Bitcoin’s $3 billion surge in short-term holder activity

Bitcoin’s $3 billion surge in short-term holder activity Quick Take

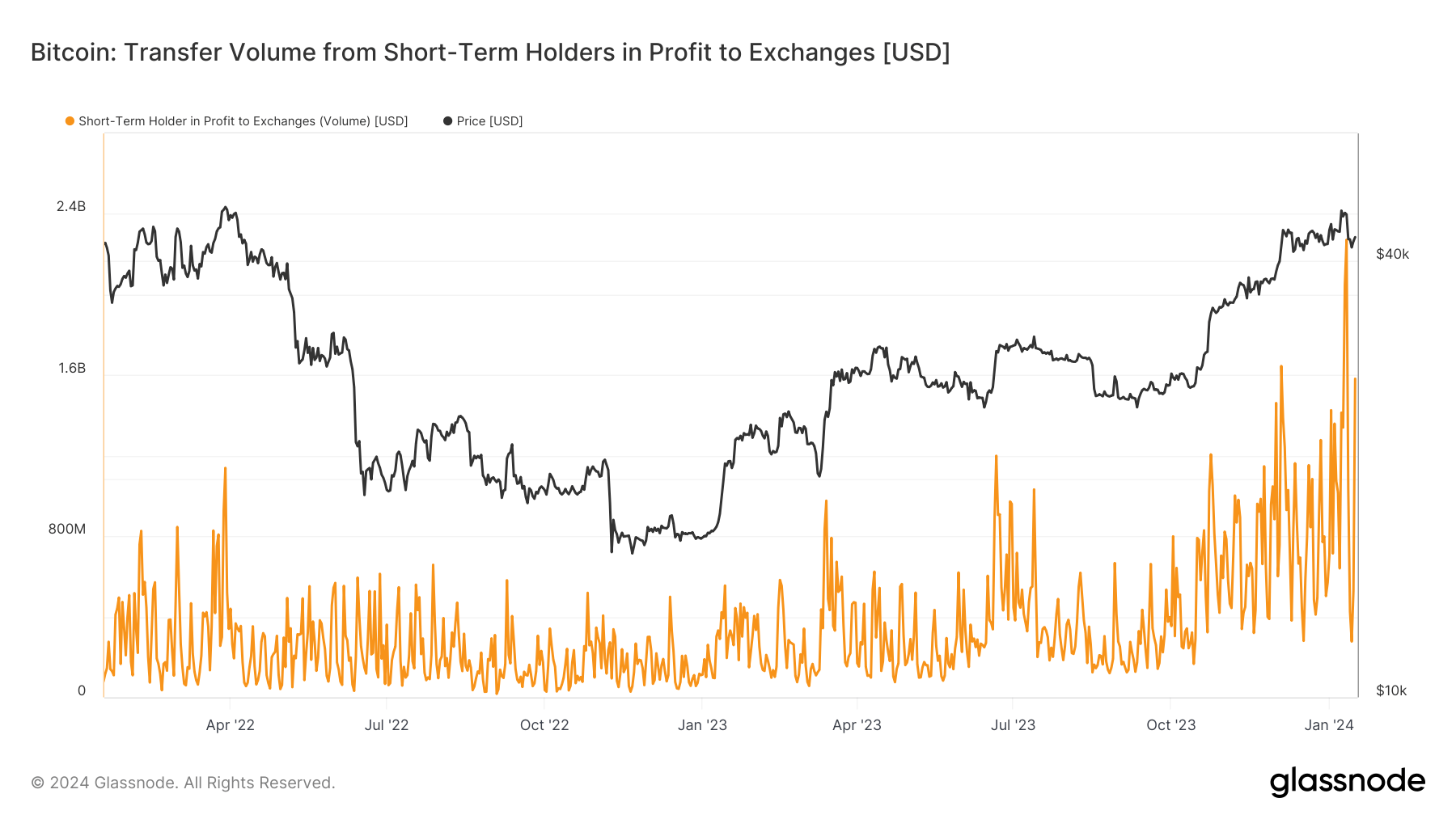

Recently, there’s been a notable surge in activities from short-term holders (STHs), defined as investors who held Bitcoin for less than 155 days. On Jan. 12, CryptoSlate reported the most significant short-term holder activity since May 2021, with $6.1 billion in Bitcoin transferred. This massive transfer is primarily attributed to profit-taking as Bitcoin’s value escalated to a high of $49,000 due to the ETF.

