Investor behavior shows strong bull market conviction as Bitcoin tops $38,000

Investor behavior shows strong bull market conviction as Bitcoin tops $38,000 Quick Take

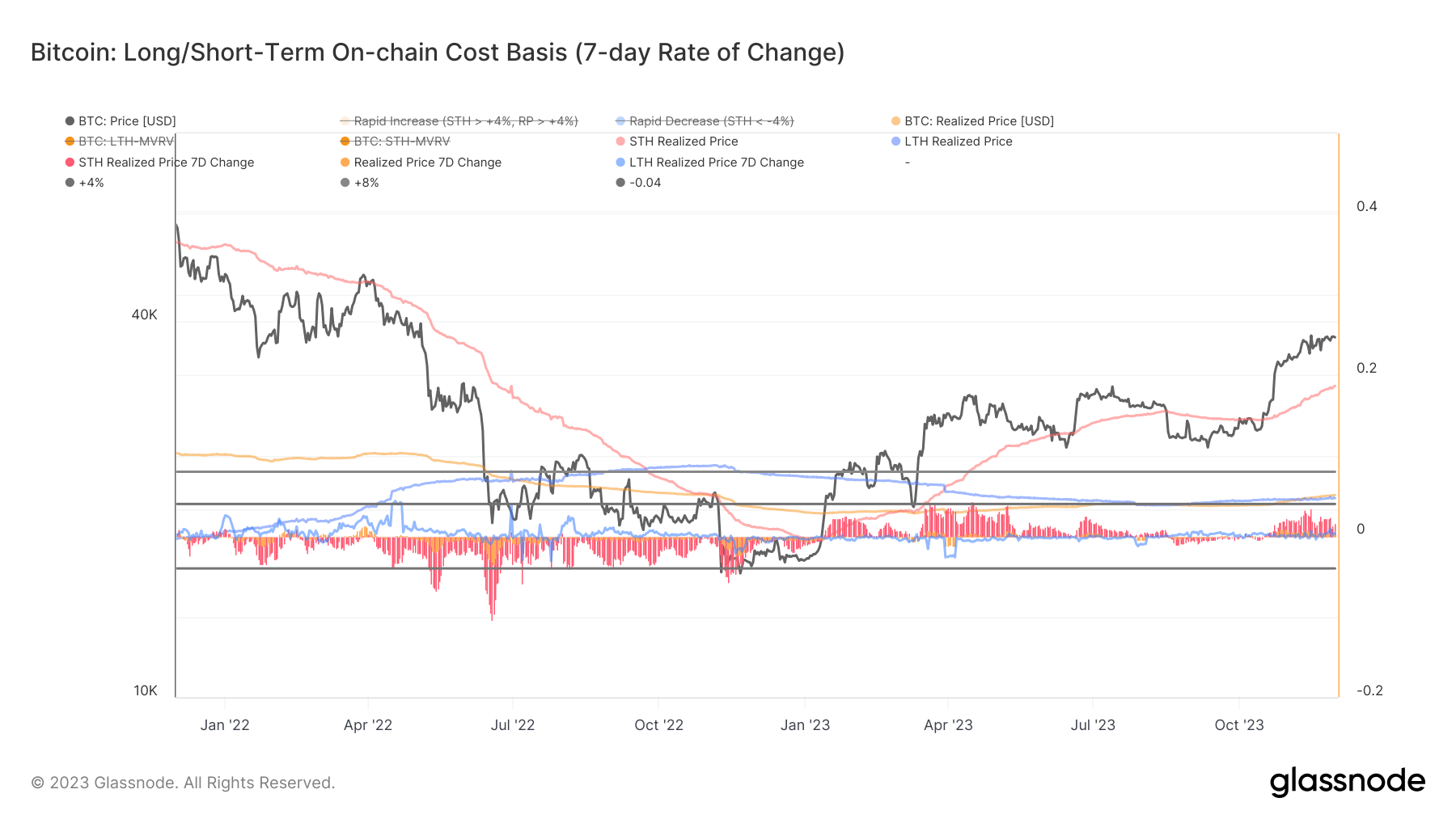

Bitcoin’s upward trajectory continues unabated, registering a remarkable 133% increase YTD and surpassing the $38,000 mark. CryptoSlate’s earlier reports of an imminent bull market are in line with the steady increase in Bitcoin’s realized price.

Realized price reflects the average price at which each Bitcoin was last spent on-chain, offering an aggregate view of the acquisition price for all coins in circulation. This data can be further dissected by applying Short-Term Holder (STH) and Long-Term Holder (LTH) heuristics, providing a more nuanced understanding of investor behavior.

STH Realized Price, for instance, corresponds to the average price for coins moved within the last 155 days, excluding those held in exchange reserves. These coins are more likely to be spent on any given day and currently have a cost basis of $31,500, a YTD high. Conversely, LTH Realized Price pertains to coins not moved within the last 155 days, indicating a lower probability of spending, which continues to decrease with a cost basis of $20,848.

An intriguing development is the increase of the realized price beyond the LTH realized price. This suggests a higher aggregate cost basis set by coins changing hands, underlining the continued strength of the bull market.