Sorry bulls: On-chain metrics show Bitcoin is highly bearish ahead of halving

Sorry bulls: On-chain metrics show Bitcoin is highly bearish ahead of halving Sorry bulls: On-chain metrics show Bitcoin is highly bearish ahead of halving

Photo by ?? Janko Ferlič on Unsplash

Bitcoin’s halving is finally here. After years of waiting, the long-awaited event has arrived that will see the number of coins issued per block cut in half — hence “halving — from 12.5 to 6.25.

Although BTC investors on Twitter and other forums are claiming they’re over the moon about the halving, on-chain data paints a totally different story. In fact, the cryptocurrency analytics company IntoTheBlock found that Bitcoin is currently flashing “bearish momentum.”

Bitcoin’s “actionable signals” suggest investors should be cautious

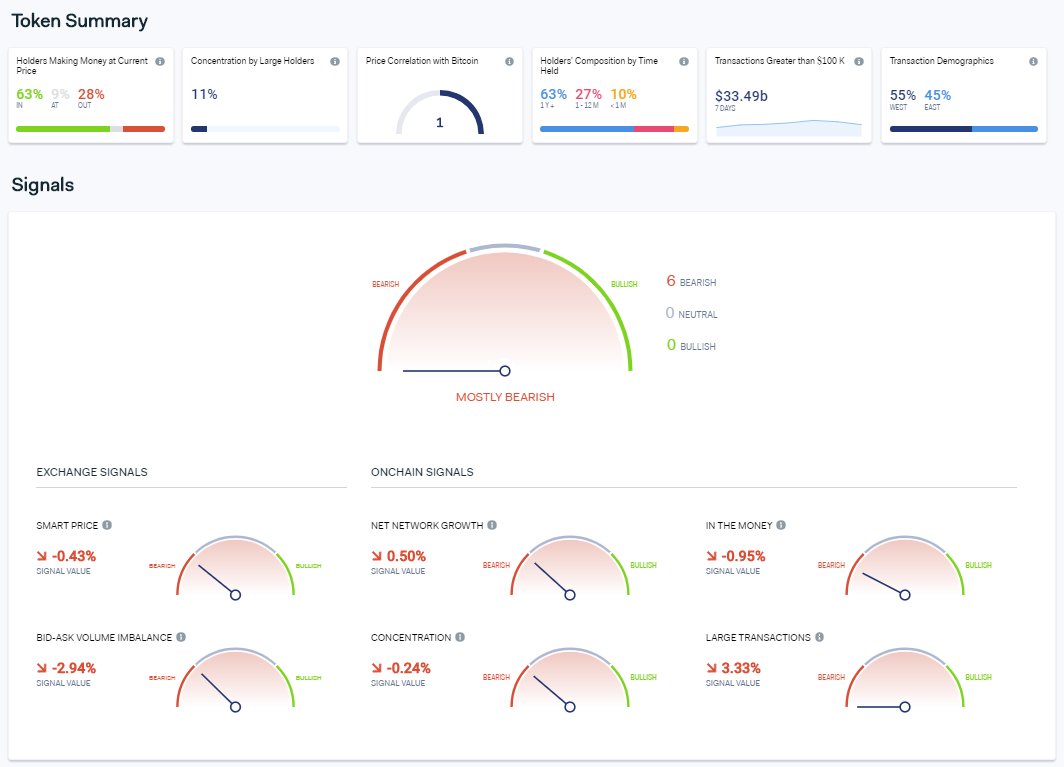

According to the below image shared by IntoTheBlock on May 10, there is a confluence of six proprietary on-chain and market signals signaling that Bitcoin is “mostly bearish,” with there being zero signals from the company that are bullish or even neutral.

Again, this data was taken just a day out from the most hyped cryptocurrency event ever, the 2020 halving.

Some of these signals found by IntoTheBlock are as follows:

- There is currently a negative bid-ask volume imbalance, suggesting there are more margin sellers than buyers of Bitcoin at current prices

- The growth of the leading cryptocurrency’s network, determined by new users, has started to slide

- There is less accumulation of BTC by large holders or “whales”

While on-chain metrics aren’t the perfect way to analyze Bitcoin’s prices, they are a key insight into the overall mindset of traders and holders the world over, which in turn can be interpreted to determine market trends.

The long-term trend remains bullish

Although there has been this network slowdown in the short term, data indicates that Bitcoin is anything but bearish from a macro perspective.

Rafael Schultze-Kraft of Glassnode, a blockchain intelligence startup, observed that just a day out from the halving and “Bitcoin’s fundamentals are stronger than ever.”

Here is some of what he found when comparing on-chain data from the time of the last halving to data from today:

- Bitcoin’s new daily addresses count — indicative of users joining the network — is up 68 percent

- The average count of daily transactions rose by 44 percent

- The average value of daily transactions (U.S. dollar terms) has risen by 700 percent, which is reflective of the growth in BTC

- Bitcoin’s hash rate, the amount of computational power processing transactions, is up 6,837 percent

Schultze-Kraft’s conclusion was that “network fundamentals are compelling; long-term bullish [for] Bitcoin.”

This comes shortly after the firm reported that as of May 3, BTC “has been moving strongly towards the bullish quadrant,” suggesting a bull market is imminent.

As reported by CryptoSlate previously, they came to this optimistic conclusion by noticing that the “Glassnode On-Chain BTC Index,” or GNI, which is derived from a convergence of indicators, to “yield insights” into “where Bitcoin may evolve.”

Bitcoin Market Data

At the time of press 9:25 am UTC on May. 11, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.63% over the past 24 hours. Bitcoin has a market capitalization of $158.91 billion with a 24-hour trading volume of $46.66 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:25 am UTC on May. 11, 2020, the total crypto market is valued at at $237.07 billion with a 24-hour volume of $155.04 billion. Bitcoin dominance is currently at 67.03%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant