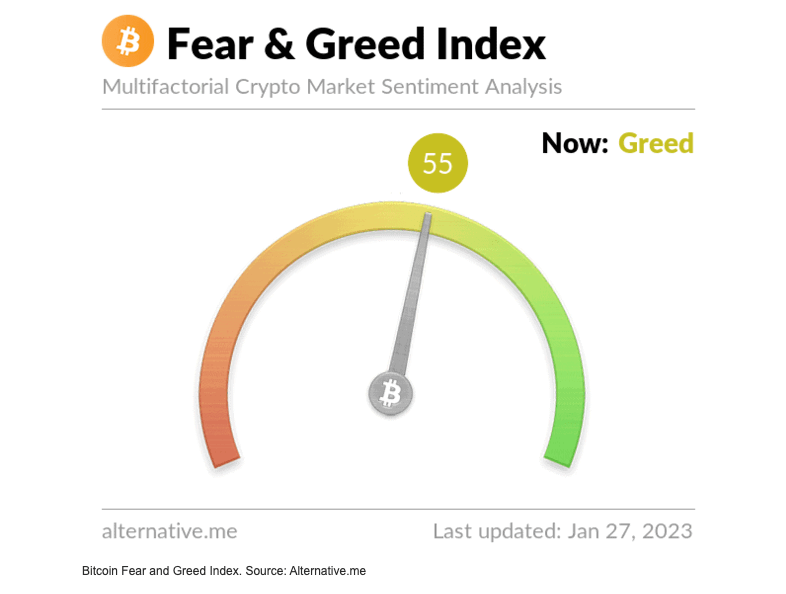

Bitcoin fear and greed index enters ‘greed’ zone after 10 months

Bitcoin fear and greed index enters ‘greed’ zone after 10 months Bitcoin fear and greed index enters ‘greed’ zone after 10 months

The news comes as BTC remains stable at around $23,000 going into the weekend.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

For the first time since March 30, 2022, the Bitcoin Fear and Greed index is firmly in the “greed” zone.

With BTC up nearly 40% year-to-date, the index signals a bullish sentiment as the original cryptocurrency makes significant strides after plummeting to below $16,000 and a two-year low in 2022.

What metrics make up the BTC/FGI?

The Bitcoin Fear and Greed Index (FGI)uses a combination of technical and fundamental analysis to measure the sentiment of the market. The index uses a variety of data points, including:

- Volatility: Measures the volatility of the price of BTC, based on the daily standard deviation of returns.

- Market Momentum/Trend: looks at the direction of the moving averages and the gap between them

- Trading Volume: Analyzes the trading volume of BTC, looking for changes in the buying and selling pressure.

- Social Media Sentiment: Analyzes the sentiment of the online community by looking at the number of positive and negative mentions of BTC in social media.

- Surveys: Surveys of investors and traders, to gauge their sentiment towards BTC and the cryptocurrency market as a whole.

- The index ranges from 0 to 100, with a higher score indicating a higher level of fear and a lower score indicating a higher level of greed. It is published by alternative.me, a website that tracks alternative investments, including BTC.

Posted In: Analysis, Price Watch