South Korean crypto trading volumes soar with altcoins taking center stage

South Korean crypto trading volumes soar with altcoins taking center stage South Korean crypto trading volumes soar with altcoins taking center stage

Upbit commands an 80% market share among South Korean exchanges as altcoin trading drives the surge.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

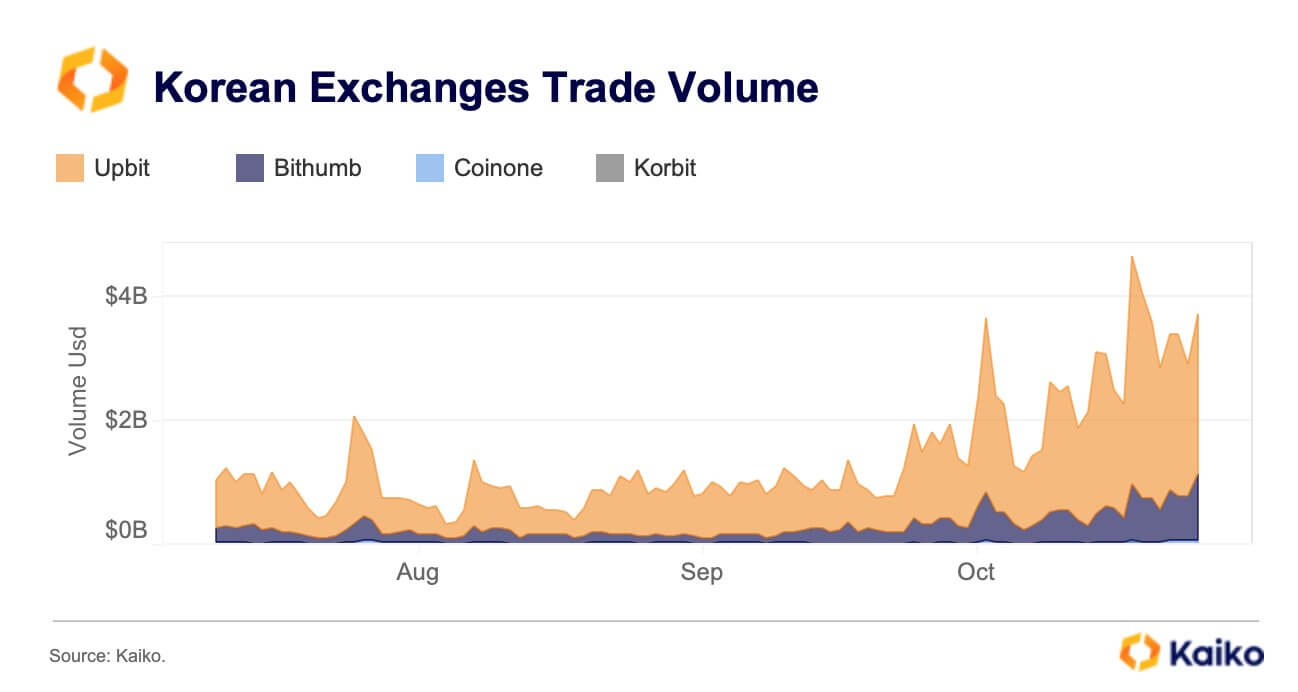

Daily trading volumes on South Korean exchanges have hit their highest point since August last year, with altcoins dominating the transactions, according to data from blockchain analytical firm Kaiko.

Trading activities on major South Korean platforms, including Upbit, Bithumb, Coinone, and Korbit, surged to an average of more than $4 billion towards the end of October and the beginning of November before dropping to more than $3 billion.

Data from CCData, as reported by Bloomberg, also corroborates these upward trading activities on South Korean exchanges. According to the report, crypto trading platforms in the Asian country saw their market shares rise to around 13% from the 5.2% recorded in January.

Around this period, the crypto market saw flagship digital assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rally to new yearly highs driven by the market optimism surrounding the possible approval of a spot exchange-traded fund (ETF) in the United States.

However, South Korean crypto traders heavily trade altcoins, according to CryptoQuant analysts.

Upbit dominates

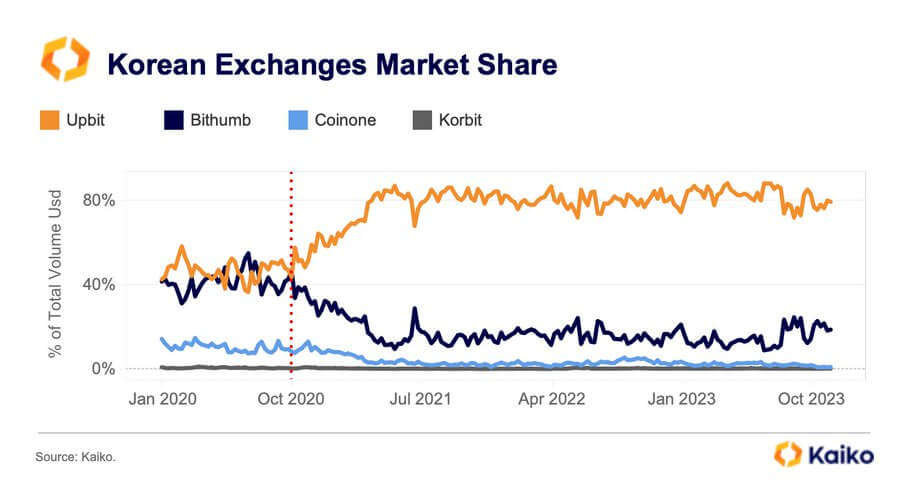

Meanwhile, the Kaiko data restates Upbit’s South Korean crypto market dominance, as the exchange accounts for most trading activities.

Kaiko noted that Upbit’s market dominance had soared to as high as 90% in May last year before slightly declining to around 80% in October 2023. Altcoins account for 88% of all trading activities on Upbit.

On the other hand, its rival, Bithumb, controls around 20% of the market. During the past year, the crypto exchange’s leadership has faced various challenges, with its majority shareholder, Kang Jong-hyun, being arrested for allegedly embezzling roughly $50 million.

This has resulted in its latest efforts to rebuild public trust by planning an Initial Public Offering (IPO) for 2025 and removing transaction fees.