Crypto ownership in Turkey, Argentina and Philippines surges as inflation skyrockets

Crypto ownership in Turkey, Argentina and Philippines surges as inflation skyrockets Crypto ownership in Turkey, Argentina and Philippines surges as inflation skyrockets

Uncover the connection between high inflation and increased crypto ownership rates in Turkey, Argentina, and the Philippines, as citizens seek refuge in digital assets amidst economic turmoil.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

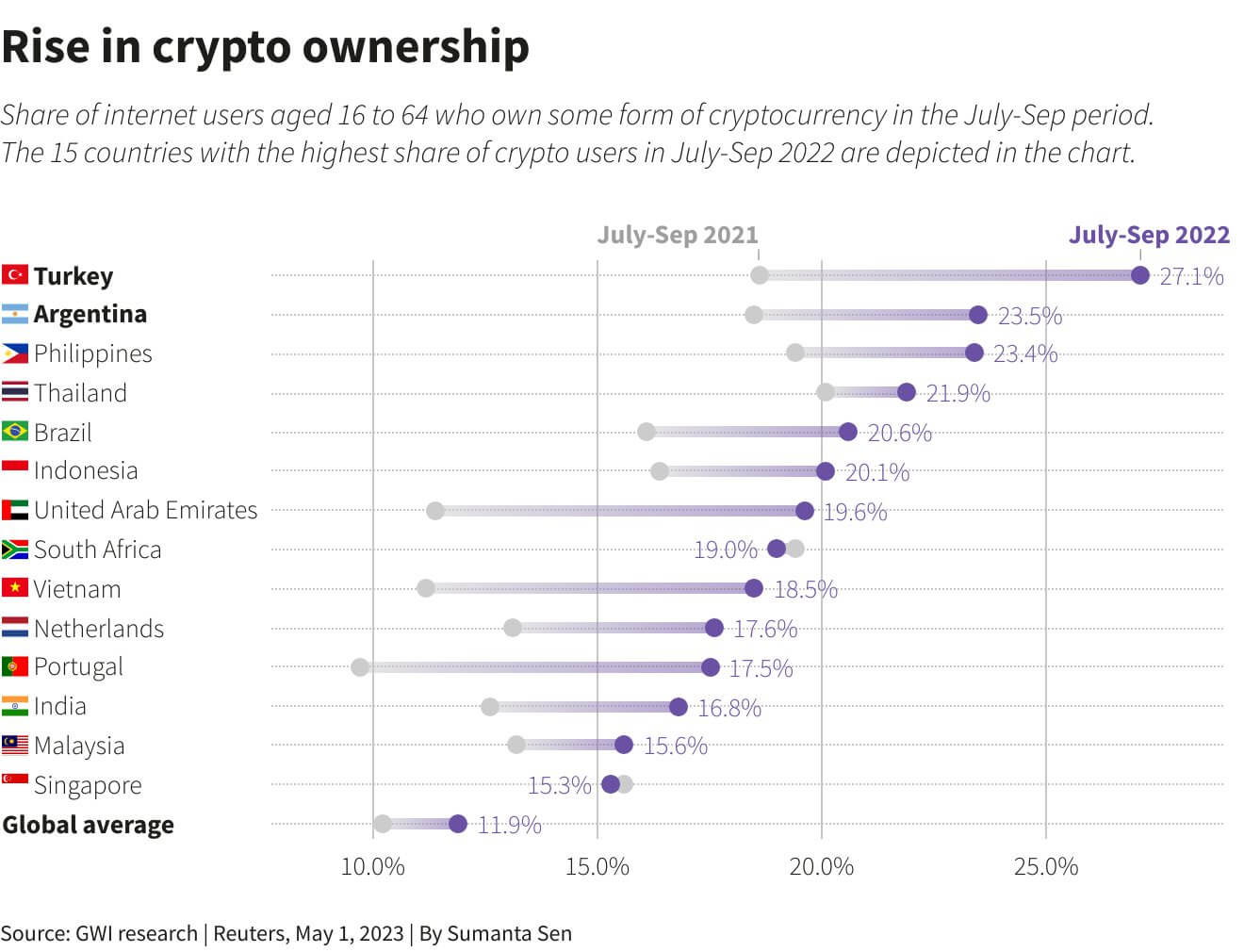

Turkey recorded the highest growth in crypto ownership, with 27.1% from July-September 2021 to July-September 2022, according to GWI Research.

Argentina and the Philippines followed Turkey as the second and third by increasing their crypto ownership rate by 23.5% and 23.4%, respectively, according to GWI research data.

The ranking

The study includes individuals between the ages of 16 and 64 and examines if they own some form of cryptocurrency.

The chart below demonstrates the top 15 countries that recorded the highest surges in crypto ownership and the global average for the period, which is an 11.9% increase.

Even though Turkey appears at the top of the chart, the United Arab Emirates, Vietnam, and Portugal also recorded strong growth.

Is it inflation?

Even though the data doesn’t disclose a reason behind the surges in crypto ownership, the top three countries share a common feature: skyrocketing inflation.

In late 2021, Turkish Lira quickly lost 44% of its value against the US dollar. The country’s inflation surpassed 30% in early 2022 and ended the year at 72.31%. These factors motivated the Turks to turn to crypto, and the daily trading volume reached an average of $1.8 billion.

Argentina’s inflation rate was 94.8% in 2022, the highest percentage since 1991. The decreasing value of the Argentine peso might have pushed the citizens to adopt crypto as it did in Turkey. The country proved its interest in crypto when a Bitcoin (BTC) wallet became the number one application in Argentina within a week of its launch.

The situation is the same in the Philippines — the country’s inflation sat at 8.1% in December 2022, which reflects a 107% increase from the 3.9% recorded in 2021.

CryptoQuant

CryptoQuant