The Taller They Stand, The Harder They Fall: The Collapse of BitConnect

The Taller They Stand, The Harder They Fall: The Collapse of BitConnect The Taller They Stand, The Harder They Fall: The Collapse of BitConnect

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It was common knowledge, to anyone having spent over 10 minutes conducting due diligence on BitConnect, that the platform was a textbook Ponzi scheme. The website makes bold claims as to how it can ‘guarantee’ returns, thanks to what it calls ‘volatility software’, as well as a Bitcoin trading bot. The legitimacy of these claims remains questionable, at best – there is no proof of anything going on behind the scenes.

Many speculated that the returns investors received were a mix of both the profits accrued from Bitcoin’s bullish price increase (to trade on the platform, users were required to purchase the native BCC token for Bitcoin), and the deposits from newer investors (locked up for close to a year).

In classic HYIP style, this business model worked so long as more users were onboarded, which explains the focus on referrals that incentivised attracting friends, family, and followers to the platform.

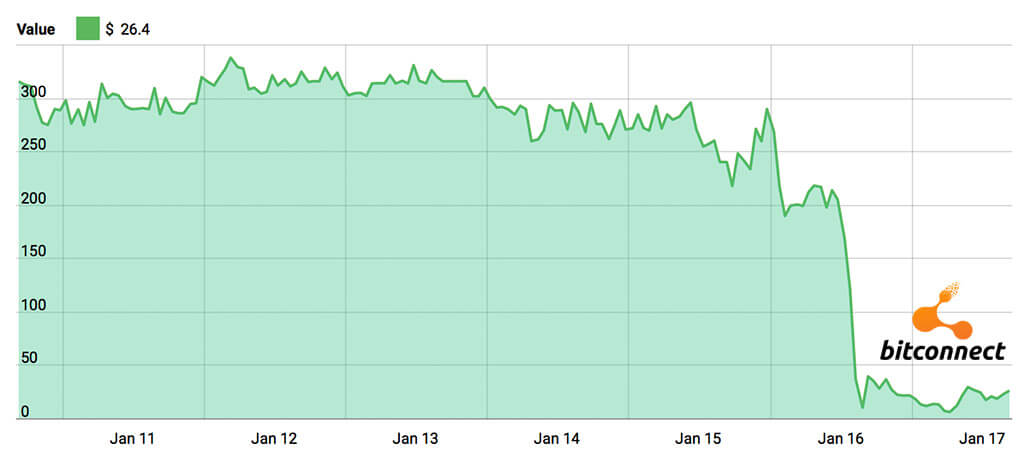

Dramatic Unravelling – Down 94% In 24 Hours

The writing was on the wall for BitConnect for some time now – the site had been subjected to DDoS attacks in the past few days, and received yet another cease-and-desist letter, whereby the platform was accused of dealing in unregistered securities (this marks the second this month, the first being from the state of Texas).

1/2 Our counterparts at the Texas State Securities Board have ordered BitConnect, a $4B cryptocurrency promoter, to halt its fraudulent sales. https://t.co/y5No9YDdca

— SEC Fort Worth (@FortWorth_SEC) January 5, 2018

On the 16th of January, the site announced its shutdown, citing the above, as well as bad press, as reasons for its decision (worth noting is that it fully intends on continuing with its ‘BitconnectX’ ICO).

The tokens locked up in active loans have been returned to their owners, but few see this as the act of good faith it purports to be – the current downtrend has plunged virtually every cryptocurrency into the red, though not many have fared as badly as BCC (down over 90% in the past week). Some exchanges have opened trading on the token, although, unsurprisingly, supply far outweighs demand.

In the backlash, many are condemning the actions of some of the more prolific shills of the platform that took to YouTube to promote BitConnect.

Some have begun to delete older content wherein they boast about the profit they’ve made, likely to distance themselves from the stigma (there are rumblings in cryptocurrency communities about legal action – it seems that, as the developers are anonymous, the known supporters have been targeted).

Moving Forward

I wrote about the impending collapse back in November. To many, it seemed blatantly obvious that BitConnect would come crashing down sooner rather than later, but the BitConnect subreddit stands as a bleak reminder that many are diving into cryptocurrency without informing themselves.

It’s worth remembering that there are no guaranteed returns in crypto. We’re still at the beginning of what will surely be a turbulent adoption curve, with no real idea of what the future holds for the area. Flashy website design and Twitter hype mean nothing if the software isn’t there.

Invest because you believe in the technology, not because the four-page whitepaper promises that XXXCoin is going to be the next Bitcoin. Don’t trust, verify.

And please, for the love of all that is holy, don’t invest in the BitconnectX ICO. We’ll leave you with this…