Three reasons why the DeFi crypto bull run is just getting started

Three reasons why the DeFi crypto bull run is just getting started Three reasons why the DeFi crypto bull run is just getting started

Photo by María Noel Rabuñal Cantero on Unsplash

The DeFi sector has been seeing tremendous growth in recent weeks. Although the days of every crypto-asset related to the sector seeing 100 percent returns each week may be over, there is still massive room for growth.

There are a few key reasons why this fragment of the crypto market has yet to reach its full growth potential, and even some data suggesting the sector remains undervalued compared to its utilization rates.

One venture capitalist spoke about a few of these factors in a recent post, concluding that the DeFi bull run is just getting started.

#1: Compound continues seeing growth on multiple fronts

Compound is currently the second-largest decentralized finance protocol behind Maker, with a total of $790 million worth of assets locked within it.

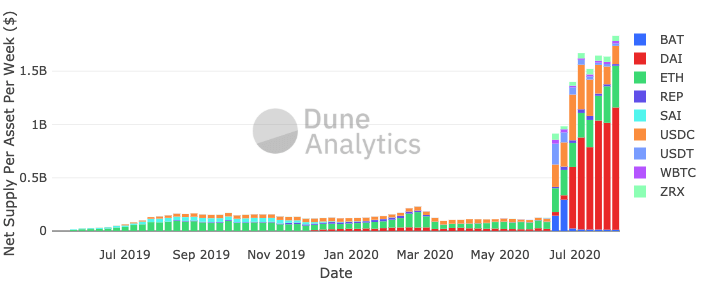

The total-value locked (TVL) within this platform has been seeing significant growth as of late, and the number of assets supplied on Compound has risen by 14x since the COMP governance token was first launched in June.

Spencer Noon – a crypto investor and the head of DTC Capital – spoke about this trend, explaining that supplied assets have increased from $124m in June to $1.84b today.

“Assets supplied to [Compound] have risen nearly 14x since the launch of the COMP governance token, with supplied assets increasing from $124m on June 14th to $1.84B today.”

A portion of this growth can be seen while looking towards the supply of DAI on the platform, which has exploded from $48m just five weeks ago to its current levels of $1.1b.

This data illustrates that the demand for protocols like Compound is more than just a fad.

#2: Balancer Labs also sees rapid growth

Compound isn’t the only protocol that is seeing tremendous growth.

Spencer Noon also spoke about three major milestones that this platform – which is currently the seventh-largest by TVL – has seen in recent weeks.

He notes that these milestones include:

- Reaching $500m in total volume

- $6m in liquidity provider fees

- $10m in daily volume from over 1,000 crypto-traders

Other platforms like Set Protocol and Aave have also seen massive spikes in activity from users.

#3: DeFi tokens still only account for a small portion of the crypto market

The growth seen on platforms like Compound and Balancer demonstrates that the recent bull run seen by many DeFi crypto tokens is rooted in more than speculation and hype.

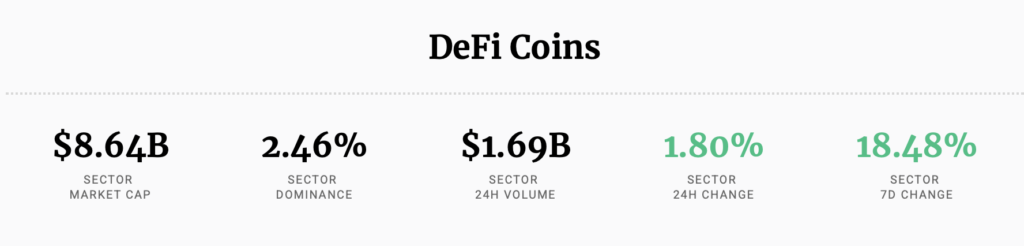

That being said, these assets still only account for a tiny portion of the entire crypto market.

According to CryptoSlate’s proprietary data, the aggregated market cap of the top 65 DeFi tokens relating to decentralized finance currently sits around $8.64b. If the oracle network Chainlink is removed from this calculation, the number drops down towards $5.2b.

To put this into perspective, Bitcoin Cash – which is considered by many to be a “ghost chain” due to its incredibly low transaction volume – has a market capitalization of $5.6b.

The relatively small size of this market fragment, coupled with growing utility, suggests there is still room for major upside for many of these crypto tokens.

CryptoQuant

CryptoQuant