Bitcoin firm that exploded 12,000% in the past year is buying the world’s largest mining farm

Bitcoin firm that exploded 12,000% in the past year is buying the world’s largest mining farm Bitcoin firm that exploded 12,000% in the past year is buying the world’s largest mining farm

One company as spent over $650 million in cash and stock to takeover a mining facility.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Riot Blockchain, a publicly listed U.S. Bitcoin mining player, acquired a crypto mining facility for over $650 million last week as it looks to expand its operations. The farm is currently under construction and is touted as the world’s largest Bitcoin mining farm.

Mining Bitcoin with RIOT

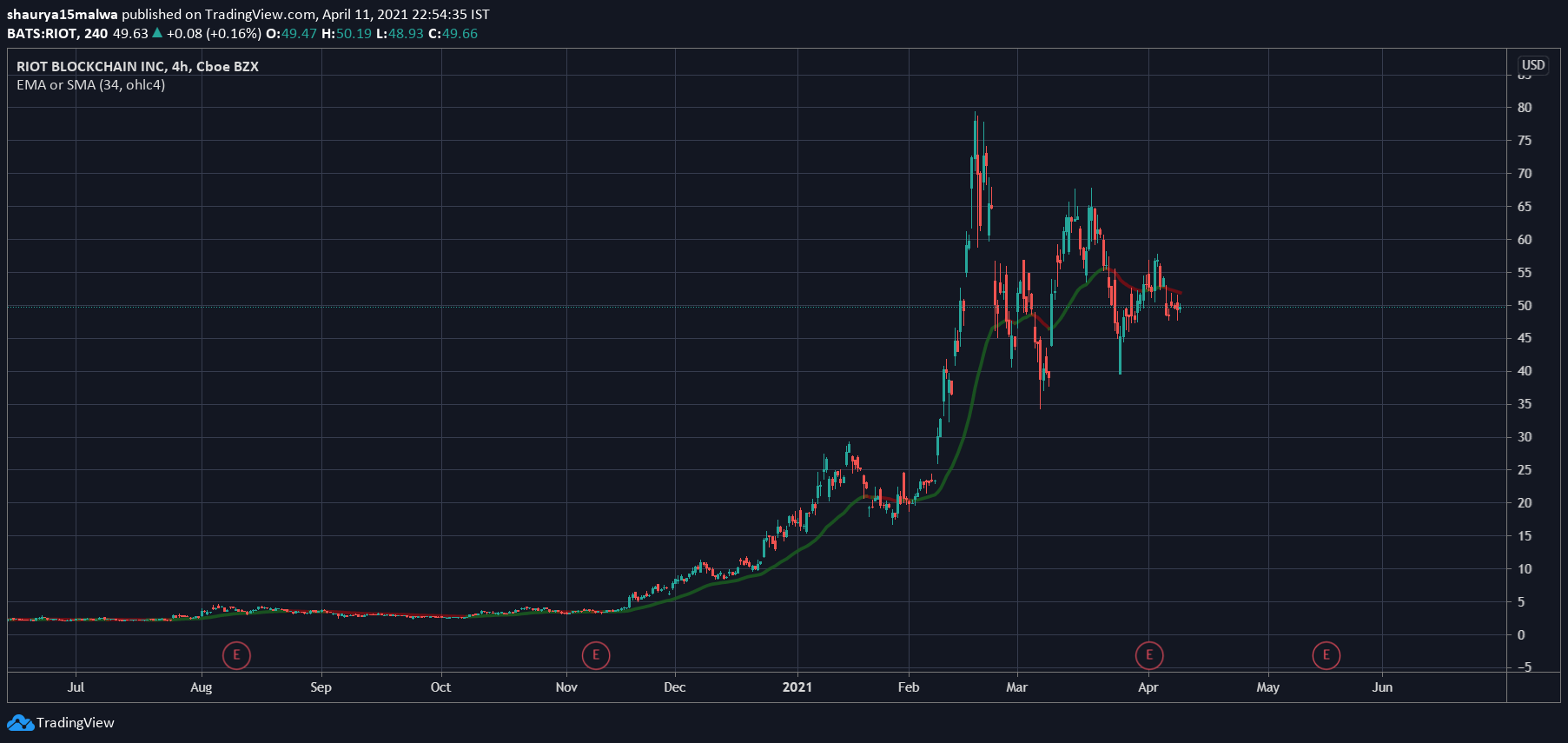

Riot Blockchain (RIOT) was one of the hottest equities in 2020 as it mirrored the price rise of Bitcoin with a massive rally of its own stock. Bitcoin pumped over 767% in the past year—while RIOT surged over 12,000% (calculated as per its peak of $77 on Feb 18, 2021).

As per finance publication The Street, Riot Blockchain will take over Whinstone’s mining facility in Texas, USA. The latter was itself acquired in 2019 by Munich Stock Exchange-listed data infrastructure company Northern Data, an information technology company that develops and operates global infrastructure solutions in the field of high-performance computing.

As #Bitcoin miners & exchanges come public, capital is going to surge into the industry from institutional investors via deals like this one, accelerating the expansion of the $BTC network. If you didn't factor this into your forecast, all your models are destroyed. https://t.co/Xcv1YKknmL

— Michael Saylor (@michael_saylor) April 8, 2021

Riot Blockchain will pay $80 million in cash and transfer 11.8 million shares of common stock for the acquisition. Northern Data will hold 12% of Riot Blockchain’s outstanding stock as a result.

The new mining facility will consume one gigawatt of electricity is spread over 100 acres. Northern Data has touted it as both the largest data center in North America and the largest Bitcoin mining facility in the world.

A rally

For the uninitiated, miners are arguably the most integral part of the Bitcoin network as they both maintain data and validate transactions on the network by solving millions of mathematical questions per second. They spend their own resources and receive Bitcoin as a “reward” in return (for ‘mining’ a block).

And while most mining was previously done in China, the trend has shifted to data centers in the US and Europe in the past year. Texas—with its favorable wind energy and natural gas supplies—has become a sought-after location among miners in the US. Chinese mining giant Bitmain and London-listed Argo Blockchain have facilities in the area as well.

Meanwhile, the move comes as shares of Riot Blockchain surged by 11,000% in the past year. As the above image shows, RIOT traded at just $0.67 in mid-2020 but exchanged hands at $49.63 on Friday. Bitcoin, in comparison, traded under $5,000 in March 2020 and trades at nearly $59,880 at press time.