First Digital USD soars on Binance as overall stablecoin market sinks to two-year low

First Digital USD soars on Binance as overall stablecoin market sinks to two-year low First Digital USD soars on Binance as overall stablecoin market sinks to two-year low

Tether's USDT supply, for example, contracted for the first time since last October.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The total market cap of stablecoins has been on a continuous decline for 17 months, now standing at $124 billion, its lowest level since August 2021, according to CCData.

The data aggregator highlighted a broader impact of the decline in stablecoin’s monthly trading volume. Notably, July saw this volume plummet to its second-lowest point this year, at $453 billion.

CCData attributed this significant downturn to the subdued market dynamics observed in Bitcoin and Ethereum. These two major cryptocurrencies have experienced an unusual period of reduced volatility, reaching levels not seen in multiple years.

The firm continued that the trend could continue into August. However, it noted that the myriads of spot ETF applications before the U.S. Securities and Exchange Commission (SEC) could catalyze the market.

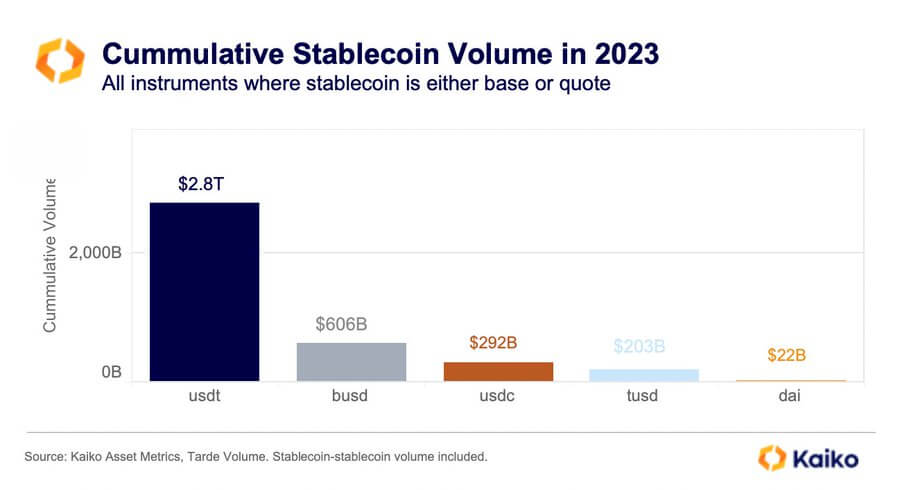

The blockchain analytics firm Kaiko stated that this year, the overall trade volume of stablecoins on centralized exchanges had crossed the $4 trillion mark

Tether (USDT) leads the pack, contributing more than $2.8 billion of the volume, while embattled Binance USD (BUSD) and Circle’s USD Coin (USDC) recorded $898 billion combined.

FDUSD thrives

Despite the overall market decline, the circulating supply of Binance-listed First Digital USD (FDUSD) skyrocketed by 1410% to $305 million, less than a month post its launch on the crypto exchange

In July, a Binance spokesperson told CryptoSlate that the firm was pushing the asset because it believes its customers would benefit from more stablecoin choices in the market. Since then, the exchange has introduced several features designed to incentivize its usage on the platform.

Of the $305 million, 280 million were issued on Ethereum (ETH), while the $25 million balance was minted on the Binance-backed BSC Chain network, as per data from DeFillama.

USDT supply declines

Meanwhile, USDT’s supply declined for the first time since last October by 0.62% to $83.3 billion as of the end of July. However, it remains the dominant stablecoin in the space, with its market dominance currently at 67.16% as of press time.

Tether’s USDT has been one of the best-performing digital assets in the current year, with its supply rising to an all-time high amid the issues plaguing its rivals like BUSD and USDC.

The stablecoin company has also maintained a healthy balance sheet, reporting substantial profits during the first two quarters of the year and intending to invest in BTC.

Across other stablecoins, CCData stated that USDC’s supply fell for the eighth month to $25.8 billion, while BUSD and TrueUSD’s (TUSD) market plunged to $3.37 billion and $2.75 billion, respectively.

Arkham Intelligence

Arkham Intelligence