Footprint November Monthly Report: DeFi TVL surpasses $288B, NFTs stall

Footprint November Monthly Report: DeFi TVL surpasses $288B, NFTs stall Footprint November Monthly Report: DeFi TVL surpasses $288B, NFTs stall

Following a gradual recovery in October, November saw breakthrough growth in all areas of the crypto market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

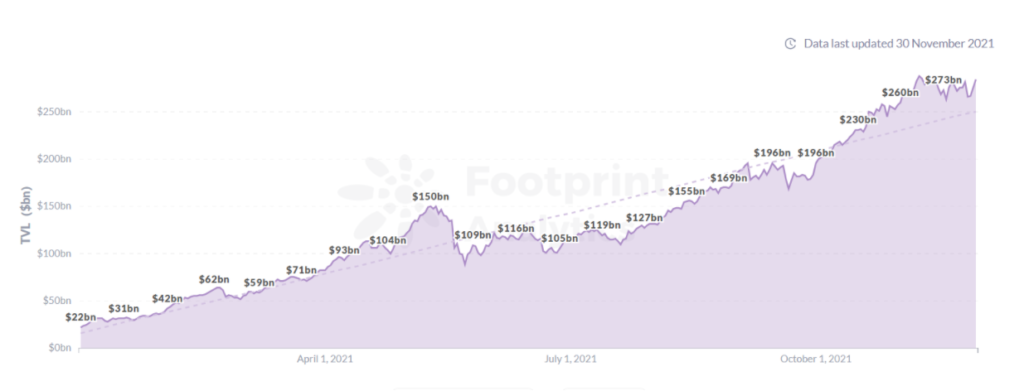

In the month of November, DeFi’s Total Value Locked (TVL) surpassed a record high of $288 billion, up by 32.7% MoM, and Bitcoin and Ethereum surpassed previous all-time peaks.

Although NFT trading activity slowed, it has not affected fundraising in the sector.

BTC, ETH hit record highs

Bitcoin

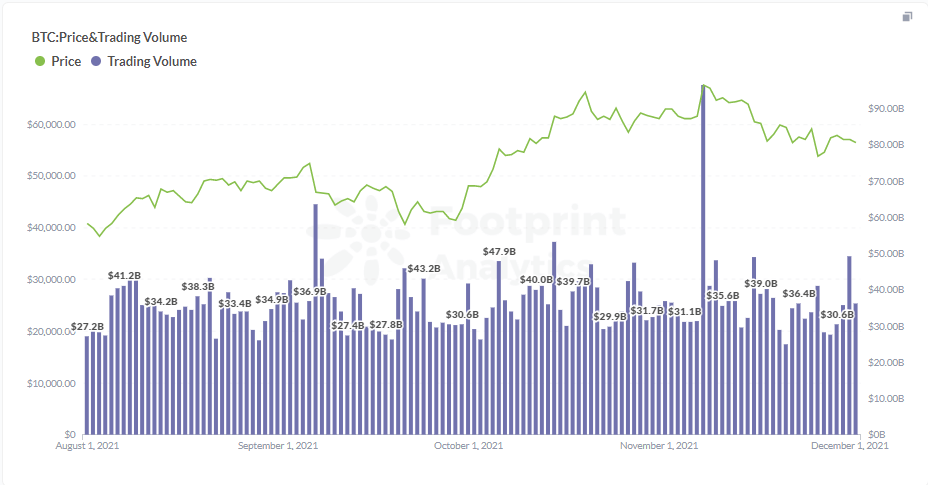

The price of BTC hit another record high on Nov. 8, surpassing $67,670, a 25% monthly increase, bringing its market cap to $1.28 trillion. As of Nov. 30, the BTC price returned to May levels, with overall coin price fluctuations remaining between $50,000 and $60,000.

BTC’s first all-time high resulted from the first Taproot upgrade, which aims to enhance the Bitcoin protocol by improving privacy, introducing smart contract functionality and process complex transactions at a lower cost. These are major changes and important factors directly affecting BTC’s price increase.

