Bitcoin Mysteriously Drops 5 Percent to $6,250: What Caused the Abrupt Decline?

Bitcoin Mysteriously Drops 5 Percent to $6,250: What Caused the Abrupt Decline? Bitcoin Mysteriously Drops 5 Percent to $6,250: What Caused the Abrupt Decline?

Photo by Caleb George on Unsplash

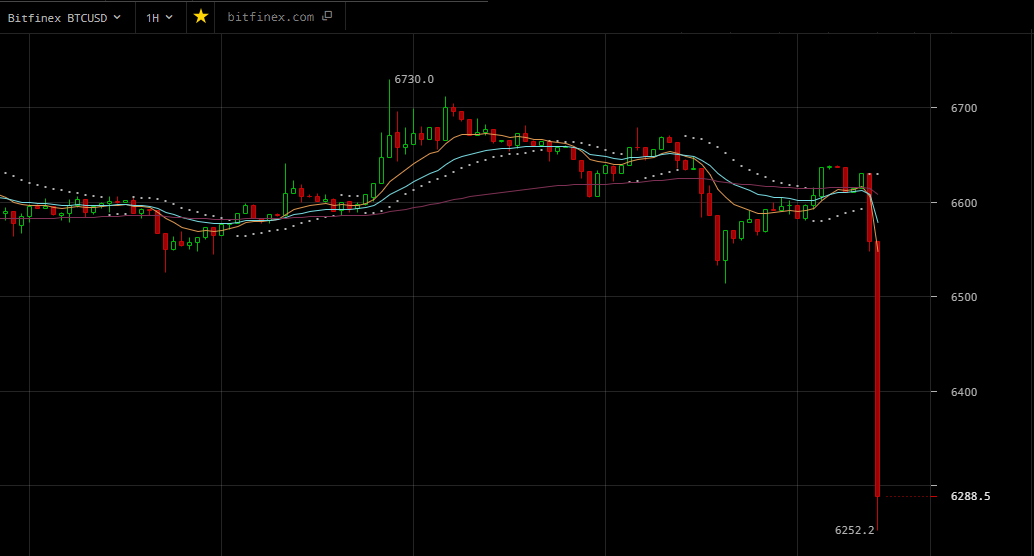

On Oct. 11, the price of Bitcoin dropped from $6,750 to $6,250, within minutes. The dominant cryptocurrency experienced a massive sell candle which saw traders dump BTC from $6,550 to $6,250 in a 10-minute period.

The sudden drop in the Bitcoin price comes as a surprise to the cryptocurrency market because BTC had defended the $6,500 support level relatively well over the past two weeks and the magnitude of each sell-off initiated by bears in the market started to gradually decline.

What Caused the Shock in the Market?

Throughout the past week, Bitcoin demonstrated low daily trading volume across most major crypto exchanges. According to CryptoSlate, the volume of Bitcoin dropped to $3.2 billion, to the lowest point in the entire year.

Edward Morra, a cryptocurrency trader, said:

‘This is the lowest recorded daily volume in more than a year at least while hovering around the POC of the whole 2018.”

The decline in the volume of Bitcoin led traders to express concerns regarding the short-term price trend of BTC, which favored sellers and bears due to the lack of trading activity in the cryptocurrency exchange market.

On Oct. 10, Twitter user @DonAlt, a widely recognized technical analyst, stated that BTC is set to initiate a major price movement in the days to come. But, uncertainty in the market and the drop in trading activity has made it challenging for traders to predict to which direction BTC will engage in a large short-term movement.

Don Alt said via Twitter:

$BTC daily update:

The range that never ends.

It's getting tighter though and I suspect we'll get a big move soon.

Recent PA is stuck in the one big green candle.

Be careful in both directions, I wouldn't be surprised by big shakeouts before the real move.S: 6430

R: 6700 pic.twitter.com/22emt7ihf7— DonAlt (@CryptoDonAlt) October 10, 2018

Generally, traders expected a big shakeout in the cryptocurrency market before attempting to initiate a major mid-term rally. Historically, Bitcoin tended to see 10 to 30-fold increase in price following months of stability in a low price range.

The lack of volume, trading activity in the market, and the inability of BTC to break out of the $6,800 resistance level after several attempts have contributed to the abrupt drop in the value of Bitcoin.

Crucially, since Aug. 9, Bitcoin has maintained stability in the range of low $6,000 to $6,700 for more than two months. Thus, if Bitcoin successfully defends the $6,000 support level and bounces off of the $6,300 mark in the next 12 to 24 hours, it is unlikely for BTC to demonstrate another large drop.

However, other major cryptocurrencies and tokens including Ripple (XRP), Bitcoin Cash (BCH), and Ethereum (ETH) recorded 9 to 10 percent losses against both Bitcoin and the US dollar.

What Happens to Bitcoin Now?

As cryptocurrency trader @TheCryptoDog said, after a large short-term drop, Bitcoin tends to recover with oversold conditions. Adding that BTC will still need to surpass $6,450 in the days to come to comfortably reject a potential drop below the $6,000 mark, he said:

This actually looks pretty good. I think it will bounce.

The question is what happens after the bounce.$BTC $BTCUSD #Bitcoin pic.twitter.com/MhBU5BGZXy

— The Crypto Dog? (@TheCryptoDog) October 11, 2018

On Sept. 20, subsequent to experiencing a similar 6 percent drop within a 12-hour period, the price of BTC surged from $6,200 to $6,800.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is down 4.65% over the past 24 hours. Bitcoin has a market capitalization of $109.34 billion with a 24-hour trading volume of $4.46 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $204.74 billion with a 24-hour volume of $14.37 billion. Bitcoin dominance is currently at 53.42%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant