These three assets are dominating the crypto market’s trading volume

These three assets are dominating the crypto market’s trading volume These three assets are dominating the crypto market’s trading volume

Photo by Wengang Zhai on Unsplash

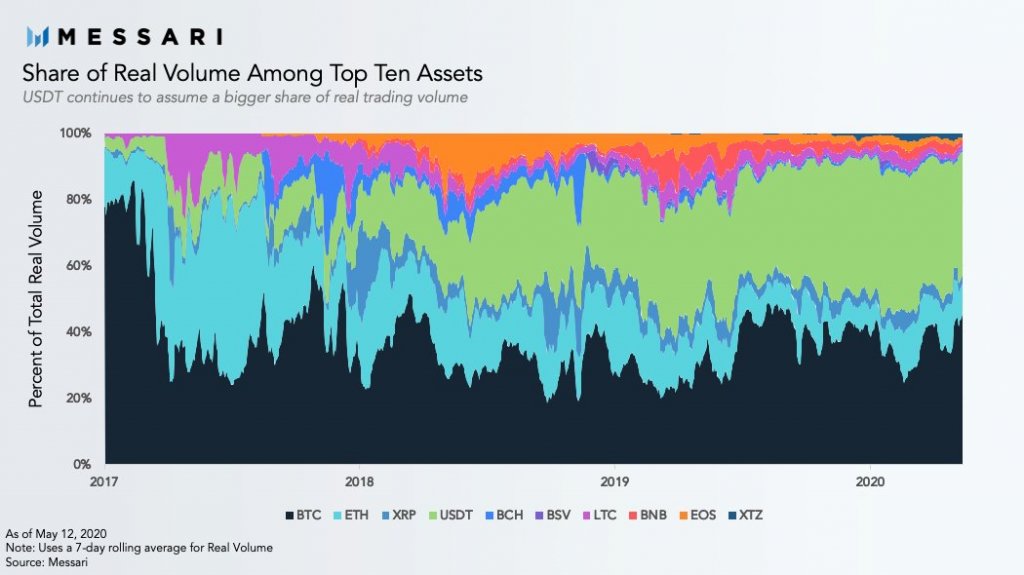

Throughout the past year, traders, users, and investors appear to have been driven primarily to three digital assets, which now account for 90 percent of the trading volume seen amongst the top ten cryptos.

This comes as the thousands of other digital assets that have sprouted up in recent years are seeing virtually no trading volume, signaling that investors have been increasingly valuing to quality and liquidity as part of their investment theses.

Tether (USDT) has seen one of the quickest growing trading volumes on a percentage basis out of the top ten digital assets – a sign that investors around the globe are widely viewing the US Dollar as a safe haven during times of economic uncertainty.

Bitcoin, USDT, Ethereum attract 90% of the crypto market’s trading volume

According to recently released research from blockchain analytics firm Messari, Bitcoin, Tether, and Ethereum have all been magnates for trading volume throughout 2020.

Collectively, these three digital assets have drawn 90 percent of the total real trading volume in seen amongst the top ten cryptocurrencies by market capitalization.

Wilson Withiam – a researcher at the analytics firm – spoke about this data in a recent tweet, saying:

“Crypto trading volume in 2020 has been all about BTC, USDT, & ETH. These three now represent ~90% of real vol within the top 10 compared to 75% just 1 year ago.”

While the data illustrated in the above graph seems to indicate that Bitcoin and Ethereum’s trading volume on a percentage basis has remained rather constant as of late, USDT’s share of the volume has been rising at a rapid pace.

It appears that the growth in USDT’s trading volume has come as that of the smaller cryptos charted above – including Binance Coin, EOS, Litecoin, and others – all dwindle.

USDT’s volume growth shows that USD is still viewed as a safe haven

USDT’s trading volume’s growth may trace back to the economic turbulence seen across the globe.

Withiam notes that crypto is “dollarizing” at a rapid pace due to the global perception of USD still being a great store of value.

“USDT’s increasing share of real vol is not surprising. As [Qiao Wang] noted, crypto is dollarizing at a rapid rate because the world still views the USD as a great store of value, especially in times of crisis. Stablecoin demand shows no signs of slowing down.”

Because Ethereum, USDT, and Bitcoin all account for such a massive percentage of the aggregated crypto market’s total trading volume, it does indicate that investors are searching for assets that they believe will perform well against a backdrop of economic turbulence.

Farside Investors

Farside Investors