How StarSharks became the top BSC game in less than 6 months?

How StarSharks became the top BSC game in less than 6 months? How StarSharks became the top BSC game in less than 6 months?

The hottest game on BSC, StarSharks, has gained immense popularity but also faces negative token price pressure.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

According to BNB Chain Twitter, StarSharks is once again the top crypto game on BSC. Both in terms of transactions and WAU, StarSharks is far ahead of the previous leaders, Mobox and Bomb Crypto.

What makes this game, which looks similar to Axie Infinity, one of the hottest games today?

What is StarSharks?

StarSharks is a BSC-based metaverse game that revolves around shark NFTs, where players complete various game challenges using different kinds and levels of sharks.

StarSharks was launched in December 2021 by a team with a background in traditional gaming. It positions itself not just as a GameFi project, but as ContentFi, with an emphasis on content, targeting potential NFT applications, and creating new value for users.

StarSharks’ main features

To start their StarSharks journey, players must have three NFT sharks, and burning two sharks can make one higher-level shark. Players are rewarded with SEA tokens for defeating all of the sharks in PVP or PVE, and extra SSS tokens for ranking in the top 500 in PVP each season.

StarSharks has more highlights to attract players than many other GameFi projects.

- Built-in leasing system

Players can choose to buy a blind box of sharks at 500 SEA (about $200) or buy on the marketplace for about 0.341 BNB (about $150) floor. Even if a player chooses a shark with lesser attributes, he has to spend at least $450.

StarSharks has a built-in leasing system in order to allow players to access the platform more easily. Also as lessors have an additional passive income, as the platform reduces the minting of NFTs.

The current rental floor price is about 4 to 5 SEA, so renting three sharks is about 12 to 15 SEA. Three one-level sharks can earn about 37 SEA per day. Players who choose to rent sharks need to evaluate the balance between rental price and revenue.

- Invite players for profit sharing

By setting up an invitation mechanism, the platform encourages guilds and players to attract more players to join. The platform will set aside SSS tokens to reward the top 500 referrals for their contributions.

However, in the StarSharks voting, completed on March 31, in order to reward loyal VeSSS holders, the scope of players who can create invitation links was narrowed down to only eligible StarSharks affiliates.

Tokenomics and data

StarSharks uses a dual token model, with SSS as the governance token and SEA as the in-game token.

- SSS

SSS acts as the governance token, with a total supply of 100 million. 61% of this is for Collect to Earn to be fully circulated within 10 years, with 15% reserved for the team, 5% for the company reserve, 3% for the market fund, 5% for the angel financing, 6% for the private round, and 1% for the liquidity pool.

The platform stabilizes the value of SSS through a “releasing-staking-recycling” system.

In terms of release, SSS decreases year-by-year through an annual decay factor.

Staking SSS not only gives players the right to vote in community governance, but also shares in the profits of the platform, and in this way the platform reduces the pressure to sell off SSS.

Users receive different amounts of VeSSS by choosing different lock-up times for SSS, with the maximum lock-up period of 4 years being 1:1 for users who receive VeSSS.

VeSSS holders receive a weekly share of bonus based on the number of holdings. The bonus is mainly generated from 70% of the 4.25% trading fee on NFT and 30% of the SSS paid on the synthesis of NFT.

According to the model, the recovery rate (SSS consumed in the year / SSS released in the year) needs to be at 20% to maintain a robust platform.

- SEA

SEA is an in-game token with unlimited issuance, and the platform keeps the value of the token stable by balancing production and consumption. Except for the SEAs initially circulating on the DEX platform, players can only obtain them through the game.

Users can only use SEA when purchasing the Shark blind box, which provides the scenario for SEA to be used. And the rewards earned in the game are also SEA. This setup extends the lifecycle of the game, and the payback period for NFT purchasers is easier to calculate, anchored by SEA of about 40-60 days to earn back the initial 1500 SEA.

A small percentage of the 500 SEA paid by players minting sharks will be used as a handling fee, 90% will be burned and the rest will be rewarded to the referrer. The SEA spent on the shark upgrade will also be burned, and these measures ensure that the SEA is trying to prevent inflation.

It is worth noting that players selling NFTs receive BNB instead of SEA, which also relatively diverts the selling pressure on SEAs.

