Stabilization of Bitcoin price aligns with equilibrium in Bitfinex interest positions

Stabilization of Bitcoin price aligns with equilibrium in Bitfinex interest positions Onchain Highlights

DEFINITION: Analyzing Bitcoin price in relation to Bitfinex long and short interest

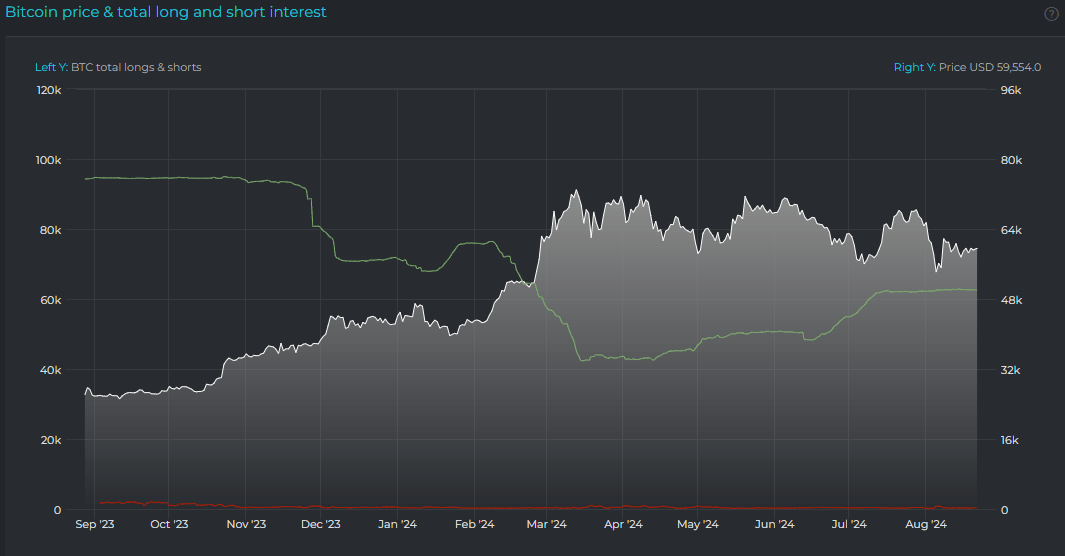

Bitcoin’s price and total long and short interest show a strong correlation over the past 12 months. As depicted in the chart below, Bitcoin’s price experienced a significant increase from October 2023 through March, coinciding with notable shifts in long and short interest.

A sharp decline in long interest in December 2023 was followed by a relatively flat price until late January to early February when the market observed a steady recovery in long positions. However, the data shows this was short-lived as long interest began declining along with Bitcoin’s climb to a new all-time high in March.

The subsequent stabilization of Bitcoin’s price in the $60,000 range since July coincided with a flatlining of long and short interest, suggesting a period of relative market equilibrium. This data indicates that shifts in market sentiment, reflected in long and short positions, may be key drivers of Bitcoin’s price movements during this period.

CryptoQuant

CryptoQuant