Ethereum

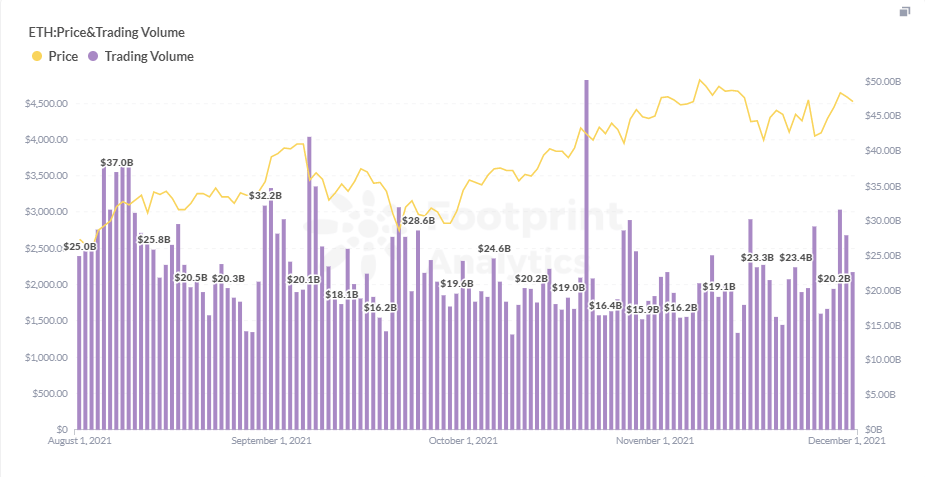

Likewise, the price of Etheruem rose to a new high of $4,800 on Nov. 8 and has remained above $4,000 as of writing. This rise comes not only from the launch of Etheruem 2.0, and features of Layer-2, providing users and projects with a better experience, higher efficiency and lower gas fees.

Most importantly, with the upgrade from POW to POS and the formation of automatic destruction, the circulating supply of ETH has been restricted, causing a scarcity of ETH and a natural price rise.

DeFi’s TVL exceeds $288 billion

Compared to October, DeFi’s TVL has been booming, reaching an all-time high on Nov. 9. The competition for TVL dominance within DeFi has also become increasingly fierce among chains and projects.

Here are just a few November highlights:

- The emergence of DeFi 2.0 as a concept, which aims to solve issues such as inefficient funding and selling pressure.

- DeFi platform Acala won the first Polkadot parachains auction to enable cross-chain information interaction.

- Completion of the EVM equivalency upgrade for Optimism, the Etheruem Layer2 scaling solution, simplifies the development process for developers and reduces transaction costs.

- Blockchains Avalanche, Solana and Terra reached new highs in DeFi TVL.

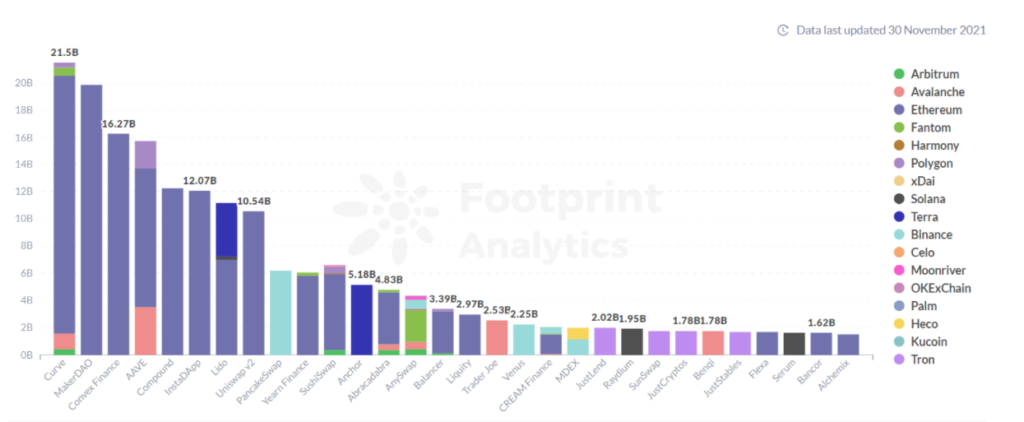

Curve leading DEX, Convex overtakes Aave to rank third

Convex Finance, which officially launched on May 17 this year, has overtaken Yearn Finance ($16.27 billion) as the leading yield project in terms of TVL ($6.06 billion) on Nov. 30. It is now the third-largest DeFi project, even overtaking Aave ($15.72 billion).

What made Convex Finance so popular?

Convex aims to improve on Curve’s UX shortcomings with a one-stop platform for CRV pledging and liquidity mining. It aims to simplify the process of locking and pledging CRVs on Curve through an easy-to-use interface with CVX tokens, and to boost the growth of the CRV ecosystem by increasing the compensation of CRV holders and liquidity providers. Its new economic model is one of the key features of DeFi 2.0.

Curve continues to lead the DEX category with $21.5 billion in TVL. From its inception, it has positioned itself as a decentralized exchange specifically designed for stablecoins, solving the issue of high slippage in the AMM model as well as high gas fees, which will undoubtedly be taken into account when using stablecoins, thus making inroads with investors.