- Overall data

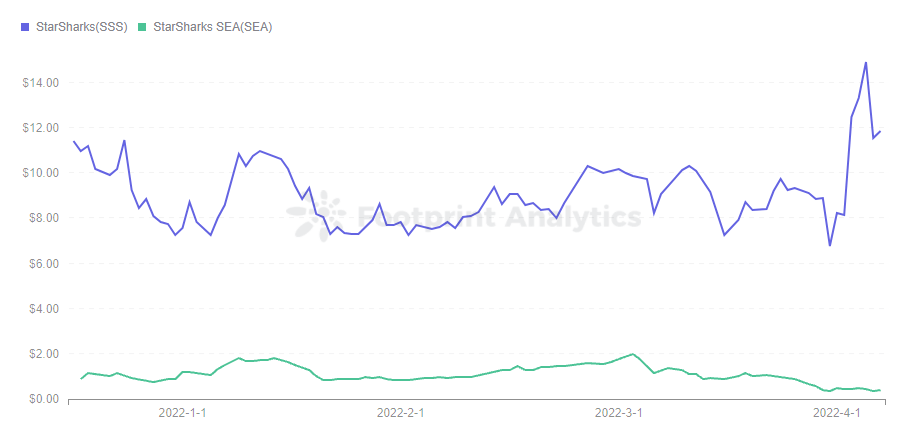

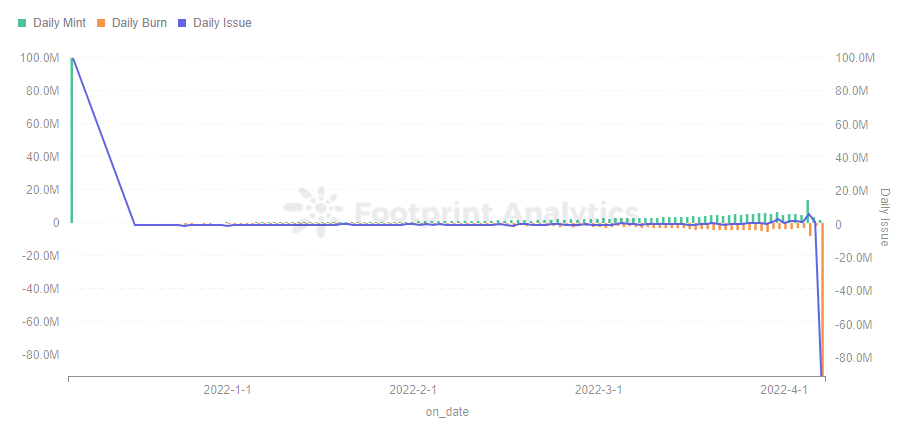

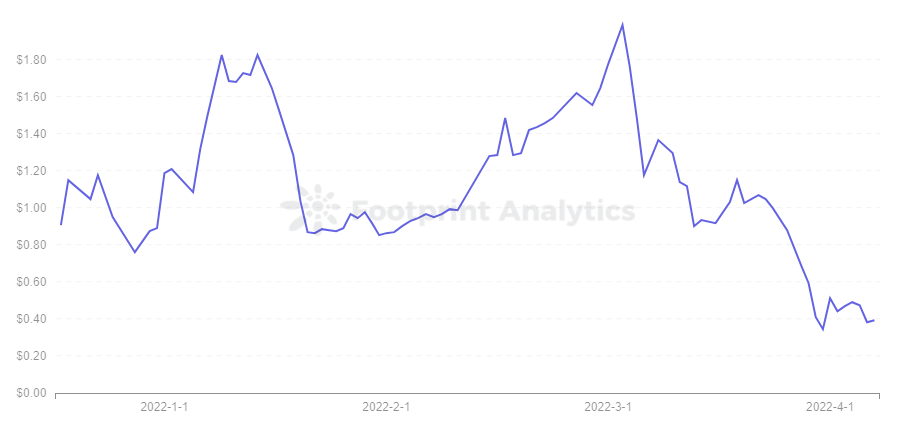

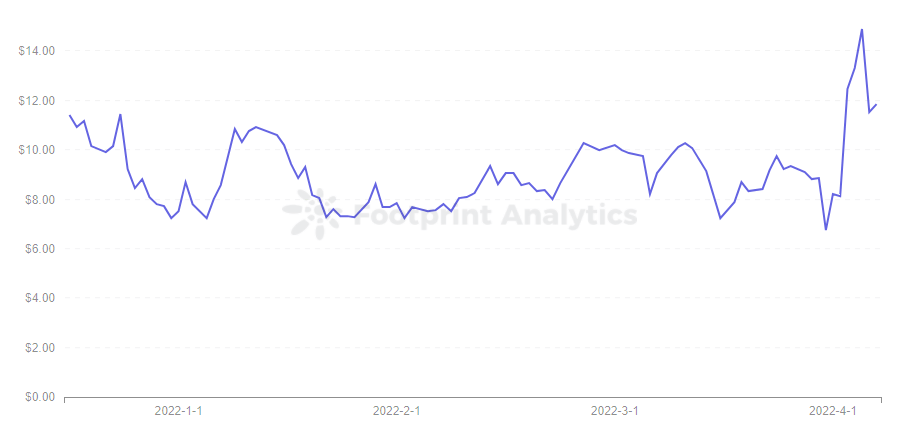

Looking at the data from Footprint Analytics, SSS and SEA have remained relatively smoothly priced. The governance token SSS is priced higher around $10, while the in-game token SEA has fallen below $1, with more selling pressure.

Looking further at the token trend, StarSharks has been growing in users, but SEA has not been able to reverse the decline with the burning model, only slowing it down.

