Bitcoin largest one-day plunge in nearly a month liquidated over $700 million

Bitcoin largest one-day plunge in nearly a month liquidated over $700 million Quick Take

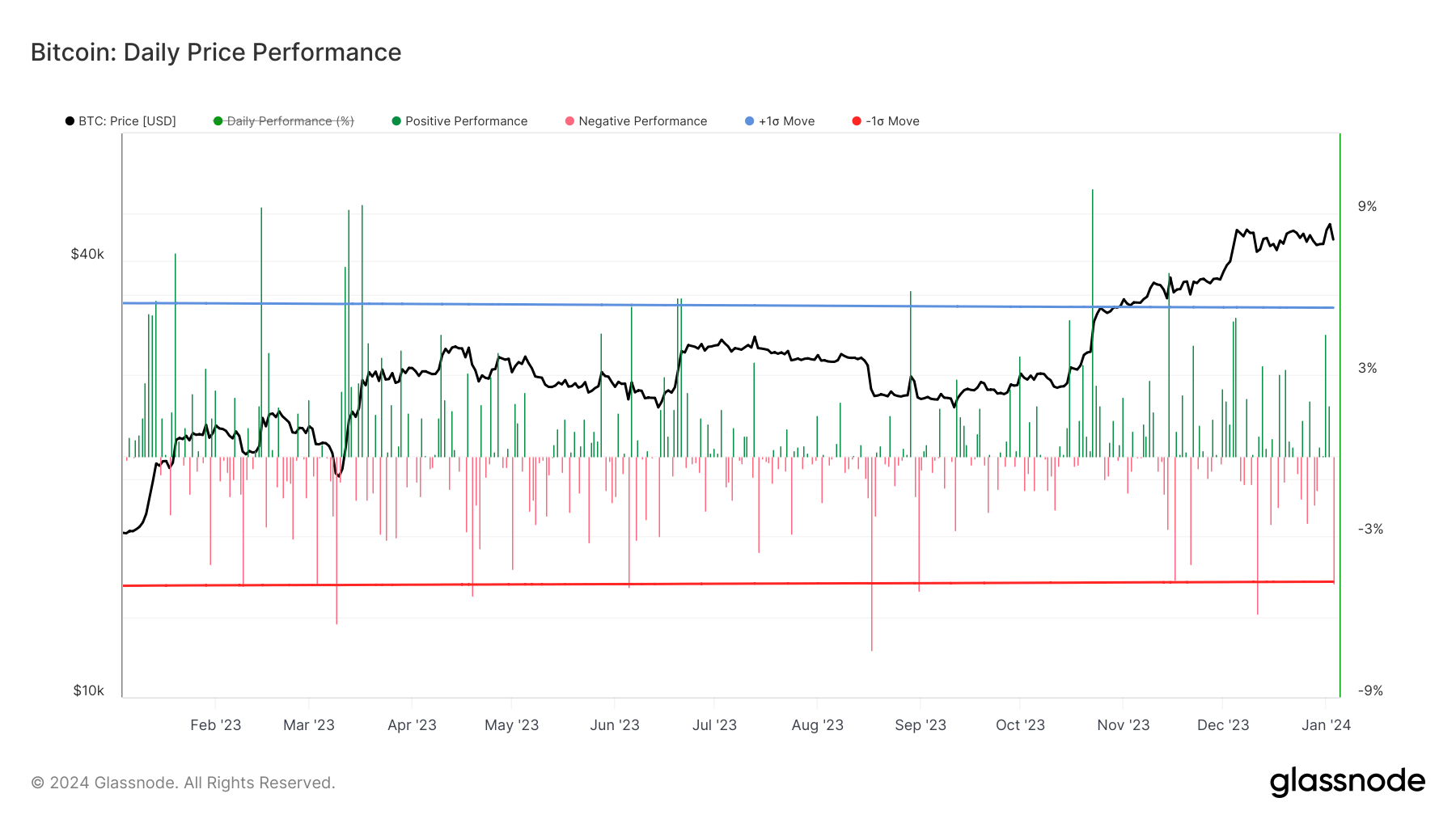

Bitcoin’s performance on Jan. 3 marked a significant downturn as it experienced its largest one-day drop since Dec. 11, a decrease of 4.7%. In the last twelve months, only five instances exhibited a greater one-day drop.

