Grayscale says it’s “100% committed” to morphing its Bitcoin Trust into ETF

Grayscale says it’s “100% committed” to morphing its Bitcoin Trust into ETF Grayscale says it’s “100% committed” to morphing its Bitcoin Trust into ETF

Becoming an exchange-traded fund was the ultimate goal of Grayscale's crypto trusts all along, the company explained.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As the race for the title of America’s first Bitcoin exchange-traded fund (ETF) rages on, digital assets investment giant Grayscale today revealed that launching such a product was its goal from the very start.

“Grayscale first submitted an application for a Bitcoin ETF in 2016 and spent the better part of 2017 in conversations with the SEC. Ultimately, we withdrew our application because we believed the regulatory environment for digital assets had not advanced to the point where such a product could successfully be brought to market,” the firm noted.

Grayscale’s Intentions for a Bitcoin ETF$GBTChttps://t.co/YprrukV5Il

— Barry Silbert (@BarrySilbert) April 5, 2021

In a Medium blog post titled “Grayscale’s Intentions for a Bitcoin ETF,” the company, which currently has $46.6 billion worth of cryptocurrencies under its management, explained that each of its trusts has a certain life cycle and that becoming an ETF is the final stage.

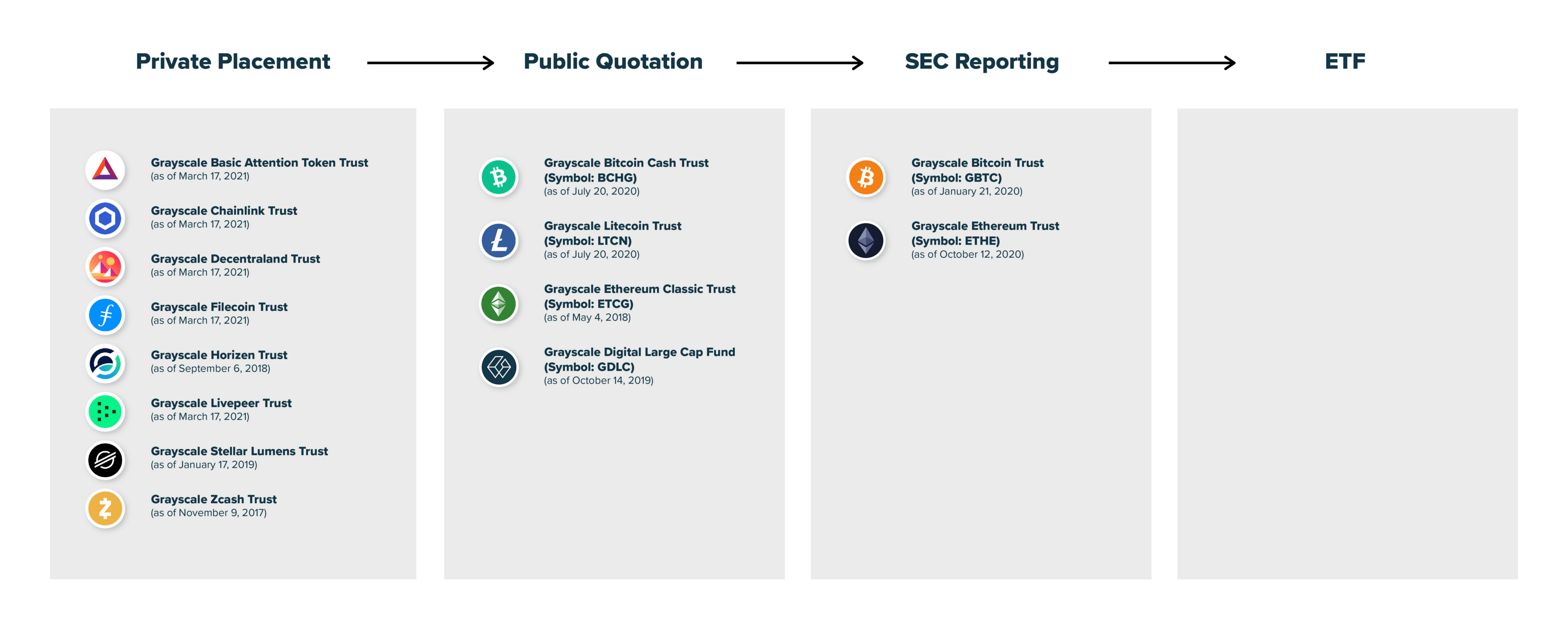

For example, all of Grayscale’s publicly traded crypto trusts started off with the launch of a private placement. Via this method, sales of stock shares or bonds are available only to pre-selected investors and institutions.

After this initial stage, the trusts then seek to obtain a public quotation on secondary markets which allows exchanges to provide information on their shares, including their bid and ask price, last traded price, and volume traded. For example, Grayscale’s Bitcoin Cash Trust, Litecoin Trust, Ethereum Classic Trust, and Digital Large Cap Fund are currently at the stage of public quotation.

The third stage of Grayscale trusts’ life cycle is becoming regulated by the Securities and Exchange Commission (SEC), the company added. So far, only two of its investment trusts—Grayscale Bitcoin Trust and Grayscale Ethereum Trust—have reached this status.

3/ In 2013, we launched $GBTC and pioneered the model of providing investors with exposure to digital assets in the form of a security without the challenges of buying, storing, and safekeeping digital assets.

— Grayscale (@Grayscale) April 5, 2021

Finally, the ultimate goal of each product offered by Grayscale is to become an ETF, offering a special type of securities that track the prices of certain underlying assets. In particular, crypto-based ETFs allow institutional investors to get exposure to digital assets’ price volatility without actually holding any cryptocurrencies. ETFs are also freely tradeable on traditional exchanges.

“Today, we remain committed to converting GBTC into an ETF although the timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly traded GBTC shares will not need to take action and the management fee will be reduced accordingly,” the company concluded.

As CryptoSlate reported, several major investment companies such as Fidelity Investments, SkyBridge Capital, and VanEck have recently filed their applications for Bitcoin ETFs with the SEC. However, the regulator has already declined a number of similar proposals over the past few years, leaving the niche vacant so far.

Farside Investors

Farside Investors

CoinGlass

CoinGlass