Bitcoin mining faces no threat from China, here’s why

Bitcoin mining faces no threat from China, here’s why Bitcoin mining faces no threat from China, here’s why

Photo by Owen Winkel on Unsplash

The Chinese state does not present a long-term threat to Bitcoin, a well-known developer wrote in a blog this week.

China is not a threat to Bitcoin

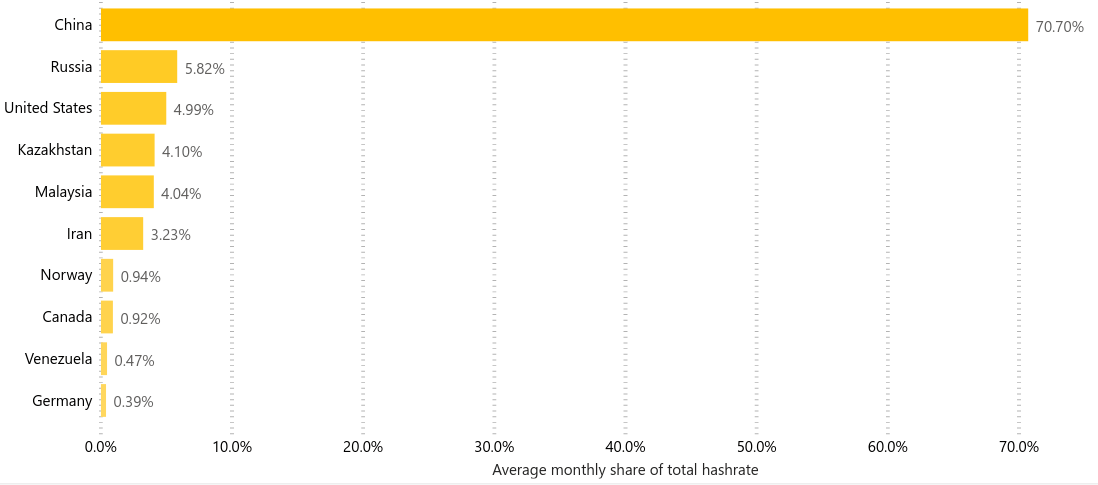

Jameson Lopp, founder of Casa Wallet and a Bitcoin contributor, said Chinese miners do not pose a threat to Bitcoin. His post came amidst long-held fears of centralization by companies in the Far Eastern nation, who command over 70% of Bitcoin’s global hash rate.

Since 2015, when Bitcoin mining was commercialized, critics have stated the chances of a China-led attack against the Bitcoin network are high. The country’s cheap energy, an abundance of labor, and a cool climate in some regions have made it a hotbed for mining.

But Lopp says a government-led attack is out-of-bounds. “I suspect it would be nearly impossible for the state to start seizing control of mining facilities without the news leaking to the rest of the world,” he noted.

While there are thousands of such farms, Lopp noted only ten contribute to over 70% of Bitcoin’s hash power. These are easier for the government to target, presenting an easier attack vector.

However, even doing that is not straightforward. Lopp said switching mining pools is “incredibly easy” for miners and independent entities — such as the Twitter bot below — continuously observe and relay suspicious activity.

“It’s practically guaranteed that within a matter of minutes an alert would be sounded and miners would start looking into taking action against malicious actors. At the time of writing, we even have Twitter bots that put out alerts about any orphaned blocks.”

At 22:17 UTC on 9 July 2020, Bitcoin had a stale block at height 638,519

The losing block contained 2,384 txns:

* The coinbase txn

* 2,377 txns which made it into the winning block

* 6 txns which made it into the next blockThere were no double spendshttps://t.co/xqsaWOCBbT pic.twitter.com/knJEpZbwp6

— BitMEX Research (@BitMEXResearch) July 10, 2020

Unlikely scenario

Lopp noted, “it’s hard to imagine a scenario” in which a state actor would be able to quickly and covertly seize enough hashpower to perform an ongoing attack that lasts more than a few hours.

However, one “worst-case” scenario would be state actors seizing all the physical equipment owned by mining consortium, could result in China only mining empty blocks and orphaning other blocks that did contain transactions, essentially halting all transaction confirmations on the network.

He concluded:

“Any large-scale mining attack is going to be limited in its effectiveness for a variety of reasons and will be unlikely to disrupt network operations for more than a short period of time.”

China’s resource-rich economy has ushered in a favorable environment for miners to flourish. Established firms like Bitmain and even startups like Lubian.com make millions of dollars each month from maintaining the Bitcoin network.

But government worries have increased in recent times, especially as the legal noose around cryptocurrencies has tightened. Earlier this year, China ordered all miners in the second-largest mining region to shut down, a dictum that put 9% of the network at risk.

CryptoQuant

CryptoQuant