This data shows Bitcoin’s halving hype is fading; here’s what this means for investors

This data shows Bitcoin’s halving hype is fading; here’s what this means for investors This data shows Bitcoin’s halving hype is fading; here’s what this means for investors

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s upcoming mining rewards halving has long been looked upon as a bullish event that will catalyze upwards momentum for BTC due to the effect it has on the cryptocurrency’s inflation rate, and historical precedent backs this notion.

It is important to note that analysts have claimed that the short-term impact that the halving has on the benchmark crypto’s price action is largely due to investors widely regarding it as being bullish, while the fundamental impacts of the event take months — or even years — to impact its price.

One key data metric seems to elucidate that hype surrounding Bitcoin’s upcoming halving is beginning to dwindle as the cryptocurrency’s price declines, which may suggest that it won’t end up having any sort of bullish near-term impact on BTC’s price.

Interest in Bitcoin’s upcoming halving plummets in tandem with its price

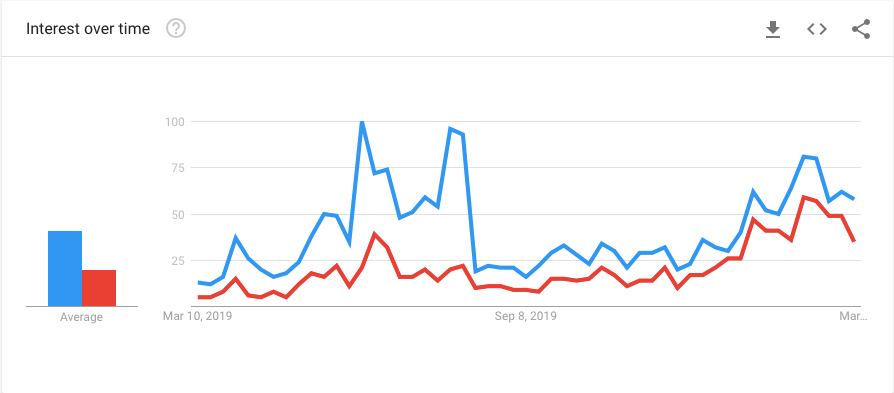

Data from Google Trends offers an interesting insight into the correlation between Bitcoin’s price and interest in the crypto’s upcoming halving event – currently slated to occur on May 11th – which appears to be moving in tandem.

The below chart shows search volumes for the terms “halving” and “Bitcoin Halving” in the United States over the past 12-months, showing a notable decline in search volume for the terms since late-February when BTC began descending from highs of $10,500.

This seems to suggest that investors’ interest in the halving is purely based on how it could influence the cryptocurrency’s price in the near-term, which could mean that ongoing selloff will nullify the narrative that the halving event will induce a price rally.

Simple factors relating to BTC’s mining economics shows that the downside could be imminent

As reported by CryptoSlate yesterday, there are a few simple factors relating to Bitcoin’s mining economics that seem to suggest the crypto will see further downside in the days and weeks ahead.

These factors were outlined by Jesse Proudman of Strix Leviathan – a crypto hedge fund – who explained that the decline in BTC miner’s income resulting from the roughly 50 percent inflation reduction will constrain these organization’s access to debt or equity capital.

“Bitcoin Miners: – Income about to be cut in half in ~62 days. – Ability to obtain debt or equity capital becoming constrained. – Balance sheet of other investments eviscerated. Walk me through the bullish scenario here in the next 60 days? And S2F isn’t it…”

This impact could result in some short-term damages to Bitcoin’s network health due to smaller mining organizations capitulating, and could further centralize the crypto’s mining power in the hands of a small number of cash-flush organizations that can weather the short-term impacts of the event.

Bitcoin Market Data

At the time of press 9:27 am UTC on Apr. 25, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.31% over the past 24 hours. Bitcoin has a market capitalization of $143.44 billion with a 24-hour trading volume of $38.35 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:27 am UTC on Apr. 25, 2020, the total crypto market is valued at at $221.79 billion with a 24-hour volume of $129.58 billion. Bitcoin dominance is currently at 64.66%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant