Have investors finally come around to accepting Bitcoin (BTC) as a safe haven?

Have investors finally come around to accepting Bitcoin (BTC) as a safe haven? Have investors finally come around to accepting Bitcoin (BTC) as a safe haven?

Bitcoin shows signs of decoupling from stocks, is Nakamoto's vision finally coming true?

Photo by Karolina Grabowska from Pexels

Bitcoin is up 24% since the start of October, with six daily green closes out of seven. Meanwhile, over the same period, stocks fell, although many stock indices seemed to have bottomed mid-week.

This apparent divergence in investor activity has some wondering if Bitcoin, and the crypto class in general, has broken its correlation with the stock market.

Is Bitcoin correlated with stocks?

Bitcoin was created as an alternative financial system, and creator Satoshi Nakamoto intended it to equalize control of currency to make a fairer deal for the common man.

However, throughout its history, Bitcoin has demonstrated instances of correlation with legacy markets. Most notable in recent memory was the “corona crash” in March 2020.

Back then, over an eight-day stretch beginning March 9, the Dow experienced the worst points drops in its history, with the most significant loss occurring on March 16.

“on March 16 the Dow plummeted nearly 3,000 points to close at 20,188, losing 12.9%. The drop in stock prices was so massive that the New York Stock Exchange suspended trading several times during those days.”

In the hysteria, Bitcoin fell from $7,900 to $4,300 on March 12 – a 46% loss. Previous to this, there was continuing debate over Bitcoin’s safe haven and alternative investment status. But that one incident was enough to “prove” a strong positive correlation with stocks.

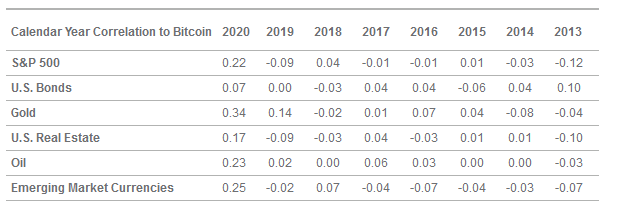

However, data analysis shows the relationship between Bitcoin and stocks is not as black and white as that. Using correlation coefficient, where -1 is strongly negatively correlated, and 1 is strongly positively correlated, Bitcoin has demonstrated a fluid correlation with the S&P500 throughout its history.

According to VanEck, over the last three years, Bitcoin has gone from being slightly positively correlated with the S&P 500 in 2018 (0.04) to slightly negatively correlated in 2019 (-0.09). Then somewhat moderately positively correlated in 2020 (0.22).

Will 2021 be the year for decoupling from stocks?

With 12 weeks remaining until the end of the year, there is no annual correlation data to compare with the above for 2021.

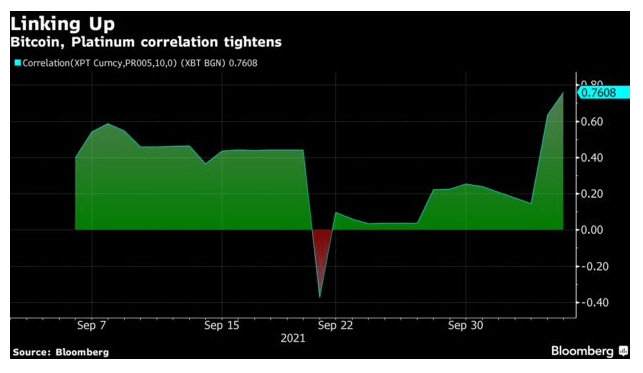

However, precious metals, in particular platinum, are typically viewed as established safe-havens. Analysis by Bloomberg shows that Bitcoin has hit a strongly positive correlation coefficient of 0.76 with platinum.

This would support the argument that Bitcoin is decoupling from legacy markets. All the same, it’s far too soon to say with conviction that this is indeed the case.

Brian Mosoff, the CEO of Ether Capital Corp points out that he still views crypto and stocks similarly, as risk-on assets. This is because investors are not fully convinced that crypto is here to stay.

Nonetheless, Mosoff added that Bitcoin’s fixed supply is an attractive proposition when considering the deteriorating macroeconomic landscape. He was referring to talk of the U.S defaulting and the money printing saga as a response to the pandemic.

“Investors are slowly saying maybe it’s not such a crazy idea and that’s why capital is trickling into this space.”

CryptoQuant

CryptoQuant