Overstock Reports Loss on Strategic Crypto Investments

Overstock Reports Loss on Strategic Crypto Investments Overstock Reports Loss on Strategic Crypto Investments

Ken James / Getty images

Overstock has a long history with cryptocurrencies. Back when the dominate conversation surrounding Bitcoin was its lack of integration at major retailers, Overstock accepted the digital currency at its online discount store. Their corporate investment strategy – to hold half of the Bitcoin received from payments – is well documented.

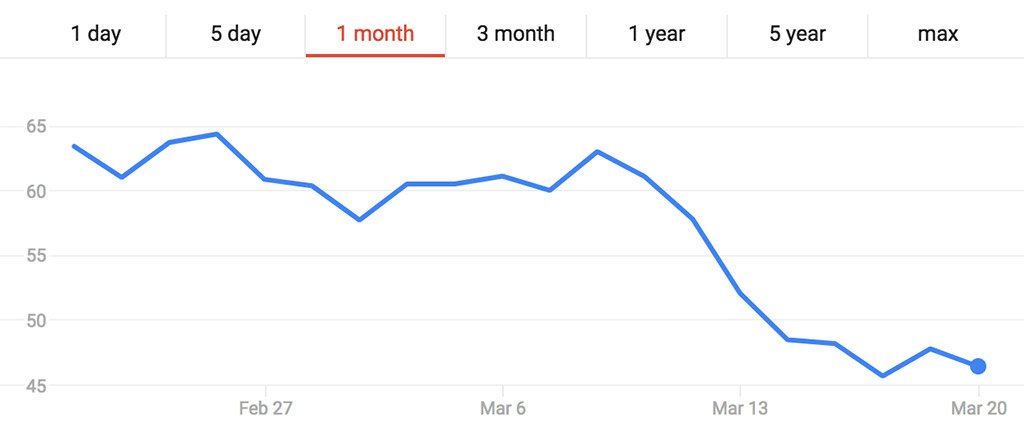

In November, Overstock’s crypto division announced a $500 million ICO through its crypto subsidiary tZero. Initially, the announcement sent Overstock’s stock price up nearly 30%. The goal was to create the world’s first regulated exchange for ICOs.

For a time, they were the winners on the front-lines of crypto mania. They integrated cryptocurrency into their payment structures, they had a comprehensive crypto portfolio, and they invested in crypto-focused startups.

In a year when cryptocurrencies felt more like an ATM than an investment vehicle, it seems like Overstock and its relevant subsidiaries should have done exceptionally well in this environment.

Strangely, they did not.

Overstock Announces Q4 Losses

On Friday, in a scheduled fourth-quarter earnings report, Overstock’s crypto unit announced a $22 million loss for the quarter. Medici Venture, Overstock’s crypto-oriented unit endured the losses, which will be paid for by the revenue generated from their recent ICO.

The losses are attributable to investments in platforms and businesses that have not generated any revenue yet. For example, their currency trading platform, tZero invested more than $20 million in companies that haven’t produced positive returns. According to the Wall Street Journal,

“tZero has generated virtually no traffic on its trading platform, and no material revenue overall.”

While Overstock is definitely an outlier regarding return on investment, their Q4 statement doesn’t mean that they don’t know what they’re doing.

Playing the Long Game

Interestingly, company leaders are not very worried about the losses. Jonathan Johnson who serves as the head of Medici said,

“Medici’s long-term goal to help companies succeed and grow…It’s not a quarter-over-quarter business. We are building long-term value over time.”

They seem committed to a long-term growth strategy that could put them at the forefront of the blockchain and crypto space.

In the meantime, Overstock will need to weather another storm. The SEC is directly investigating their tZero platform for possible securities violations. The probe is part of a broader plan by the SEC to examine certain ICOs for regulatory compliance.

In comments to the Journal, Overstock chief executive Patrick Byrne expressed his support for the SEC initiative and noted,

“The SEC is ‘clearly doing a sweep of the whole industry.’”

Despite their losses and potential legal trouble, Overstock seems committed to the long-term growth of their investments and of the blockchain industry in general. In many ways, this reflects the general crypto climate this year.

There is less emphasis on staggering, short-term growth, and more value is placed on the long-term perspective. In the near term, that means that issues like regulation and taxes must come to the forefront, and, for some companies, profits won’t necessarily be immediate.

Deribit

Deribit