60% of investors believe ETH has better growth potential than BTC – CoinShares survey reveals

60% of investors believe ETH has better growth potential than BTC – CoinShares survey reveals 60% of investors believe ETH has better growth potential than BTC – CoinShares survey reveals

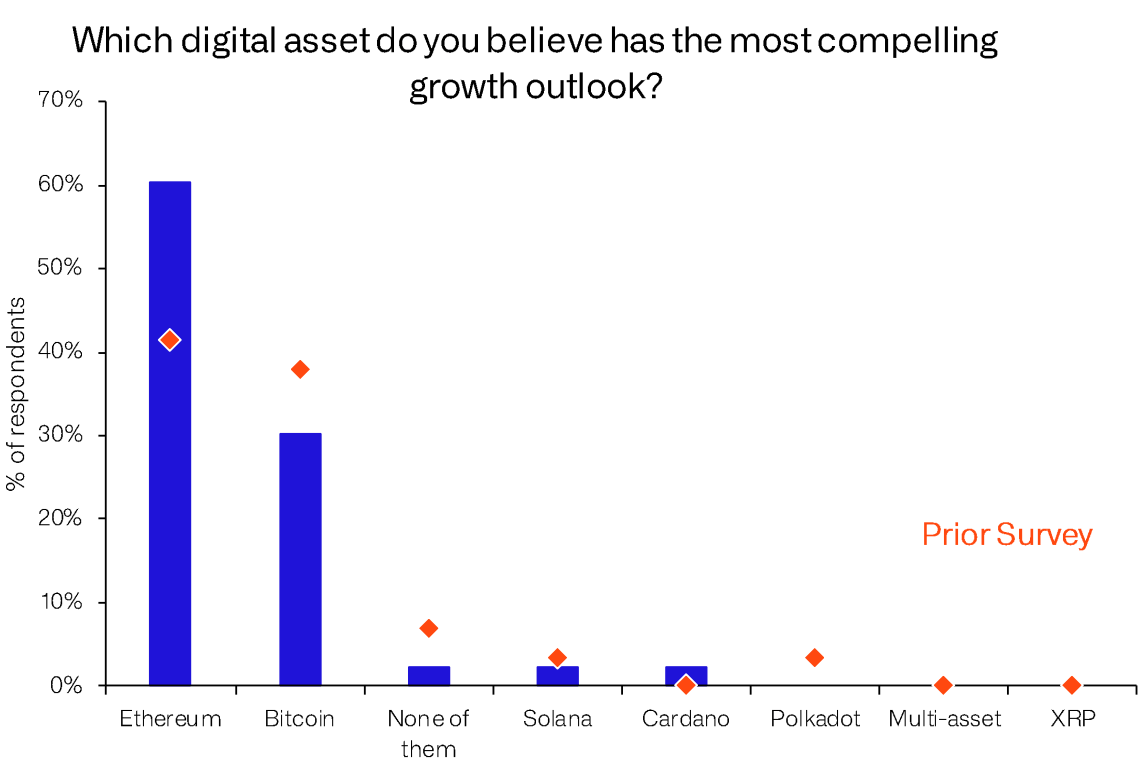

A recent CoinShares survey revealed that 60% of the participants believe ETH has a more compelling growth outlook than BTC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Around 60% of investors believe that Ethereum (ETH) has a more compelling growth outlook, according to a survey by CoinShares.

As opposed to the 60% siding with ETH, only 30% of the respondents said Bitcoin (BTC) had the most compelling growth outlook, according to the CoinShares survey.

The survey included 43 investors who managed a total of $390 billion worth of assets. Among the participants, those who identified as Wealth Managers (25%) and Family Office (25%) accounted for half of the group. Another 22% and 17% identified as Hedge Fund and Institutional, respectively.

Year-to-year changes

It can be seen that a bulk of investors shifted to ETH from BTC when comparing the latest results with results from 2022.

The blue columns on the chart below represent the latest results, while the red marks show the results from last year’s survey.

Only 40% of the respondents said ETH had more compelling growth potential, while only a little less than 40% chose BTC in the 2022 survey. In one year, investors who opted for ETH spiked to 60%, while the ones who voted for BTC fell to 30%.

Even though investors distanced themselves from BTC, this year’s results show an increase in the number of investors who invested in it. 30% of the participants own BTC, which marks an increase from 24% in 2022, according to CoinShares.

Digital assets in portfolios

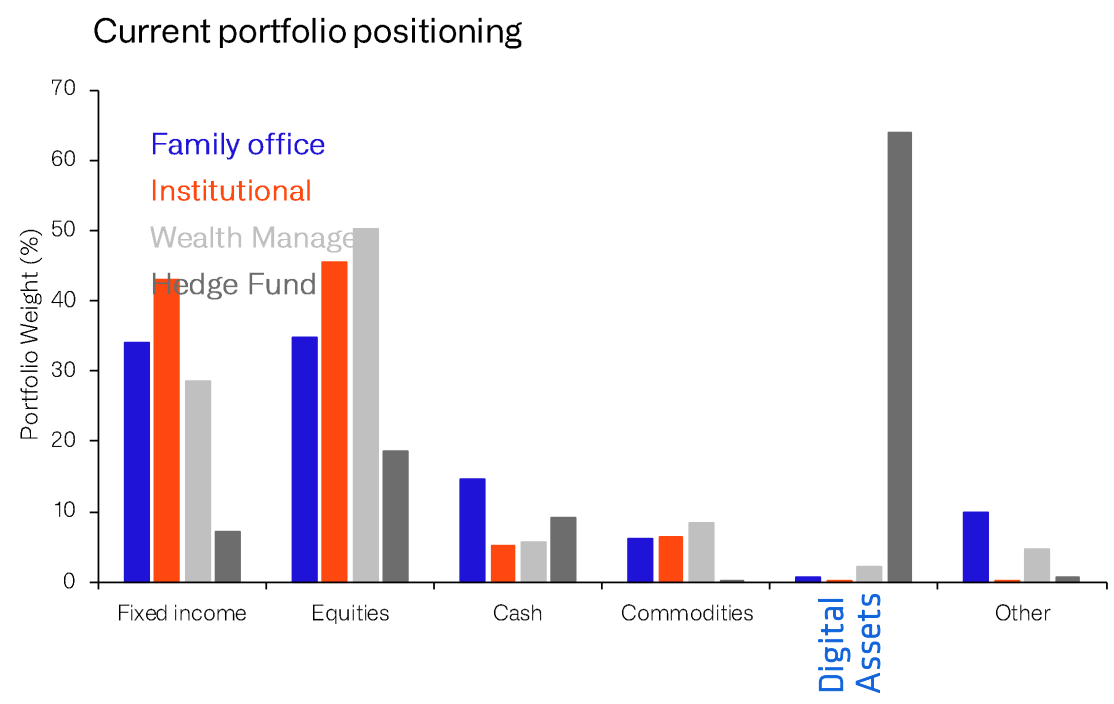

The latest numbers indicated that digital assets accounted for 1.1% of portfolios, which marks a significant increase from last year’s 0.7%.

Hedge Funds especially have considerably increased their investments in digital assets, CoinShares data revealed. In the meantime, institutional investors reduced their digital assets to below 1%.

Farside Investors

Farside Investors