Yearn.finance (YFI) surges 30% in 1 day: what’s fueling the rapid rally?

Yearn.finance (YFI) surges 30% in 1 day: what’s fueling the rapid rally? Yearn.finance (YFI) surges 30% in 1 day: what’s fueling the rapid rally?

Photo by Robin Pierre on Unsplash

The price of YFI, the native token of the decentralized finance (DeFi) giant Yearn.finance, surged 30% in 1 day.

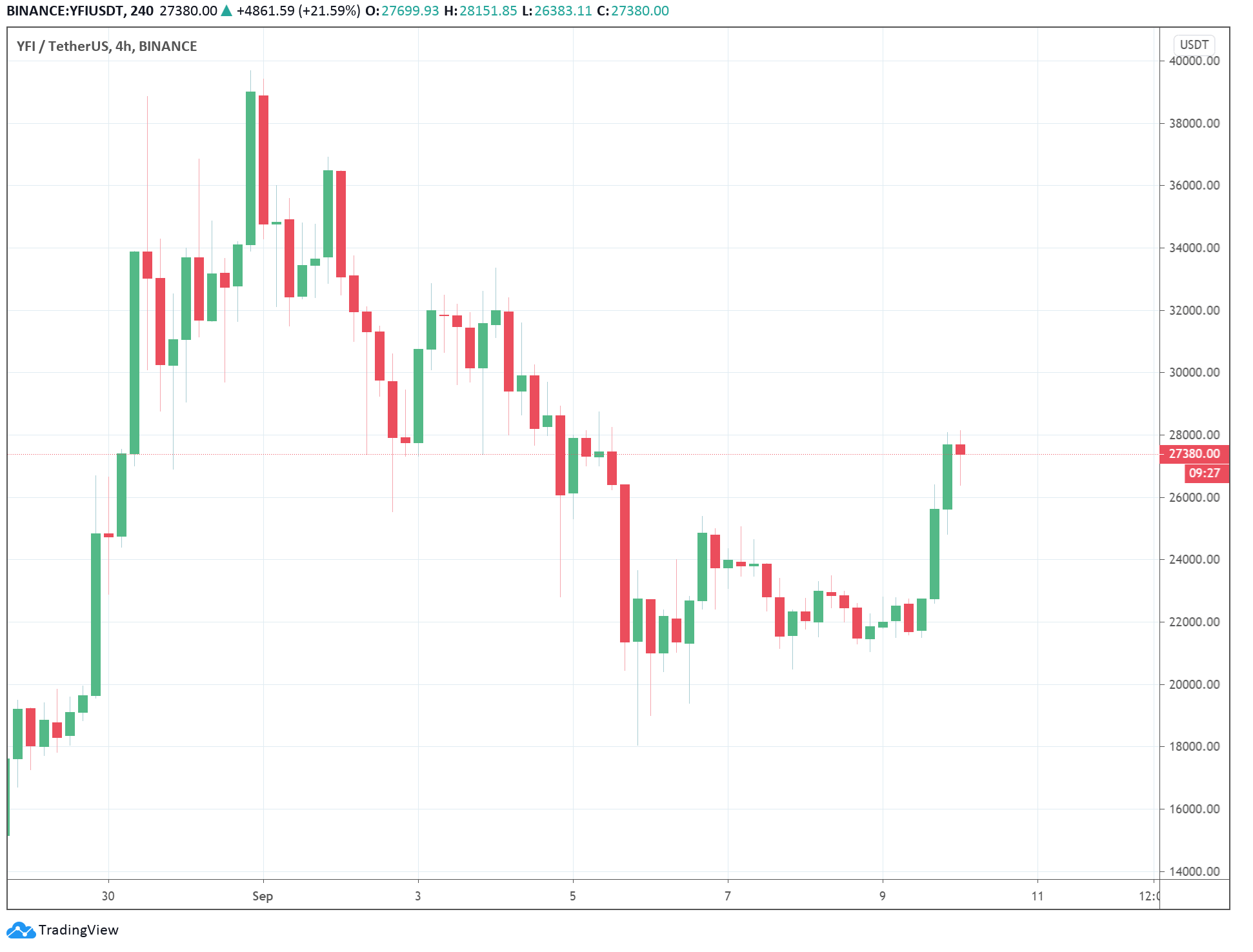

YFI rose from $21,500 to as high as $28,151 on Binance within 12 hours, demonstrating strong momentum.

Three key factors have buoyed the short-term rally of YFI: its extended consolidation, an expanding development team, and recent controversies.

Factor #1: extended consolidation

Since its initial drop to sub-$20,000 on September 5, YFI had been ranging mostly between $21,000 and $23,000.

For altcoins, which tend to see substantially higher volatility than Bitcoin or Ethereum, a five-day consolidation phase is relatively long.

Due to its exponential rally throughout August, YFI also had not seen many periods of consolidation. Hence when the price of YFI exceeded $23,500, it caused a strong rally to a major resistance level.

Throughout the past five days, YFI was below short-term moving averages for the majority of the time. Technically, that caused momentum to build over time and it fueled a huge spike in volatility.

Factor #2: an expanding development team behind Yearn.finance

Yearn.finance has rapidly expanded since early August, especially as the demand for the yETH vault massively increased.

