XRP forcing some investors out after massive sell-offs and a YTD return of -40%

XRP forcing some investors out after massive sell-offs and a YTD return of -40% XRP forcing some investors out after massive sell-offs and a YTD return of -40%

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

During the first half of the year, the top 5 cryptocurrencies by market cap recorded significant gains. Bitcoin went up over 300 percent, Ethereum surged 250 percent, Litecoin rose a whopping 400 percent, and EOS moved up just under 300 percent.

Meanwhile, XRP only saw its price increase by 78 percent, and today, it has a negative year-to-date (YTD) return of 40 percent. Now, investors wonder what went wrong with it.

Strategic partnerships

Throughout 2019, Ripple, a San Fransico-based company that builds the ecosystem around XRP, secured high profile partnerships to bolster the usage of XRP.

In May, the distributed ledger startup teamed up with Ria Money Transfer, a subsidiary of Euronet Worldwide, to power instant global payments. By joining RippleNet, Ria is now able to settle transactions with increased speed, transparency, and efficiency proving its customers with a better experience.

A month later, Ripple became MoneyGram’s key partner for cross-border payment and foreign exchange settlement. The two-year agreement enabled MoneyGram to send money from one currency and get it instantly settled in the destination’s currency with the help of xRapid.

Finally, the San Francisco-based firm announced in August the addition of Xendpay, a UK-based remittance firm, to its pool of clients for its global settlements platform, RippleNet. The partnership allows Xendpay to target new markets like the Philippines, Vietnam, and Indonesia and support currencies that were inaccessible in the past.

According to Ripple CEO Brad Garlinghouse, most of the partnerships were meant to help increase the liquidity of both XRP and RippleNet, creating a better ecosystem for growth.

Garlinghouse affirmed:

“This year has been our strongest for Ripple yet. In 2019 we’ve seen continued momentum with customers, growth of RippleNet, and adoption of On-Demand Liquidity. In just a year since we launched ODL, we are already making an impact on the bottom line for our customers. We’re excited to continue this momentum into next year and for the expansion of ODL into new markets.”

Although 2019 was the “strongest year for Ripple yet” due to the expansion of its cross-border payment solution, XRP continues plummeting. On Nov. 25, this cryptocurrency went as low as $0.20 — a price level not seen since 2017.

Ripple’s XRP sell-off

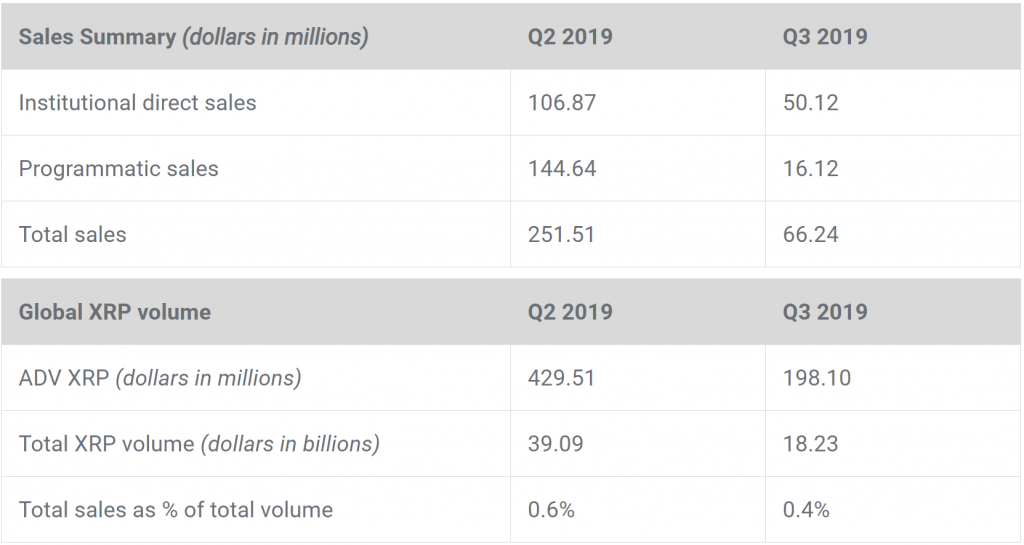

The massive downturn that XRP is experiencing could be the result of the number of tokens that Ripple sold over the last three quarters. The company disclosed that it sold $251.51 million in XRP during Q2 2019. This represents a nearly 50 percent increase from the previous quarter, where Ripple sold $169.42 million worth of XRP.

As concerns grew among investors regarding the sell-offs, the firm took a much conservative approach in the third quarter. During this time, the total XRP sales were $66.24 million, representing a whopping 73.7 percent decrease.

Despite the substantial reduction in sales, it seems like the damage is already done. Investors appear to have taken a cautious approach to this cryptocurrency, and capital is not flowing in as in previous years. Even the most anticipated conferences of the year for the XRP community, dubbed Swell, was not able to meet the market expectations, and the carnage continued.

Moving forward

Now, XRP is set to close the year as the worst-performing crypto among the top 5 by market cap, according to data from analytics site Coinlib. And, things could get uglier next year since Ripple is going into 2020 with a legal complaint that argues the XRP tokens are unregistered securities under the U.S. Security and Exchange Commission’s framework. Even though the SEC would have the last word on this, the Crypto Rating Council (CRC) concluded in October that XRP is most likely a security.

Farside Investors

Farside Investors

CoinGlass

CoinGlass