This is because the influx of new users has increased the amount of SEA minted. Since players can also earn by renting, this has affected the amount of SEA burnt by purchasing blind boxes.

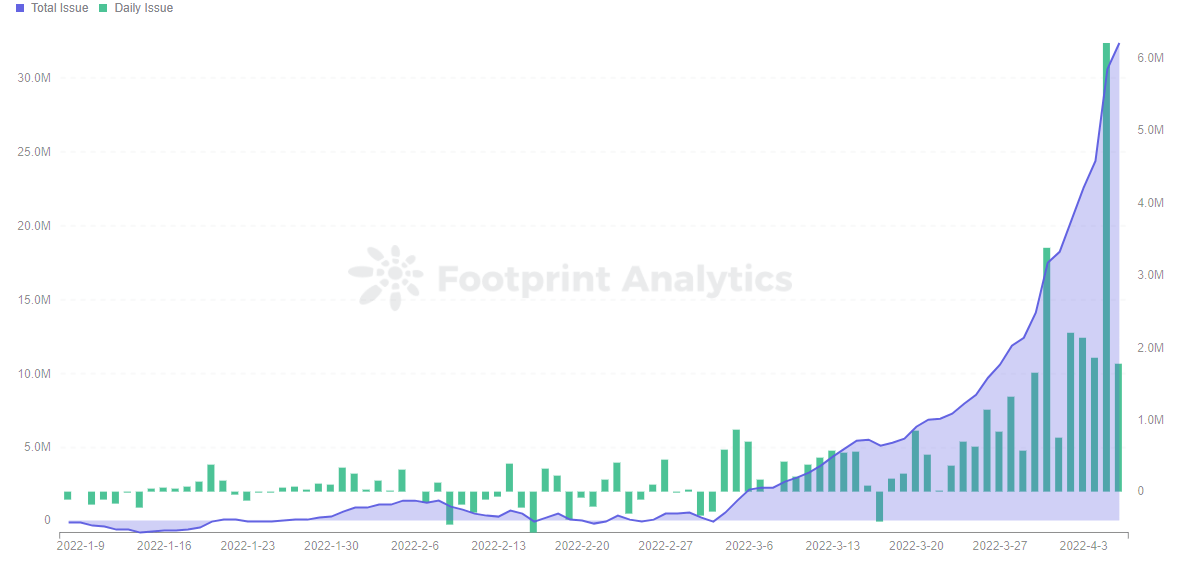

The data from Footprint Analytics shows that in the early stages, the daily SEA net issuance was mostly negative because there were not enough NFTs for users, so they buy more blind boxes. As the program grows, the players increase, the number of NFTs available for rent increases, and net SEA issuance gradually increases in the later stages.

