‘Lost and HODLed’ Bitcoin (BTC) hits 34% of supply, what does this mean?

‘Lost and HODLed’ Bitcoin (BTC) hits 34% of supply, what does this mean? ‘Lost and HODLed’ Bitcoin (BTC) hits 34% of supply, what does this mean?

While lost Bitcoin drives scarcity, on-chain metrics cannot determine the extent to which users benefit.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

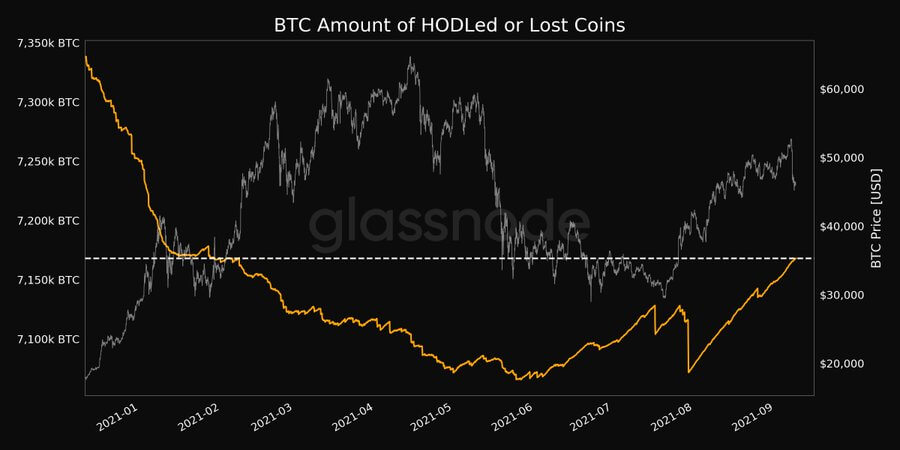

Data from the on-chain market analysts Glassnode shows the number of hodled or lost Bitcoin tokens has hit a seven-month high of 7,167,889.595 BTC. This represents 34% of the total supply.

This metric is derived by looking at the movement of large and old stashes. But it has limitations in that it cannot distinguish between coins in storage and coins that cannot be accessed.

“Some coins are certainly lost as they were associated with a provably un-spendable output script, but the majority of lost coins can only be guessed by setting a threshold of inactivity after we consider them lost.”

The relevance of this comes down to correctly assessing investor sentiment and changes to saver’s behavior. Thus, there are drawbacks in using it to gauge fundamental price drivers and if Bitcoin is overvalued, undervalued, or at fair value.

How many lost Bitcoin are there?

Lost Bitcoin refers to the permanent loss of access to a wallet storing the tokens. Given that the ledger is immutable, and there is no third party to call on for help in these circumstances, the BTC is lost forever.

Although recovery services do exist, the jury is out on whether lost Bitcoin can be recovered. There’s also the issue of scammers posing as recovery firms.

Nonetheless, millions of dollars of Bitcoin, and other cryptocurrencies, continue to get lost each year. Cane Island Digital Research estimates that users lose as much as 4% of the available supply every year.

Data analysts, Chainalysis, dig deeper with their June 2020 research on ownership and trading. As of last year, their report reveals that 3.7 million tokens were lost, representing 20% of the available supply.

Their analysis is as follows:

- 11.4 million as investment

- 3.7 million as lost (defined as tokens not moved in five years or more)

- 3.5 million as moving between exchanges for trading

- 2.4 million yet to be mined

Of course, defining lost tokens as tokens not moving in five years or more is fraught with inaccuracy. In that, it’s possible tokens within this category are still accessible but simply haven’t moved in five years.

That being so, it’s impossible to determine, with accuracy, how much Bitcoin has been lost to user error or unfortunate circumstances.

What is the effect of lost tokens?

Lost Bitcoin will reduce the token’s total supply. In theory, by making BTC even scarcer, this will act as a driver of price appreciation.

As such, an increasing number of hodled or lost Bitcoin tokens is good for existing hodlers. But because there are no splitting hodled coins and lost coins, the degree to which it’s good is a matter of debate.

Deribit

Deribit