Understanding U.S. Millennial appetite for crypto

Understanding U.S. Millennial appetite for crypto Understanding U.S. Millennial appetite for crypto

A recent report that examined trends in consumer banking and payments world gave a glimpse into millennials’ financial well-being.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

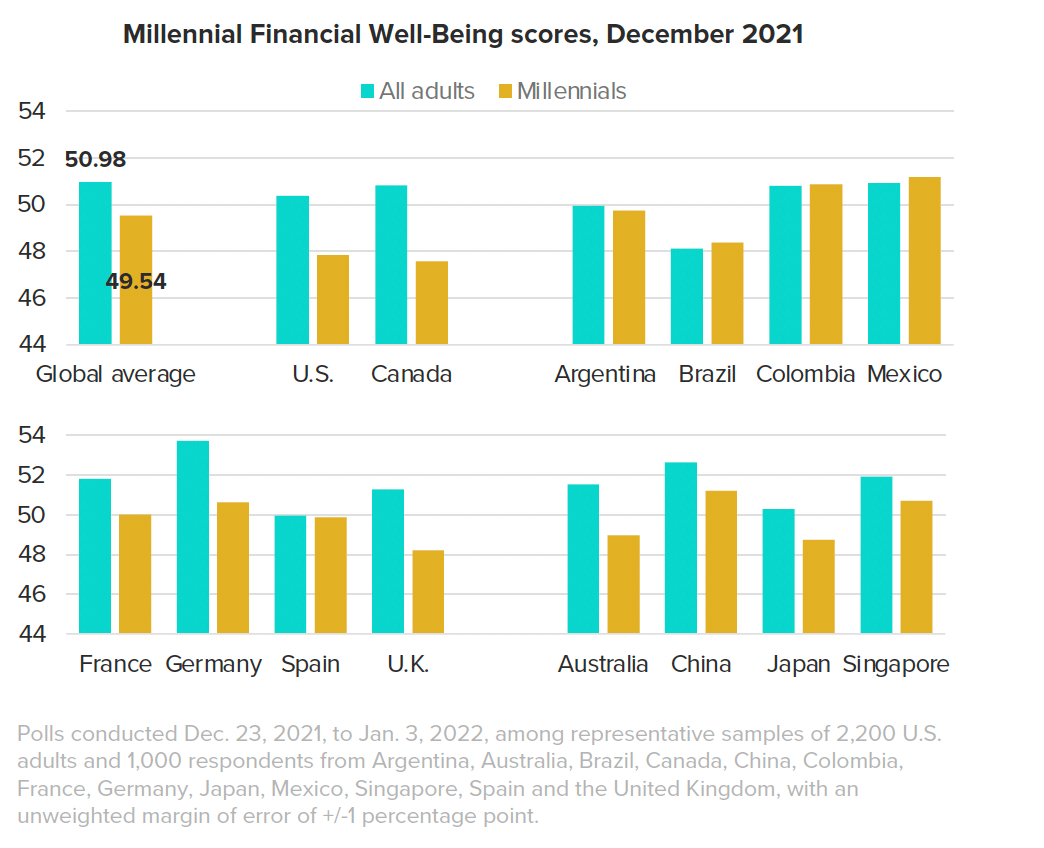

Compared to the global average, reduced financial well-being observed among US millennials could be connected to their increased interest in alternative financing methods, according to the data published in a recent report by Morning Consult.

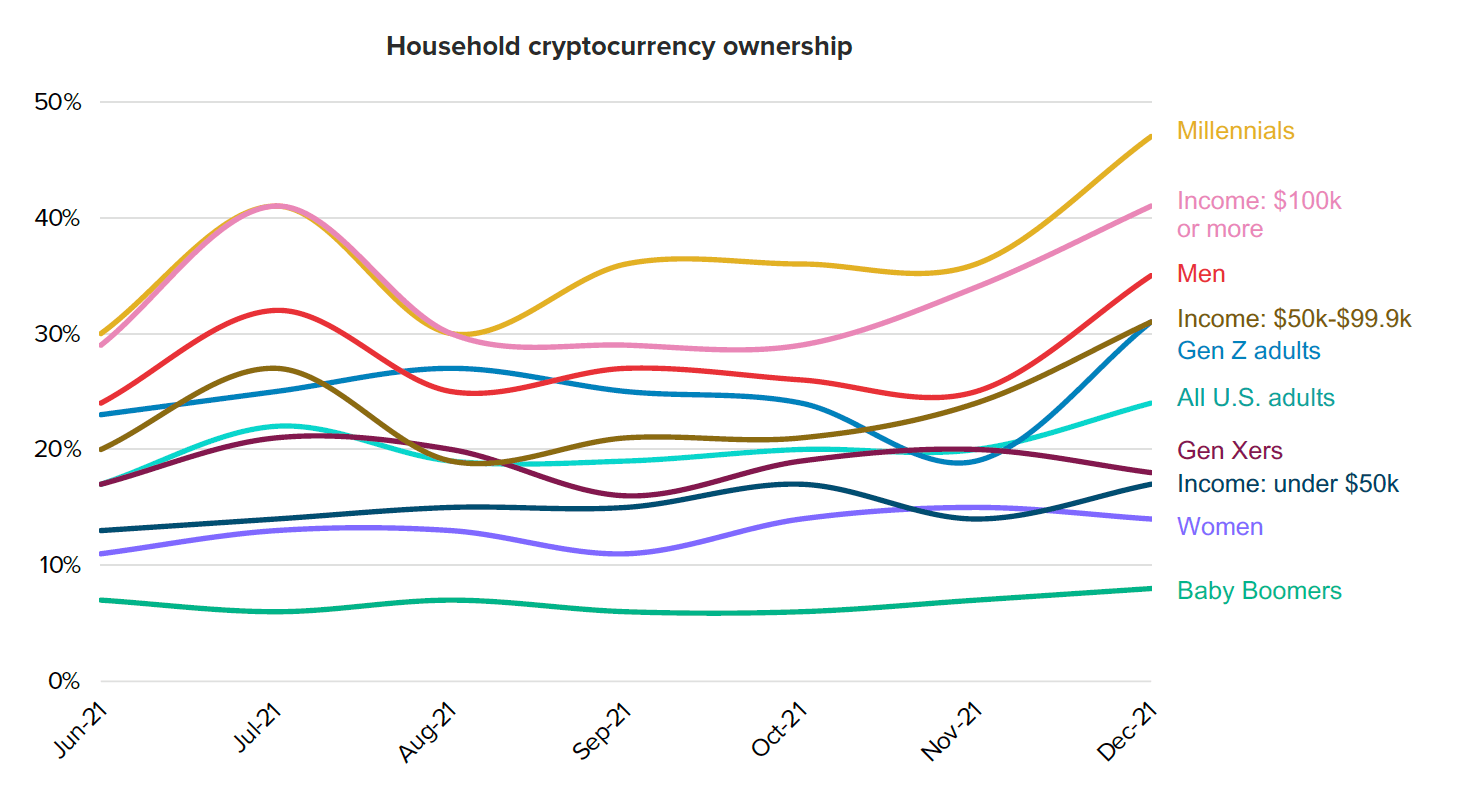

Amid rising financial vulnerability, roughly every other millennial in the US owns cryptocurrency, however, Gen Z adults have also picked up on the trend and are rapidly growing in share.