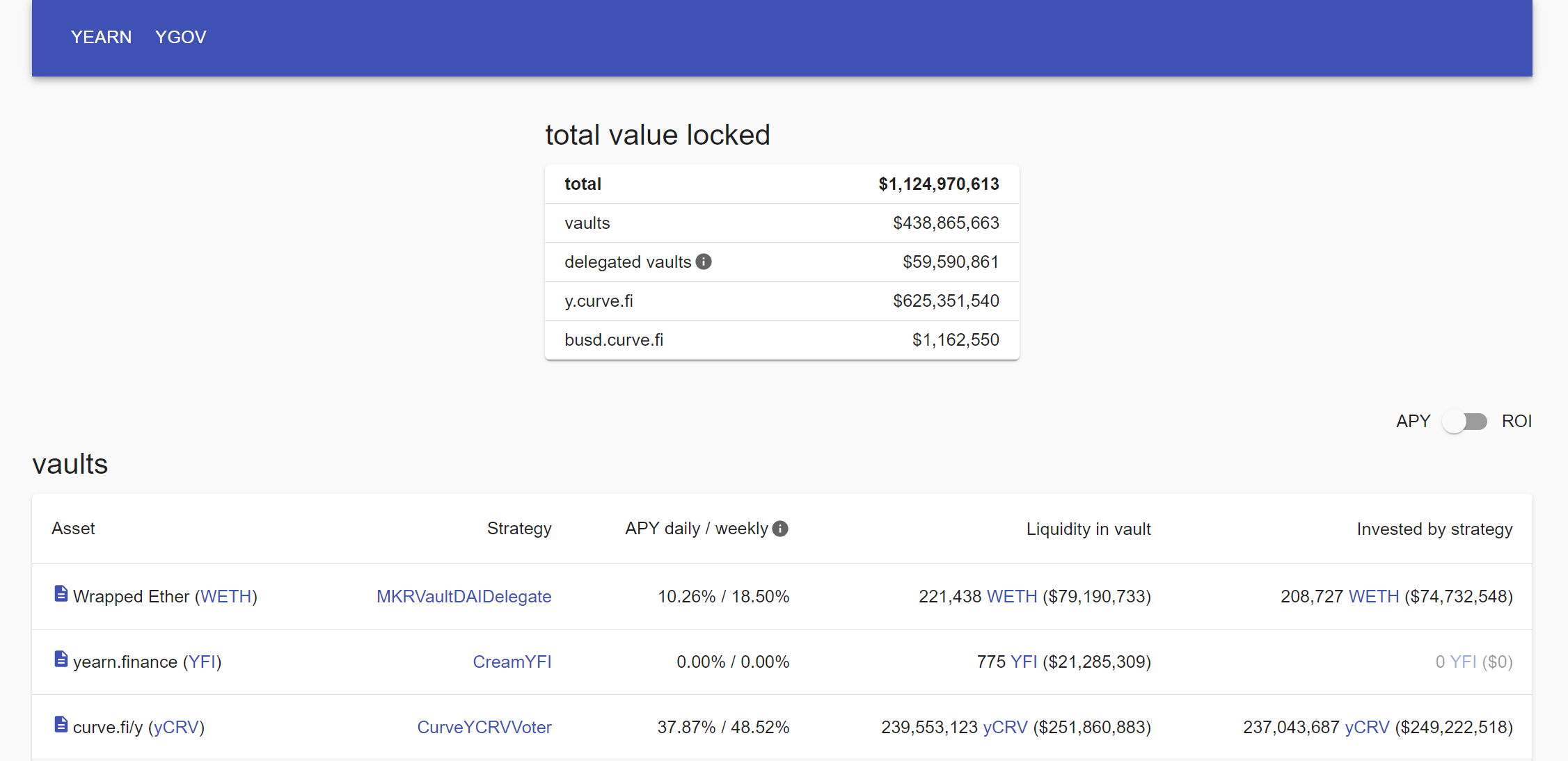

The yETH vault allows ETH holders to gain yield by simply placing their tokens within the vault. According to stats.finance, Yearn.finance has $1.124 billion in value locked. Out of the $1.124 billion, $438 million are locked in the vaults.

As the user activity on Yearn.finance sharply increased, the projected needed more developers to sustain the platform.

On September 10, the Yearn.finance team announced 12 new team members across development, content, and operations.

Factor #3: Recent controversies around SushiSwap boost Yearn.finance

As CryptoSlate extensively reported, SushiSwap founder “Chef Nomi” sold about $10 million worth of dev funds in SUSHI.

The sudden sell-off caused the price of SUSHI to drop by nearly 90% within seven days.

Since then, the community has seen newfound respect for Yearn.finance’s Andre Cronje and Uniswap’s Hayden Adams. They both released decentralized projects in a transparent manner, with no pre-mined financial incentives and clear governance models.

Cronje, the founder of YFI praised for transparently launching the token, said:

“Seeing a lot of projects promoting ‘multisig governance’ like it is a feature. It is a stopgap for proper governance. But proper governance takes time to formulate. Multisig is not a feature, its a crutch. If teams promote this as a feature, please think twice.”

The confluence of a favorable technical structure and the growing demand for Yearn.finance’s products fueled its recent upsurge.

Atop the strong fundamental factors, the confidence around the project has also started to improve due to recent controversies around pre-mined DeFi projects.

In July, Mechanism Capital’s Daryl Lau described the release of YFI as “a tale of fair launch.”

“Despite having the power to give himself a pre-mine or founder reward, he elected instead to keep zero tokens for himself,” he wrote.

yearn.finance Market Data

At the time of press 2:17 pm UTC on Nov. 7, 2020, yearn.finance is ranked #26 by market cap and the price is up 23.16% over the past 24 hours. yearn.finance has a market capitalization of $870.9 million with a 24-hour trading volume of $371.61 million. Learn more about yearn.finance ›

Crypto Market Summary

At the time of press 2:17 pm UTC on Nov. 7, 2020, the total crypto market is valued at at $334.65 billion with a 24-hour volume of $149.52 billion. Bitcoin dominance is currently at 56.93%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass