Bitcoin ETP volumes surge as institutions jump into the BTC bull run

Bitcoin ETP volumes surge as institutions jump into the BTC bull run Bitcoin ETP volumes surge as institutions jump into the BTC bull run

Photo by Connor Jalbert on Unsplash

Institutional Bitcoin products are booming as the pioneer cryptocurrency sees bullish price action.

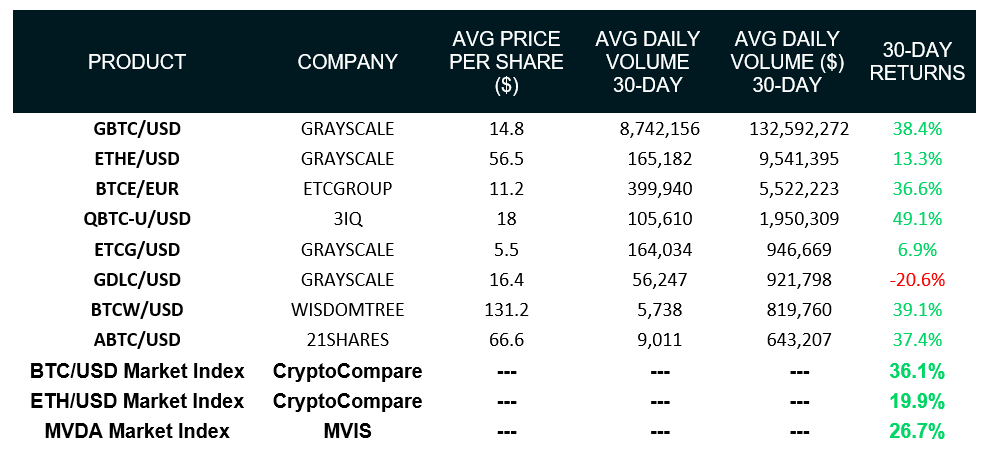

A report shared with CryptoSlate from crypto research firm CryptoCompare found that the aggregate volumes for popular Exchange-traded Products (ETPs) surged 53% this year with several products demonstrating “above-market” returns.

Of these, Grayscale’s popular Bitcoin Trust product surpassed $9 billion in market cap while 3iQ’s Bitcoin Fund (QBTC) experienced its highest returns over the last 30 days at 49.1%.

?? @Grayscale's #Bitcoin Trust saw record weekly #BTC inflows in October & surged 50% to reach $9.1bn in market cap. #ETCGroup’s #BTCE had the greatest increase in market cap, nearly doubling to $116mn while @WisdomTreeETFs' #BTCW saw a 65% increase. https://t.co/jmNDalF2W1 pic.twitter.com/QvBE3LF7ZY

— CryptoCompare (@CryptoCompare) November 17, 2020

Researchers found that the average November ETP volumes had increased by 53.5% to $173.5 million per day. Similarly, Grayscale’s Bitcoin Trust Product surged 50% to reach $9.1 billion in market cap with record weekly BTC inflows seen in October.

A smaller ETP player, the ETC Group, saw its BTCE product jumping to a $116 million market cap in the past month, representing a massive 93% compared to the last period. The product’s average volumes tripled in November to $8.87 million a day (an increase of 212% since October’s average).

However, it was 3iQ’s Bitcoin Fund (QBTC-U) that experienced the highest 30-day returns at 49.1%, followed by WisdomTree’s BTCW (39.1%) and Grayscale’s GBTC (38.4%). On the other hand, Grayscale’s Digital Large Cap Fund (GDLC) experienced a 30-day loss of 20.6% over the last 30-days.

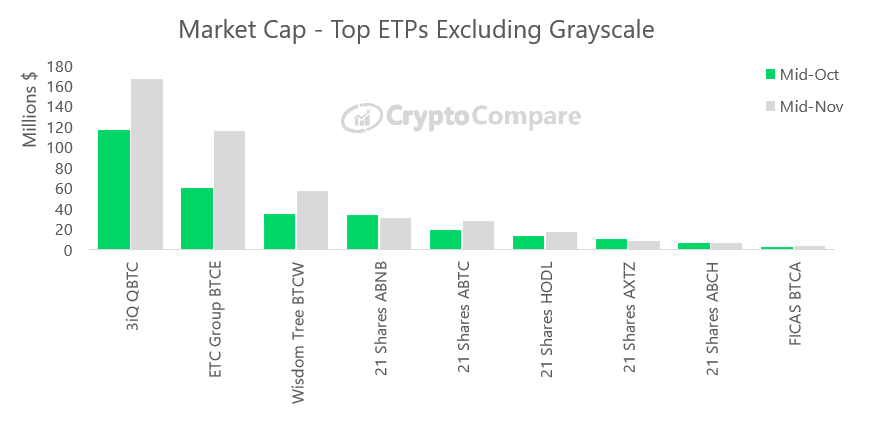

Canadian Bitcoin fund posts biggest market cap

Excluding Grayscale’s OTC-traded products, the largest ETP by market cap is currently 3iQ’s Bitcoin Fund product (QBTC), which is traded predominantly on the Toronto Stock Exchange. Its market cap surpassed $105 million in October and now stands at $167 million.

ETC Group’s BTCE product is currently the second-largest such product and saw the greatest increase in market cap, nearly doubling to $116mn (+93% since 30-days prior) while BTCW by WisdomTree experienced a 65% increase to $79mn.

Meanwhile, ETP trading activity for non-OTC products has also seen a significant boost in volume in November – ETC Group’s BTCE which trades on Deutsche Börse XETRA has tripled its volume to $8.87 million a day, while 3iQ’s QBTC-U volume has increased 52.8% to reach $2.29 million a day.

The report comes as Bitcoin crossed the $18,000 mark earlier today—a price last seen in the first week of January 2018. Institutional adoption is also reaching all-time highs for Bitcoin, as hedge fund managers, software companies, and prominent billionaires turn to the asset seeking a hedge against inflation in the traditional markets.

Bitcoin Market Data

At the time of press 2:33 pm UTC on Nov. 18, 2020, Bitcoin is ranked #1 by market cap and the price is up 5.11% over the past 24 hours. Bitcoin has a market capitalization of $331.54 billion with a 24-hour trading volume of $53.06 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:33 pm UTC on Nov. 18, 2020, the total crypto market is valued at at $499.49 billion with a 24-hour volume of $184.94 billion. Bitcoin dominance is currently at 66.44%. Learn more about the crypto market ›

Deribit

Deribit