First Regulated Ethereum Futures Launched In UK: How Will Futures Contracts Impact ETH Price?

First Regulated Ethereum Futures Launched In UK: How Will Futures Contracts Impact ETH Price? First Regulated Ethereum Futures Launched In UK: How Will Futures Contracts Impact ETH Price?

Photo by Wes Hicks on Unsplash

UK-based cryptocurrency trading startup, Crypto Facilities, has become the first crypto platform to launch regulated Ethereum futures contracts, making a new derivatives contract available from 4 pm UK time on the 11th of May. The new Ethereum futures contracts represent another step toward the maturation of the cryptocurrency market as complex financial products such as index funds and crypto ETFs loom on the horizon.

In an announcement published on Friday, Crypto Facilities stated that the Ethereum futures contract would “bring greater efficiency and liquidity to crypto markets,” making it possible for market participants to take long or short positions on Ethereum, broadening investment opportunities and assisting with risk management.

Our ETH/USD Futures contracts are live!

Contract Specs – https://t.co/vDr9Cj4ZKo

Start trading now – https://t.co/dSN7CWqpPr#ETH #ethereum #Futures pic.twitter.com/fIfle36sql

— Crypto Facilities (@CryptoFLtd) May 11, 2018

Ethereum Futures Go Live

The new Ethereum futures offered by Crypto Facilities will expand the range of derivatives offered by the platform, which include both Bitcoin and Ripple futures. Timo Schlaefer the CEO of Crypto Facilities, commented on the launch on Friday:

“Ether is the second most liquid cryptocurrency after Bitcoin, trading in the billions of dollars daily, and we are excited to be launching ETH futures. The Ethereum network is the pre-eminent blockchain for smart contracts, and we believe this new trading instrument will attract more investors and bring greater liquidity to the marketplace.”

Crypto Facilities will join forces with liquidity providers BC2C and Akuna capital in order to back the Ethereum futures contracts. Toby Allen, the Head of Digital Assets at Akuna Capital, emphasized the importance of Ethereum futures as the crypto market matures:

“The addition of a futures product enables crypto traders to take both long and short positions in ETH and is another giant leap in the development of the crypto asset class.”

Crypto Facilities is no stranger to the crypto futures market — the firm currently works in tandem with the Chicago Mercantile Exchange to establish the CME CF Bitcoin Reference Rate, which is integral to the operation of Bitcoin futures.

How Will The Availability of Futures Impact ETH Prices?

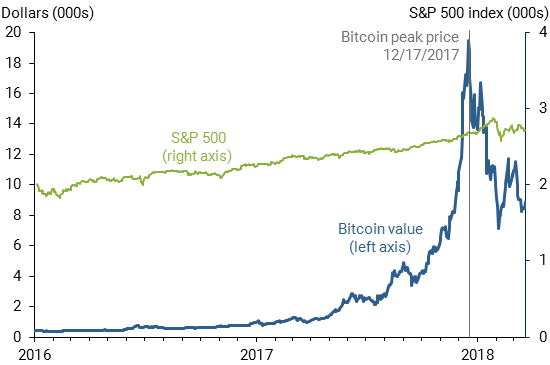

The potential impact of futures availability on the price of Ethereum cannot be understated — the launch of Bitcoin futures on the 17th of December had a significant effect on BTC values, coinciding with the all-time high of almost $20,000 on the same day.

A study conducted by the Federal Reserve Bank of San Francisco identifies the December 2017 launch of Bitcoin futures as a mechanism through which pessimists were able to enter what was, prior to futures availability, fuelled by one-sided speculative demand.

According to the study, the availability of Bitcoin futures catalyzed a reversal of Bitcoin price dynamics.

The new investment opportunity led to a fall in demand in the spot Bitcoin market and therefore a drop in price. With falling prices, pessimists started to make money on their bets, fueling further short selling and further downward pressure on prices.

Although historical data may suggest that the availability of futures may exert a negative influence on the value of a cryptocurrency as short-selling pressure from pessimists leads to a sharp decline in value, the FRBSF report also notes that the elimination of speculative dynamics leads to transactional benefits as a key driver of valuation.

With Ethereum co-founder Vitalik Buterin expressing dissatisfaction with the high levels of speculation present within the cryptocurrency market, a return to transactional benefit-driven valuation is likely far more in accordance with the ideals of Ethereum’s creator than speculative demand.

The transactional benefits of Ethereum are also far more attractive than those offered by Bitcoin. According to information available from BitInfoCharts, the Ethereum network has processed over 800,000 transactions in the last 24 hours with an average transaction fee of just $0.59 USD.

Compared to the 200,000 transactions processed on the Bitcoin network with an average transaction fee of $1.19 USD, it’s likely that the Ethereum network is more resilient to the potential damage in valuation that could occur due to the removal of speculative dynamics as Ethereum futures go live.

CryptoQuant

CryptoQuant