Fierce multi-chain competition

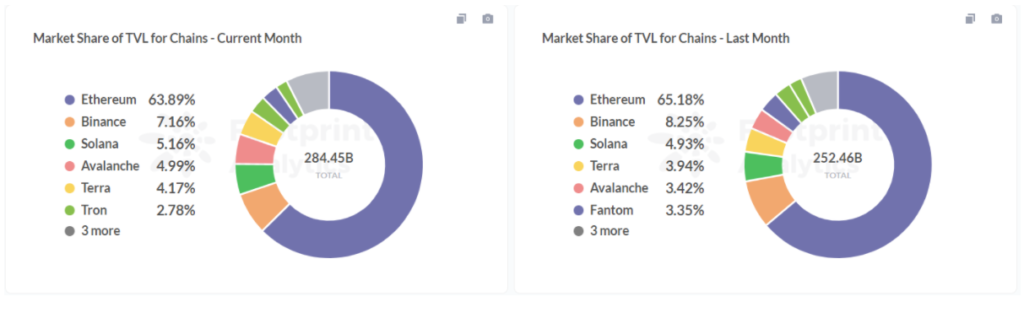

Footprint Analytics show that the market share of Etheruem and BSC was gradually divided by other blockchains in November, with slow growth in Ethereum and a decrease in BSC (Ethereum TVL: $181.74 billion in November compared to $164.55 billion in October, an increase of 10.4%; BSC TVL: $20.37 billion in November compared to $20.83 billion in October, an increase of -2.2%).

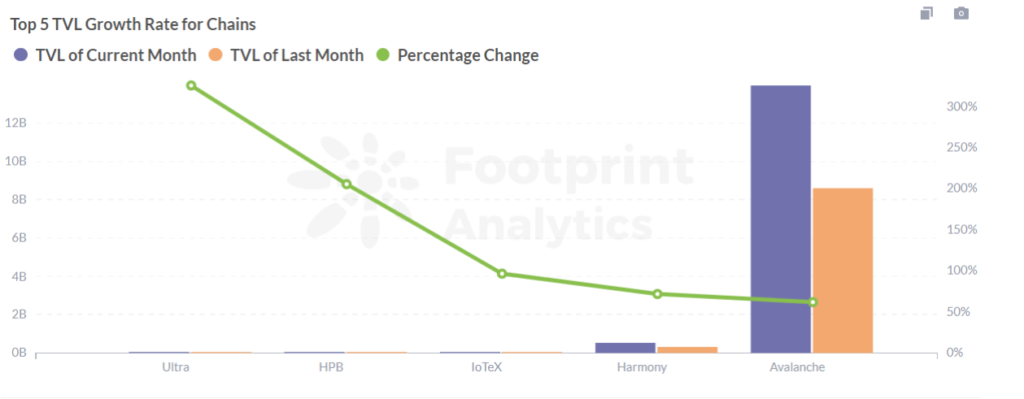

In the past 30 days, one of the fastest-growing chains has been Avalanche, with TVL rising from $8.63 billion in October to $14.2 billion in November, a 65% increase, ranking the fourth in TVL. Its success comes from its growing liquidity mining activities, increased incentives and EVM compatibility.

In November, NFT trading volumes fell by another 27%

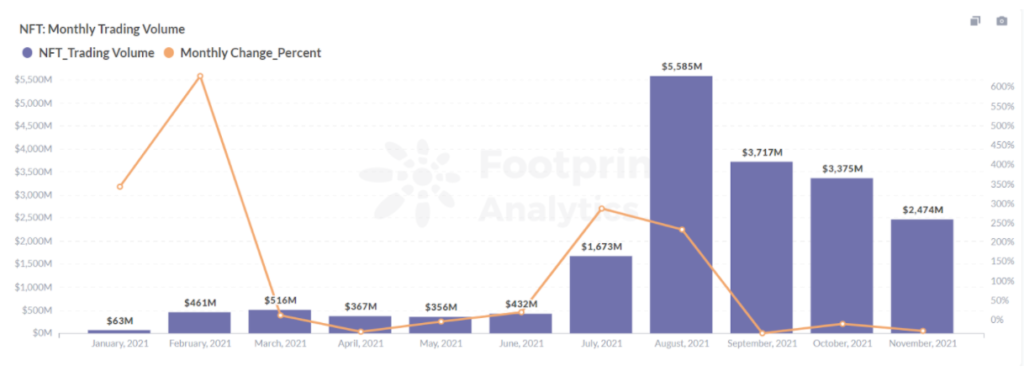

Since July, the popularity of the crypto market has moved from DeFi to NFT, with NFT’s trading volume peak in August ($5.5 billion) and has accumulated to US$19 billion this year so far, according to Footprint Analytics.