Financial well-being score

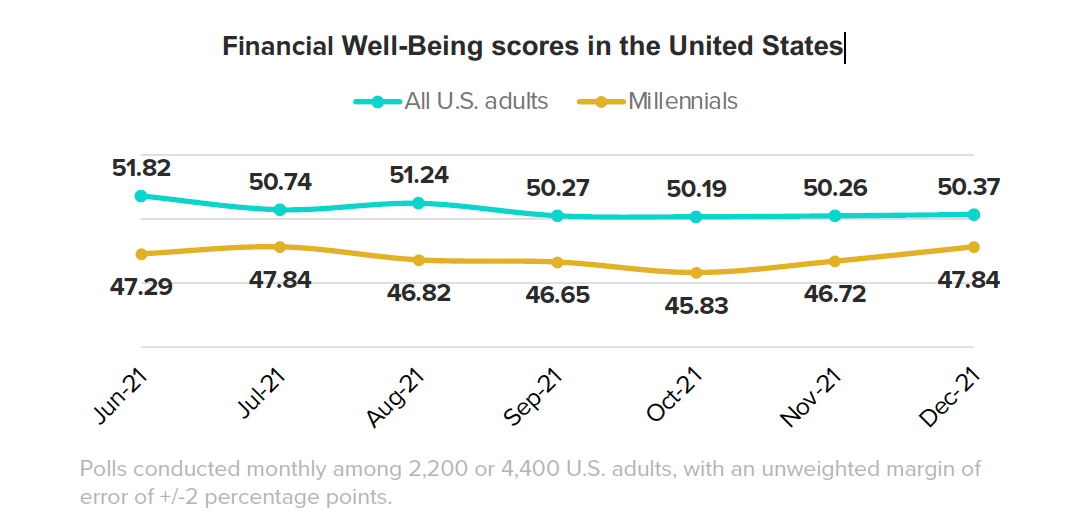

According to the report, the financial well-being score is “a reflection of consumers’ impressions of their financial security and freedom of choice,” and based on polls conducted monthly among 2,200 or 4,400 US adults, this particular demographic is having a tough time finding both.

Millennials score well below average globally, with the exception of Spain and Latin America, noted the report. However, American and Canadian millennials are particularly under the weather.

In order to meet their wide range of financial goals and needs, millennials are more likely to seek financial advice and are more social about their finances than other demographics, the report found.

“Far from being shy, millennials are more likely than other generations to report discussing their finances,” read the report, adding that millennials tend to use a number of financial service providers simultaneously.

Driving the crypto adoption

“Trying to be the only bank a millennial works with is an exercise in futility,” pointed out financial services analyst Charlotte Principato, who summarized the data and wrote up the report, explaining that the digital savvy age group is also “driving the usage of alternative financial services, cryptocurrency and BNPL services.”

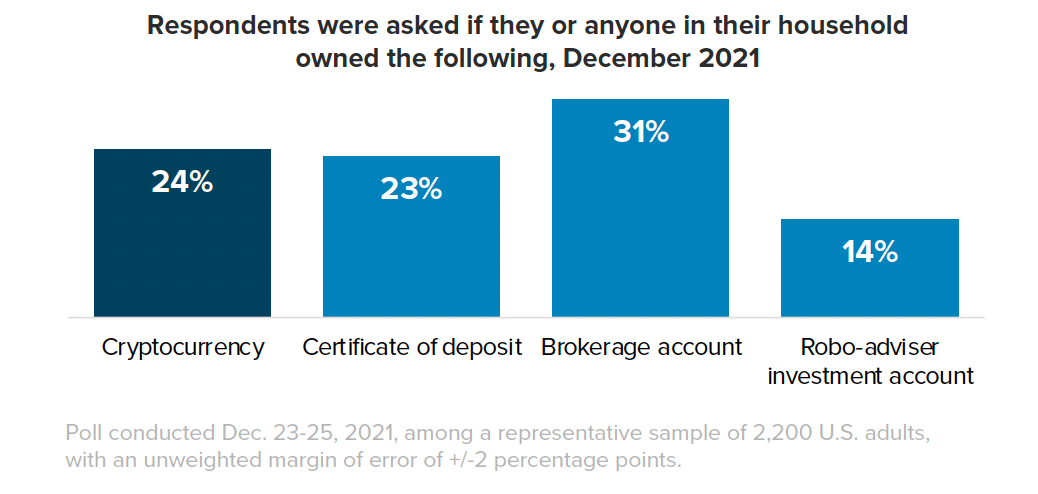

According to the report, cryptocurrencies have entered the mainstream in the US–with nearly one in four participants (24%) reporting household ownership.

The percentage of adults who own crypto is roughly equal to that of owning a certificate of deposit. Furthermore, crypto ownership is not lagging far behind the share of those reporting to have a brokerage account.

According to the report, nearly every other millennial in the US owns some form of cryptocurrency.

However, “Gen Z adults have also shown strong growth in cryptocurrency ownership and will continue to be instrumental to the success of cryptocurrency more broadly,” Principato concluded.

Farside Investors

Farside Investors