The Cryptocurrency Miner’s Guide to Taxes

The Cryptocurrency Miner’s Guide to Taxes

Photo by Andre Francois on Unsplash

The April 17th tax deadline is approaching, and miners are no exception. This article dispels some of the confusion surrounding cryptocurrency mining and taxes.

Taxes on Cryptocurrency Mining

Successfully mining cryptocurrency triggers a taxable event. How the IRS treats you, however, depends on whether you mine cryptocurrency as a hobby or a business.

Mining as a business has a few more deductions and benefits than as a hobby.

Based on the IRS website, the distinction between a hobby and a business is a subjective assessment that includes some of the following factors:

- Time and effort are expended on mining with the intention to make a profit.

- You depend on income from the activity.

- You had changed methods of your operation to improve profitability.

- Your mining activity is profitable and was profitable in the previous year.

Essentially, if you have a mining rig and are seriously involved in cryptocurrency mining, then you can argue that you are a business. If you casually mine cryptocurrency on a home computer, it is probably a hobby.

Cryptocurrency earned as part of a hobby, then it is considered income with a few limited deductions. Meanwhile, if you earned the income as part of a business, then your income is the fair-value of the mined cryptocurrency less any qualifying expenses.

Mining as a Hobby

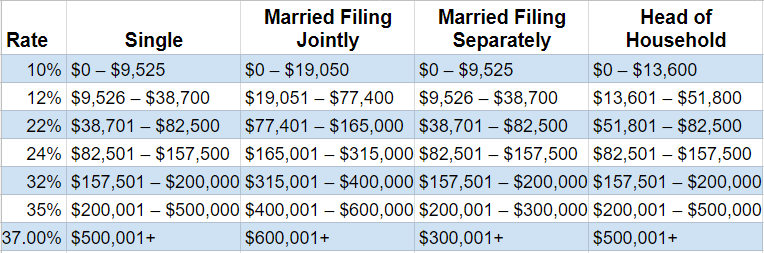

If you mine as a hobby, then it is treated as ordinary income, taxed at your marginal tax rate. This is treated as any other kind of earned income. Refer to the table below to determine which bracket your mining income falls under:

The one nuance to this is capital gains or losses between when you mined the cryptocurrency to when you sold it.

Suppose this time you mined $1,000 worth of cryptocurrency after your costs. However, you waited a month to sell the cryptocurrency. During that time the value of what you mined decreased to $900.

In this scenario, you would recognize $1,000 in mining revenue, and you would also recognize a $100 capital loss. Net, you would have a taxable income of $900 for the year from mining.

Mining as a Business

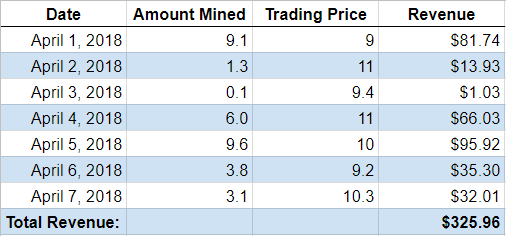

If you are a large-scale miner then calculating your revenue may become complicated. The easiest way to calculate your total revenue from mining is through an Excel table.

To calculate daily revenue take the amount mined in that day and multiply it by the trading price on a reputable exchange to find your daily revenue. Note that you may use the open, close, or average price so long as you are consistent.

Then, take your electricity bill and calculate the amount incurred because of mining. Net this amount against your monthly mining revenue to find your gross profit.

Then, qualifying business expenses such as depreciation are also subtracted from this amount. So for example, if you assume a $500 1070Ti will last you two years, and you will be able to sell it for $250 at the end of the two years, then depreciation for the month is as follows:

- (Purchase Price – Residual Value) / Time Period = Depreciation

- ($500 – $250) / 24 months = $10.4 per month

Apply a depreciation estimate on a regular schedule to all of your equipment. You may use this to reduce the taxes payable on any of your crypto-mining earnings. After this amount is calculated, factor in self-employment taxes.

For more information, see chapter 10 of Publication 334 for the IRS Small Business Tax Guide.

Impact of Incorporation

If you are mining as a business and haven’t incorporated, you are then treated as an unincorporated sole proprietorship. Any income earned by an unincorporated sole proprietorship is passed-through and added to your personal income.

However, if you choose to incorporate there is a whole other set of benefits and costs associated with a corporation. The biggest benefit is limited liability.

As a limited liability company, your personal assets are safe from debts and lawsuits involving your business.

In addition to limited liability, you can structure your corporation in several ways that impact your tax treatment differently. Each structure has its pros and cons:

A partnership is similar to a sole proprietorship, in that it is a pass-through entity. The added benefits of a partnership are that you can structure the agreement between you, and two or more people, in a way that creates different treatments for each person.

Thus, you can agree that one person gets a larger stake in the business, or has more specific responsibilities under the agreement (articles of organization).

The downside is that a partnership has limited ability to create “stock,” or “ownership units” in the case of a partnership. Ownership units are more cumbersome to transfer and require more legal legwork to create properly. All of these factors make raising outside investment more difficult.

A C-Corp is the main type of corporation you see and has a wide variety of options when it comes to creating different classes of stock.

However, corporations are subject to double taxation. Not only are you taxed on the individual level when cash is paid out by the corporation, you are also taxed at the corporate level.

Refer to the following link for more information on the corporate brackets.

An S-Corp is a corporation that elects to pass corporate income through to the owners. Owners of an S-Corp report income and losses on their personal tax returns and are assessed taxes at their individual income tax rates, thus avoiding double taxation.

To elect taxation as an S-Corp, you need to fulfill a couple of different criteria. Moreover, S-Corporations are limited in that they can only create two types of stock, voting, and non-voting. For more information, refer to the IRS guide on business structures.

Determining the best corporate structure is a complex decision. It is advisable that you first consult an attorney and an accountant before making an incorporation decision.

Wages and Other Kinds of Income

If you’re one of the pioneering few who are paid in cryptocurrency, then the cryptocurrency you receive is treated as if they were wages.

Simply take the fair-market value of the coins to get your income, and calculate that against your marginal tax bracket table above.

If you’re a business and you make a payment of $600 or more to an independent contractor for work, then you are required to report that payment to the IRS and tender the payee a 1099-Misc, and vice-versa if you receive such a payment.

These payments are again reported at the fair-market value at the time of the transaction.

Involvement in the crypto-mining is a fantastic way to increase your income. However, making sure you are on the right side of the IRS is crucial, especially as the government implements more regulation and oversight in the space.

CryptoQuant

CryptoQuant