After March, the cumulative issue turned positive and climbed rapidly, and the burning rate of SEA could not keep up with the minting, which led to SEA’s inflation.

Current GameFi projects rely on new players coming in to drive the revenue for old players, and if the token price keeps falling, less new players to join. The project may enter a death spiral. New players and token prices are key indicators of the game’s life cycle.

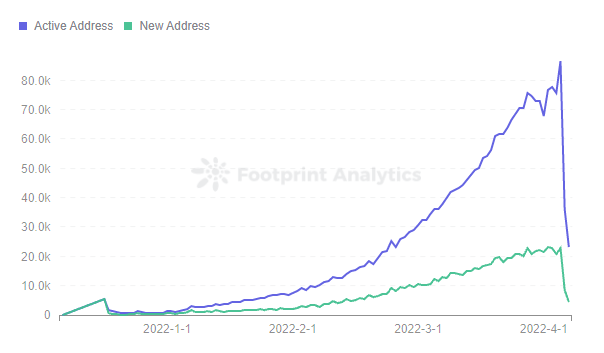

With the end of the scholarship event on April 1, new and active users started to decline, and the token price also showed signs of falling. The project saw this and quickly reacted with a series of updates.

First, the game mechanics were upgraded on April 6 and 7, including the cancellation of daily tasks and slot machines, increasing the tokens burned to upgrade, increasing the limitation for claim SEA, and widening the output difference between shark levels.

These measures show that the team is consciously adjusting the minting and circulation of SEA, and increasing the SEA burned. Data from Footprint Analytics sees a rapid decline in daily active and new holders of SEA after the 6th.

On top of that, on the 7th, the team burned 91.43 million SEA, which is all the team has earned so far. All of these moves show StarSharks’ efforts to push the price of SEA up. While it has eased selling pressure on SEA, the price has not recovered significantly as of April 8.

While the price of SEA did not rise, the price of SSS climbed rapidly after April 1 when the team finished voting on the StarSharks affiliate program. The proposal gave invite link creation ability only to stakers with over 10,000 VeSSS, which solidified usage scenarios of SSS.

Is the future of StarSharks positive?

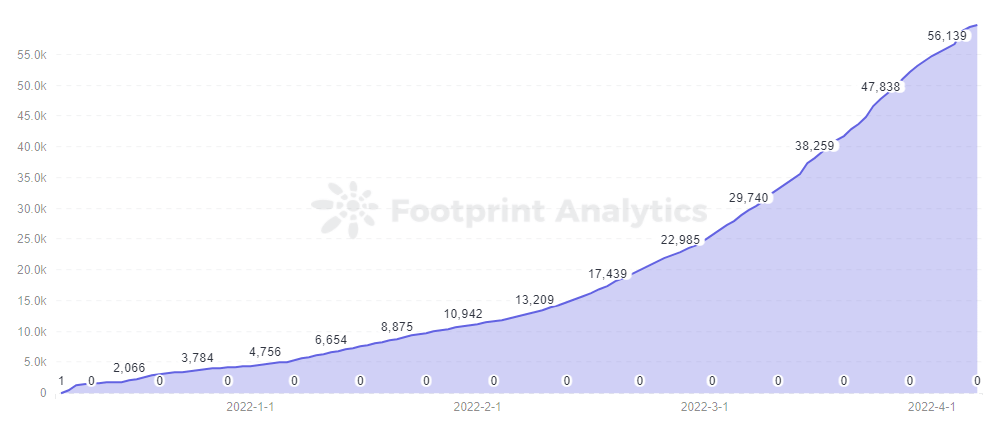

In the five months since its launch, the number of StarSharks players has grown by leaps. However, there have been some problems, such as a drop in price due to an imbalance in token minting and burning.

Although the project has learned from its predecessors and adjusted quickly to the token economy, it still failed to effectively control its decline. The token price and new users will create a negative feedback loop, and if they can’t control the price, new users will decline into a death spiral.

But the team’s efforts in game design, rapid iterative upgrades, and generous burning show that StarSharks is aiming to stick around for long run.

Date & Author: 15 of April 2022, Simon

Data Source: Footprint Analytics StarSharks Dashboard

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

CryptoQuant

CryptoQuant