked into the Curve’s CRV gauge to earn CRV rewards.

- The earned CRV is then converted into ETH, and will be deposited to the ETH Vault again. Such a cycle continues until the investor withdraws.

- The investor eventually receives ETH-settled interest and pays a certain amount of management fees.

Risk of DeFi Projects

The diversity of investment opportunities and the continuing growth make DeFi an attractive and lucrative investment. However, as with any investment, there are risks associated with a DeFi investment.

Protocol Risks

- Smart contracts: hacked (even with audit)

- Single smart contract

- Protocols built on multiple smart contracts

- Protocol risks

- Scammers: pools with protocol token + stablecoin providing high APY

- Token dumped by Wales causing price zero

- The volatility of Token Price

- Borrower: Easily get liquidated

- LP: Impermanent loss

- Operational Risks

- Wallet risk: stolen risk of seed phrase、private keys

- DeFi authorization:

- Cancel the authorization for a protocol not in use

- Don’t put all your eggs in one basket

How to evaluate a DeFi project

Investors must do their own research (DYOR) before investing, start with the following 6 aspects:

1. Basic questions to ask:

- Which type, on what blockchain, audited yet?

- When go-live, ranking of TVL, 24H users

- Whether on CoinGecko or CoinMarketCap?

2. Fundraising history with famous inventors

3. Project introduction: Official website + public articles + GitHub

- Business model, competitors, differentiate features

- Any negative news? pay attention to Too Good reports considering the neutrality of the media

- Economic model (token distribution for the team: within 15%-20% is acceptable)

- Code submit frequency of GitHub

4. Attention to the price trend

- A surge in a short time? High probability of pumping

- Risks of dumping by whales causing a large drop

5. Attention to extremely high APY

- Way to attract investors by scammers

- Cautiously try but run fast before it collapses

6. Activities of the community

- Questions of users asked: quality of the investors

- Attitude and effectiveness of admin response

DeFi offers a more convenient place for investors to choose as an alternative to traditional investments. With more and more investors, institutions, capital, and developers coming in, a more open, transparent, and safer financial system is expected.

This guide was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Farside Investors

Farside Investors

CoinGlass

CoinGlass