How Chinese crypto investors may help fuel the DeFi sector’s rise

How Chinese crypto investors may help fuel the DeFi sector’s rise How Chinese crypto investors may help fuel the DeFi sector’s rise

Photo by Marvin Ronsdorf on Unsplash

The decentralized finance sector has been grabbing the attention of crypto investors throughout the past couple of months, as virtually every associated token has been posting massive gains.

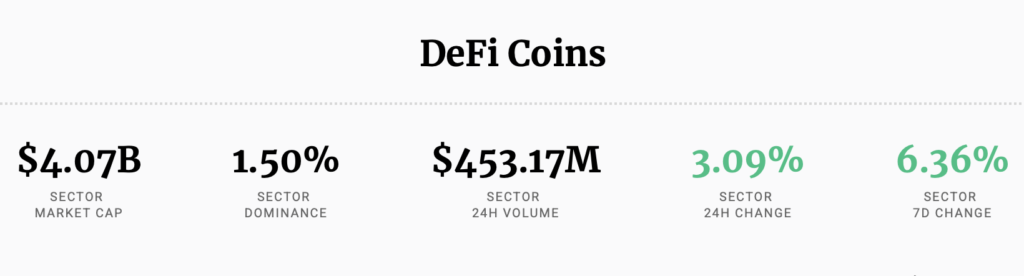

Despite seeing parabolic growth, the sector as a whole remains relatively small, with an aggregated market capitalization of just over $4 billion.

Outside of the crypto industry, DeFi remains unknown, and the trend hasn’t built popularity in many countries – including China.

There are a few reasons for this, and one analyst is noting that it is a good thing for early DeFi investors that China hasn’t yet gotten in on the trend, as an influx of investor capital from the country could cause it to see a “boom and bust” cycle.

DeFi sector continues growing as investor capital floods in

Bitcoin’s stagnant price action throughout the past few months has provided altcoins with an ideal backdrop to rally against.

Many DeFi-related tokens have seen the largest gains out of all altcoins, with some even climbing as much as 1000 percent.

Shortly after the successful launch of Compound in late-June, investors began siphoning funds into just about every token related to the bourgeoning ecosystem.

This created a multi-week uptrend in which these tokens were able to post consistent gains daily.

Although this momentum has stalled over the past couple of weeks, many of these digital assets are still caught within the throes of parabolic uptrends.

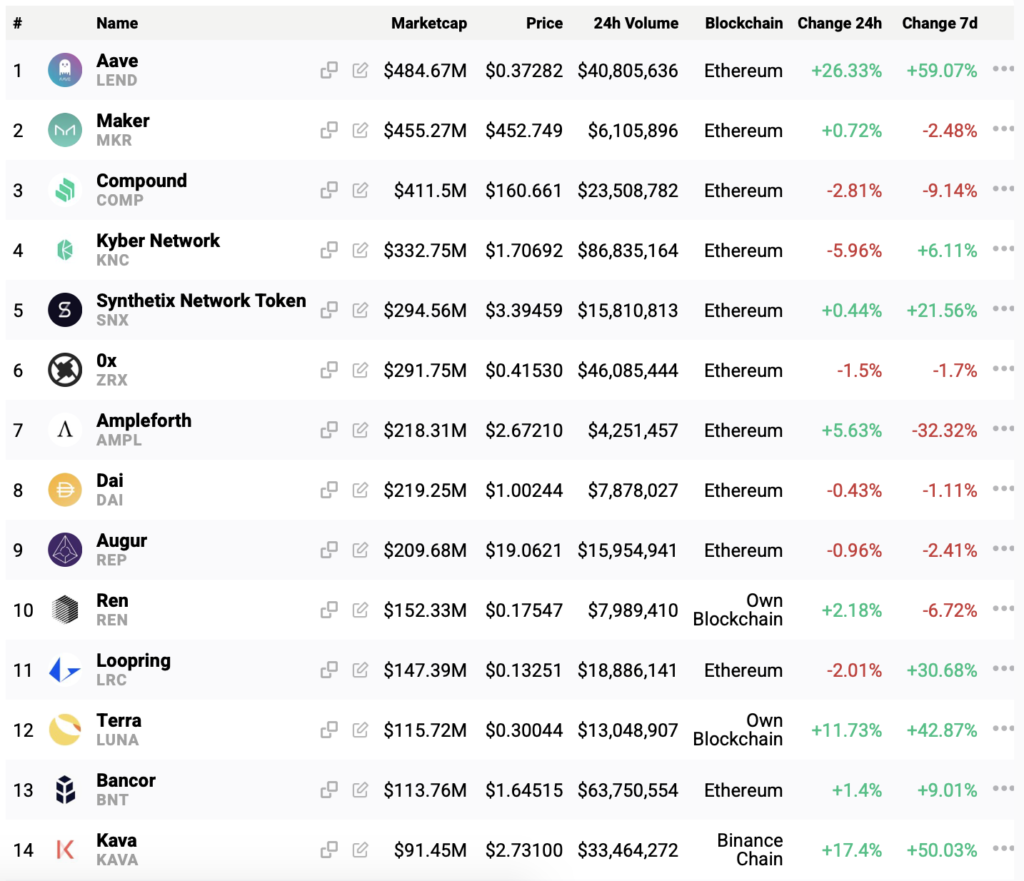

This has caused the sector to see a mixed performance.

According to CryptoSlate’s proprietary data, the DeFi sector has grown by just over 6 percent throughout the past seven days, with its market cap now totaling at just under $4.1 billion.

While looking towards the top tokens within this fragment of the crypto market, it becomes clear as to just how mixed their price action has been.

Chinese investors could ultimately fuel the market’s continued rise

Because the DeFi sector still remains relatively small, the entrance of one large investor group could propel it higher.

Chinese investors may be the next source of fresh funding, although Dovey Wan – a partner at Primitive Ventures – recently explained that there are six key things that have stopped DeFi adoption in China:

- The bust of the exchange liquidity mining era

- Lack of a large Ethereum community in China

- DeFi farms are primarily tailored towards English-speaking users

- Fears regarding DeFi being a bubble (similar to the exchange transfer fee mining trend that collapsed)

- Lack of incentives for users to hold tokens for the long-term

Assuming that the decentralized finance trend does start gaining popularity amongst Chinese investors despite these concerns, they may help fuel its continued rise.

One fund manager who posts on Twitter under the name “Spartan Black” explained that the entrance of Chinese money into the DeFi space could create a dangerous situation for the sector.

“Chinese money not doing much DeFi farming is probably a good thing for farming sustainability. When Chinese money gets involved it usually does so in size, and hence accentuates the boom and bust.”

If “yield farming” becomes unsustainable, the strong fundamentals underpinning many DeFi protocols will degrade.

Farside Investors

Farside Investors