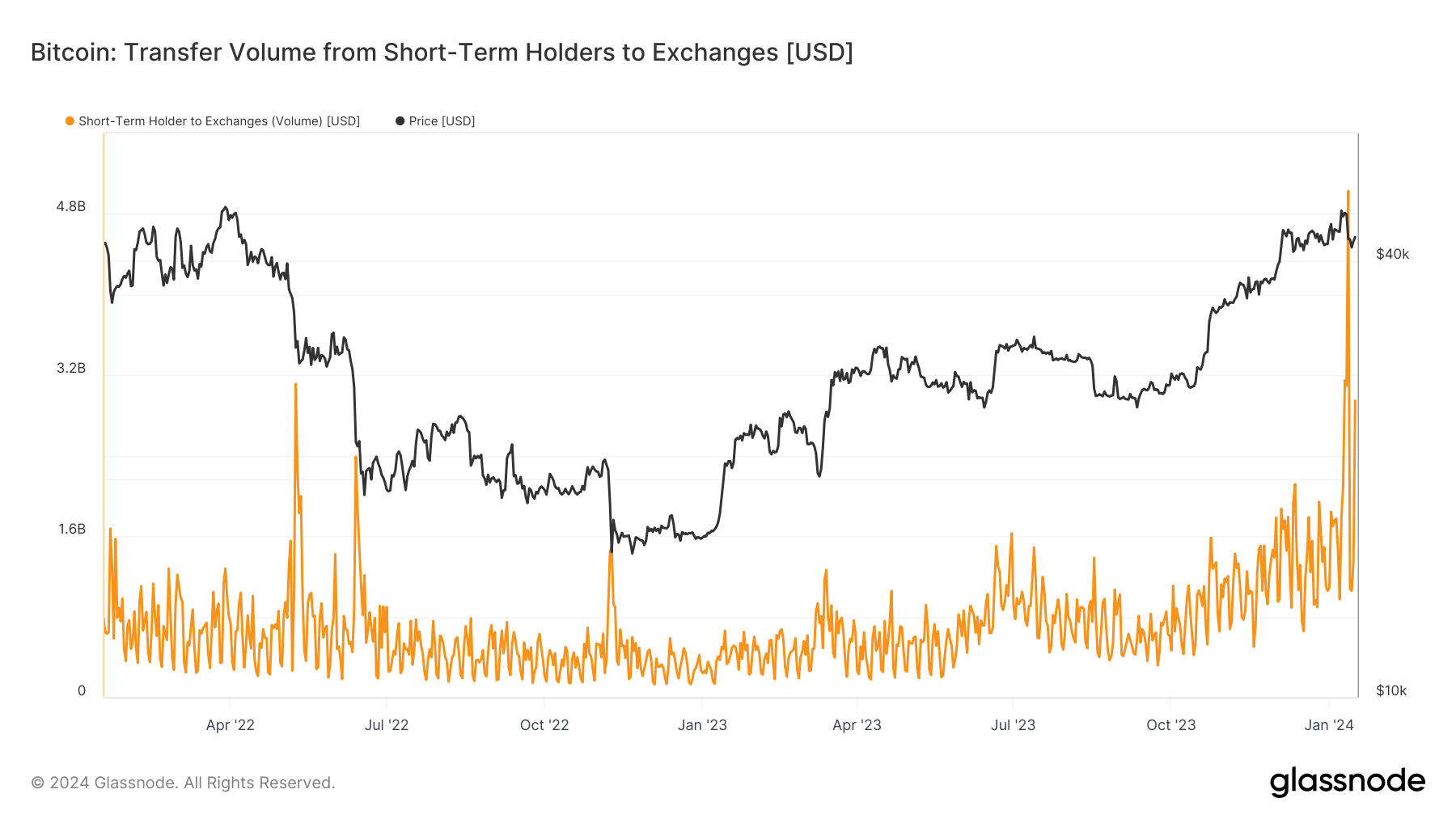

However, the climate shifted abruptly on Jan. 15. Amid the most significant single-day drop in Bitcoin value since the FTX collapse, STHs transferred a record-breaking $4 billion in Bitcoin, translating into substantial losses.

A day later, on Jan. 16, these STHs moved $3 billion in Bitcoin to exchanges. A closer look at this figure reveals a near-equal split between profit and loss, with $1.6 billion in profit and $1.4 billion in loss.

These substantial numbers indicate increased volatility and heightened activity among short-term Bitcoin holders, suggesting a reactive rather than proactive market behavior.

Farside Investors

Farside Investors