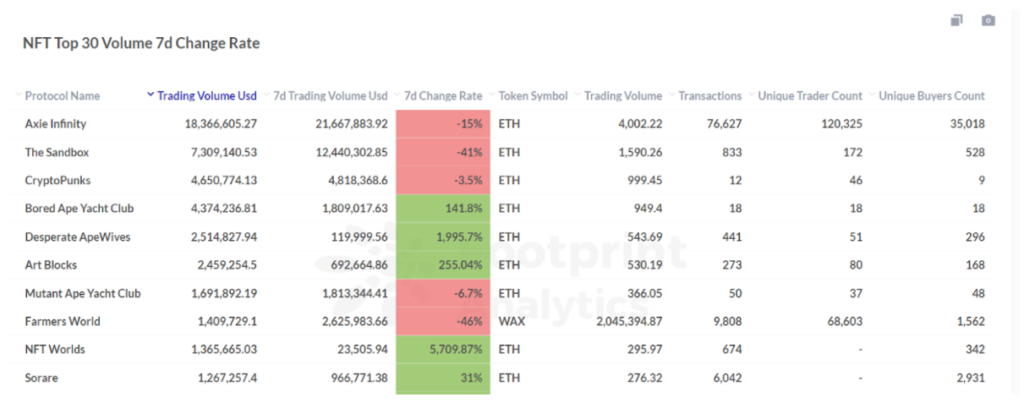

However, compared to October, trading volumes fell again in November, from $3.3 billion in volume to $2.4 billion, a growth rate of -27%, mainly due to drops in some major Ethereum NFT platforms, e.g. CryptoPunks (-3.5%), Axie Infinity (-15%) and The Sandbox (-41%).

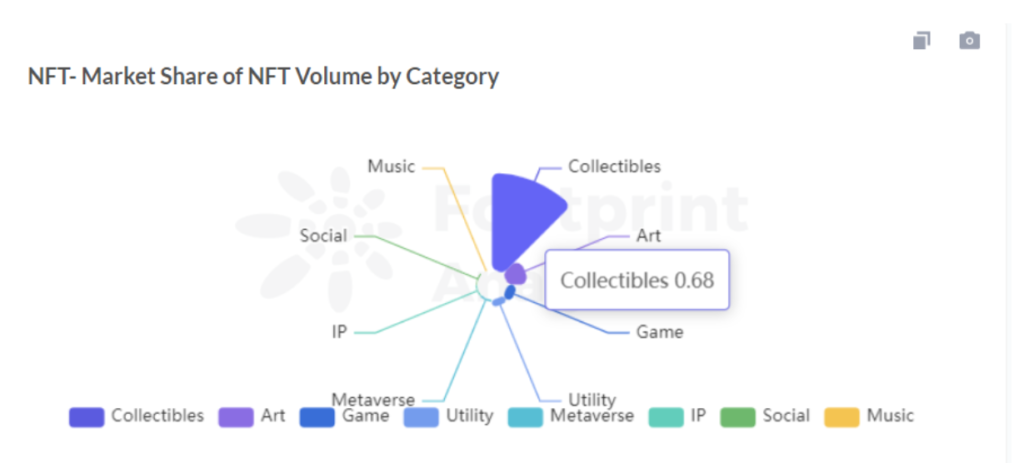

NFT collectibles are still solid, occupying 68% market share

While trading volume has decreased, collectibles still hold a solid 68% of the NFT market share, with art and gaming holding 16% and 7.3% respectively. It is no surprise then that CryptoPunks collectibles, the most well-known NFT collection, subsequently produced a slowdown in trading volumes. The likes of the DeFi ecosystem are constantly updating and iterating to offer better and better models to both projects and users, so the NFT market needs a newer, more exciting project that can help reignite the market.