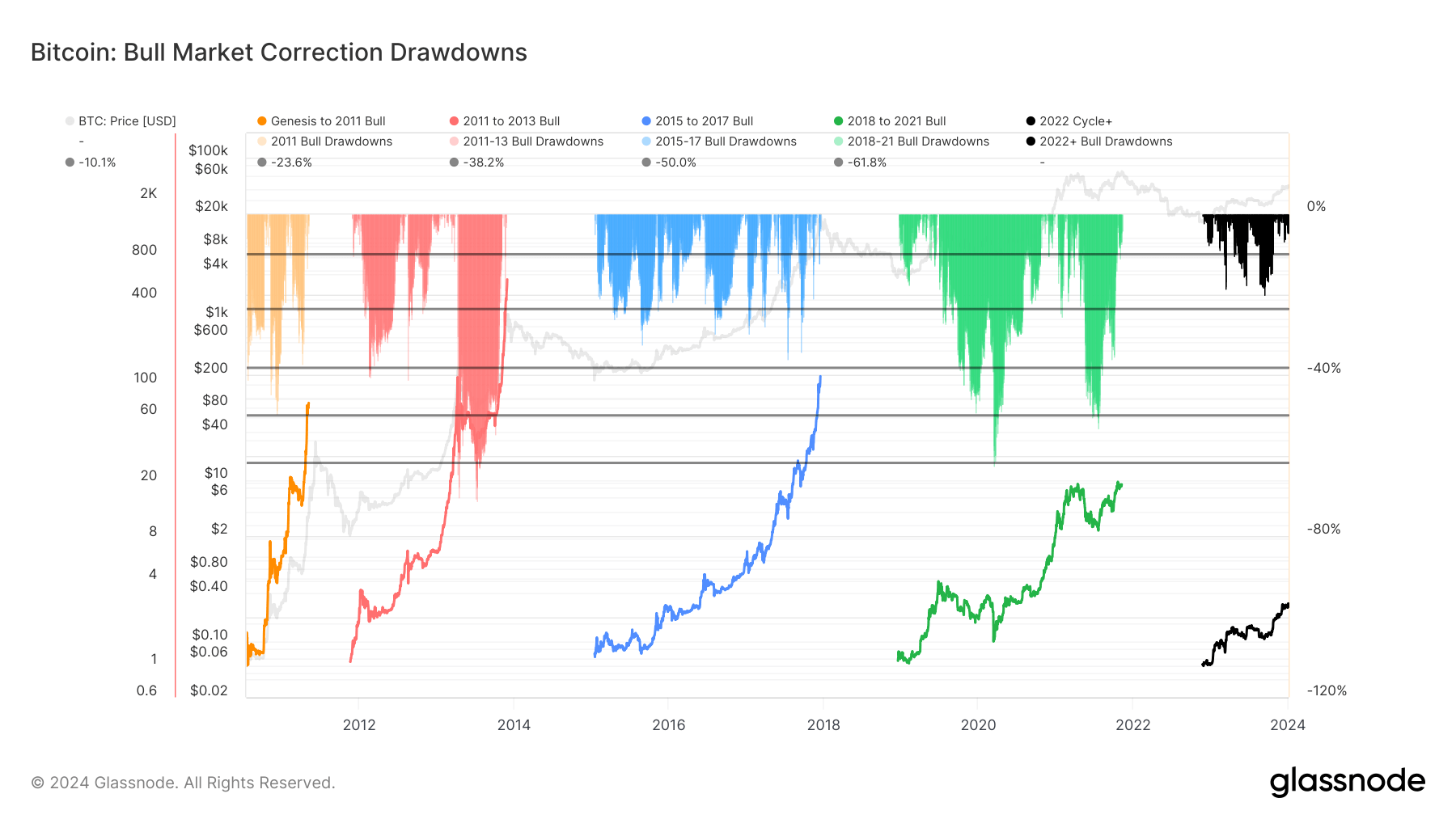

This decline triggered over $700 million of liquidations within a 24-hour window, with Bitcoin’s share amounting to $170 million, according to Coinglass. As per CryptoSlate’s analysis, this downturn is not abnormal. It aligns with the trend observed in the previous two cycles, which saw a correction of approximately 10%.

Currently, Bitcoin is trending at around 6.5% lower than its high point of $45,500. This trend may potentially extend if an Exchange-Traded Fund (ETF) is denied next week. Even so, it’s worth noting that the most significant correction during this bull market cycle was 20%, suggesting the current downturn may still fall within expected boundaries.

CryptoQuant

CryptoQuant