XRP, Ethereum fall as popular index flashes ‘Greed’ sign

XRP, Ethereum fall as popular index flashes ‘Greed’ sign XRP, Ethereum fall as popular index flashes ‘Greed’ sign

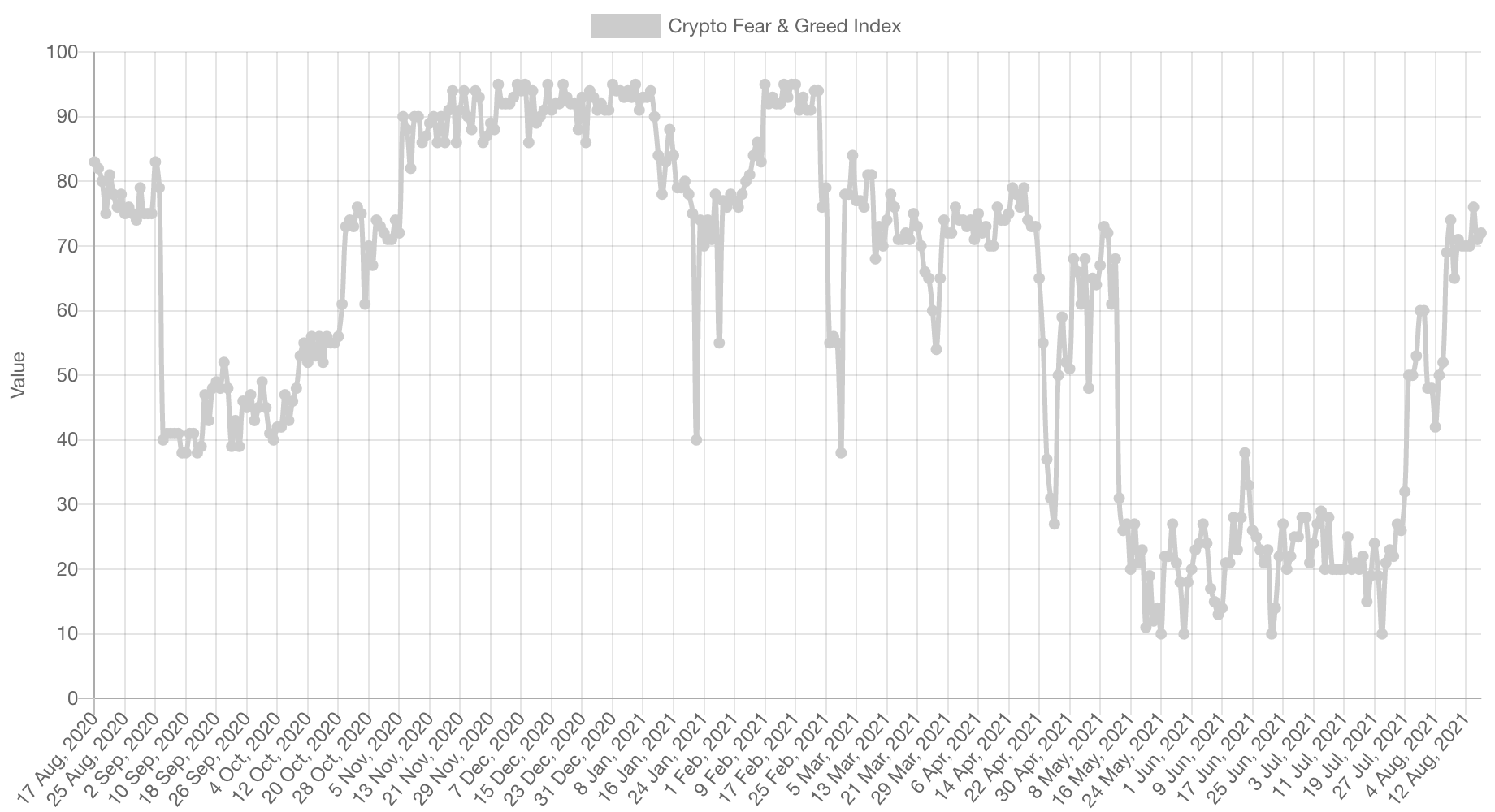

Following brutal two months, the crypto market has recently reached a greed level not seen since April.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The crypto fear and greed index, a collective metric that estimates the current sentiment on the crypto market, remains in the “greed” zone, while most of the major cryptocurrencies entered the new week with a price uptick.

The index reflects daily emotions and sentiments for Bitcoin (BTC) and other large cryptocurrencies, which are gathered and analyzed from different sources that, amongst others, include current market volatility, volume, momentum, and social media behavior.

Greedy for Bitcoin

The metric, which scales from 0 (maximum “fear”) to 100 (ultimate “greed”), typically passes through the “neutral” range and goes into the “greed” zone during periods of strong price rallies, when demand for crypto outweighs supply.

Following Bitcoin’s price drop in mid-May, the crypto fear and greed index was indicating “fear” in the market for more than two months.

The market sentiment started changing in late July and finally, the Bitcoin metric revisited the “extreme greed” level on August 14.

For the First Time in 3 Months: Bitcoin Fear and Greed Index Shows Extreme Greed ? pic.twitter.com/bcOhzoZiWs

— Traders Profit Club (@tprofitclub) August 15, 2021

Greedy for Ethereum

Similar to Bitcoin, the Ethereum (ETH) fear and greed index has also been residing in the “greed” zone recently.

The sentiment surrounding the world’s second-largest crypto by market cap also escalated to a state of “extreme greed,” following a major Ethereum network upgrade that launched on August 5.

The long-anticipated London hard fork, which included the EIP-1559 upgrade, a reductive measure set to reign in the crypto’s supply growth, drove the price of Ethereum up, nudging the index pointer to “extreme greed” on August 8, when it jumped to 79 points.

Ethereum Fear and Greed Index is 79 – Exteme Greed pic.twitter.com/QFWTSkE0Qt

— Ethereum Fear and Greed Index (@EthereumFear) August 8, 2021

Based on the metric’s two simple assumptions, “extreme fear” signals investors’ worry and the opportunity to buy, while “extreme greed” announces the market’s readiness for a correction.

Since both cryptos just started showing tendencies of provoking extreme sentiment, there is still a lot of room left for the reawakened greed to do its magic and drive the prices higher.

Did Andrzej Sapkowski, a Polish economist and fantasy writer, have “the Moon” in mind when he said, “human greed knows no limits?”

CryptoQuant

CryptoQuant