What the CFTC investigating BitMEX could mean for the Bitcoin and crypto market

What the CFTC investigating BitMEX could mean for the Bitcoin and crypto market What the CFTC investigating BitMEX could mean for the Bitcoin and crypto market

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Commodities and Futures Trading Commission (CFTC) has started an investigation into BitMEX, the largest margin trading platform in the crypto market, according to a Bloomberg report.

BitMEX, along with other major margin trading platforms, have not allowed U.S. customers to trade derivatives on the platform to avoid scrutiny from U.S. regulators.

The unexpected move of the CFTC comes after the remarks of U.S. Treasury Secretary Steve Mnuchin and his warning against increased efforts to tighten policies around the crypto sector.

Going after the biggest fish in the pond

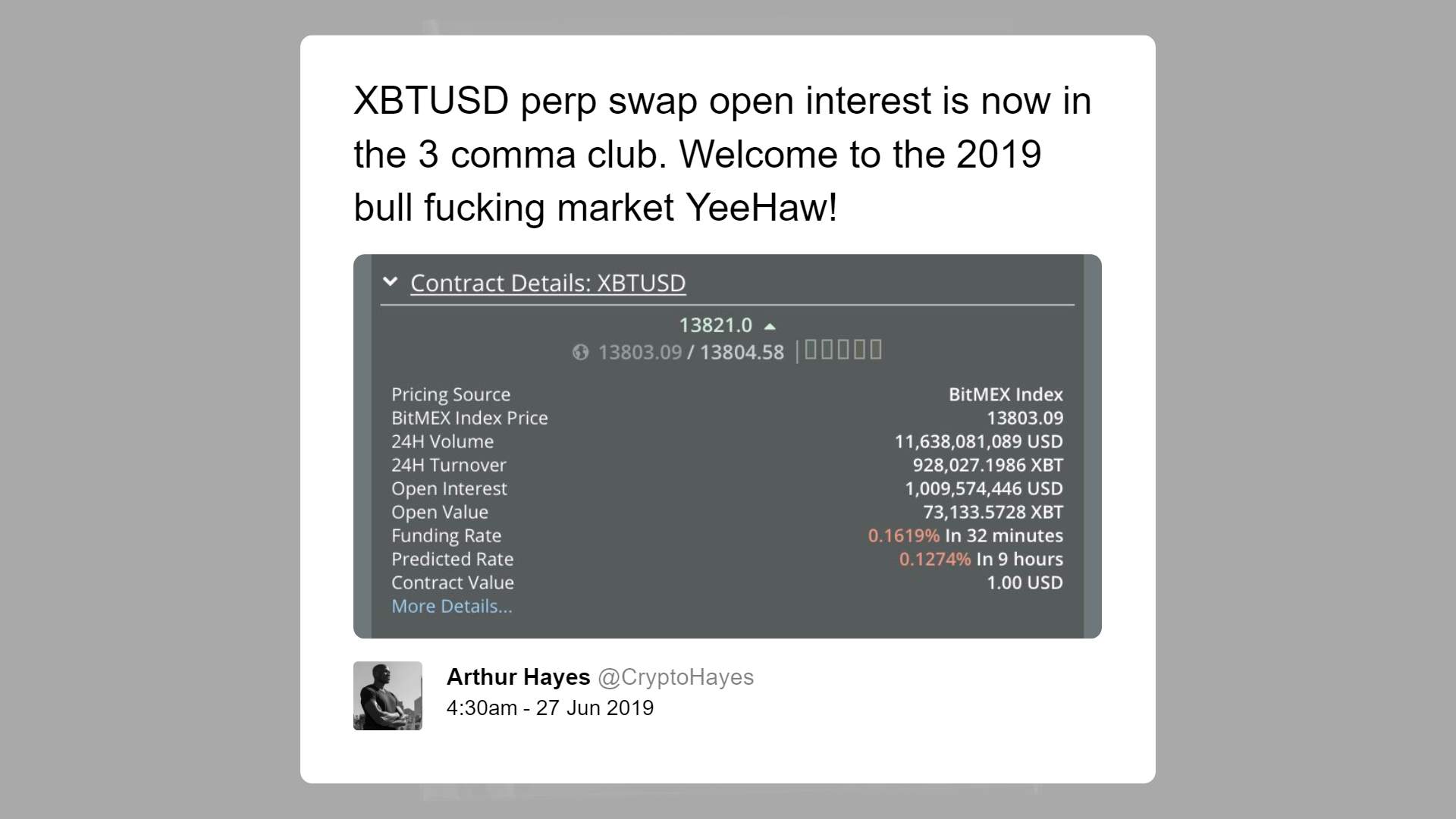

Last month, BitMEX achieved $16 billion in daily volume across its derivatives products including the widely utilized bitcoin contract when the price of bitcoin peaked at $14,000.

Primarily due to the popularity of its bitcoin contracts, BitMEX has secured its dominance over the crypto market throughout the past several years.

However, the CFTC is said to be exploring whether BitMEX has facilitated trades for U.S. customers over the years and whether U.S. customers have been able to bypass restrictions set by the exchange by using virtual private networks or VPN.

A BitMEX spokeswoman told Bloomberg that the company cannot comment on investigations by government agencies. The spokeswoman said:

“HDR Global Trading Limited, owner of BitMEX, as a matter of company policy, does not comment on any media reports about inquiries or investigations by government agencies or regulators and we have no comment on this report.”

Why is CFTC going after the biggest bitcoin margin trading platform?

Earlier this week, during an official White House briefing, Treasury Secretary Steve Mnuchin stated that with the establishment of the Financial Stability Oversight Council’s Working Group on Digital Assets, various financial agencies including the Securities and Exchange Commission (SEC), CFTC, and FinCEN will vamp up efforts to tighten their oversight on the market.

Secretary Mnuchin said at the time:

“The United States has been at the forefront of regulating entities that provide cryptocurrency. We will not allow digital asset service providers to operate in the shadows and will not tolerate the use of the cryptocurrencies in support of illicit activities. Treasury has been very clear to Facebook, to bitcoin users and other providers of digital financial services that they must implement the same anti-money laundering and countering financing of terrorism, known AMLCFT safeguards as traditional financial institutions.”

Secretary Mnuchin added that crypto money transmitters will be subject to the same standards and regulations as every other U.S. bank, indicating that FinCEN is likely to enforce existing regulations on crypto-related entities at full capacity.

The CFTC’s investigation into BitMEX, the decision of Binance to replace crypto-to-crypto trading in the U.S. with a fully regulated exchange called Binance US, and the geopolitical ban on certain cryptocurrencies by Poloniex and Bittrex indicate that companies are increasingly expecting stricter oversight in the near term.

In the short term, the BitMEX investigation could pose a negative effect on the crypto market especially due to the timing, which comes immediately after the release of the remarks of Treasury Secretary Mnuchin.