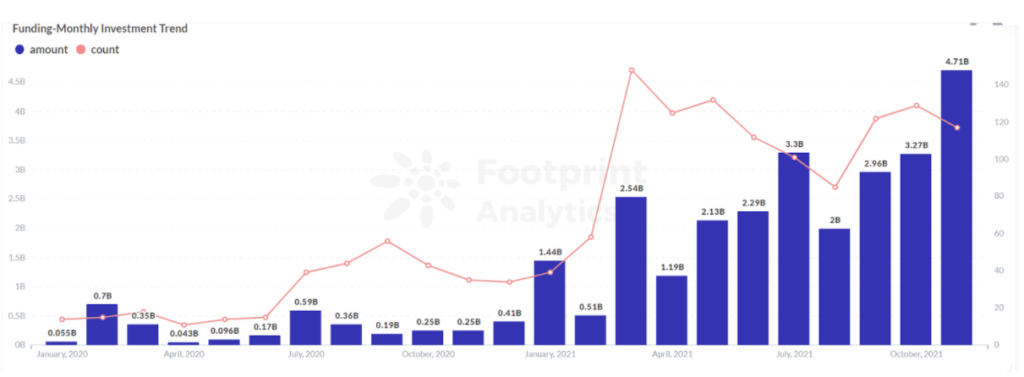

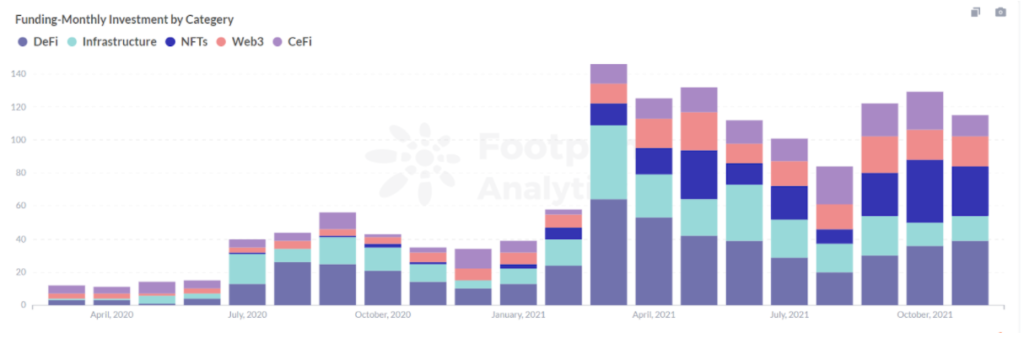

Major investment houses entering DeFi & NFT

NFTs and DeFi have become popular avenues for capital investment. According to Footprint Analytics, the largest percentage of investment funds in November entered DeFi, overtaking NFTs. One reason is that DeFi is iterating to DeFi 2.0, innovating in terms of capital efficiency and reducing gas fees, the current pain points for investors.

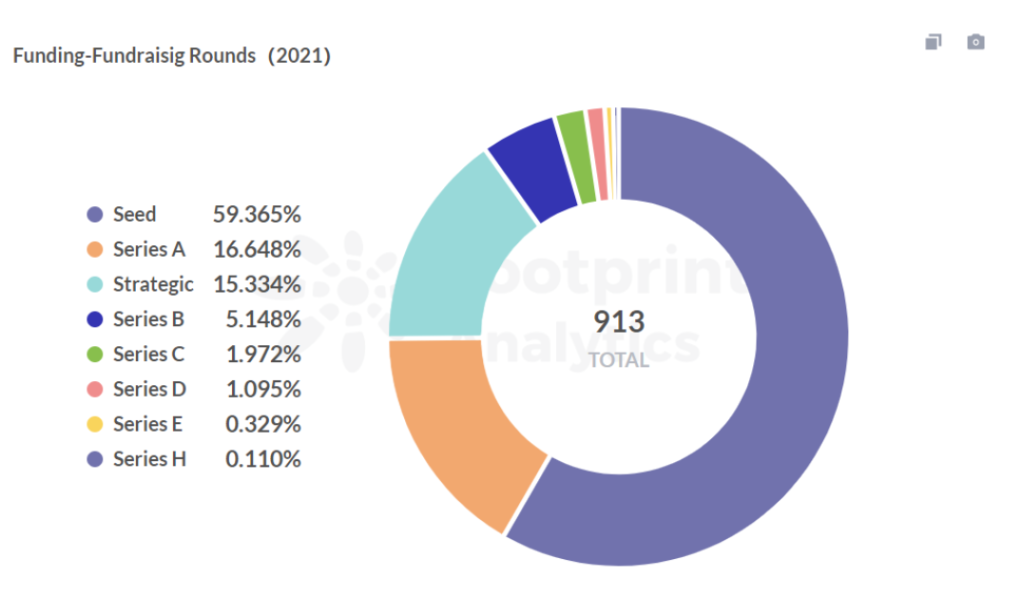

Financing is still in the early stages

In 2021, fundraising has been dominated by seed round investments, occupying 60%. Investments in the global blockchain sector are still in the early investment stage, with new types of projects of all kinds constantly sprouting.

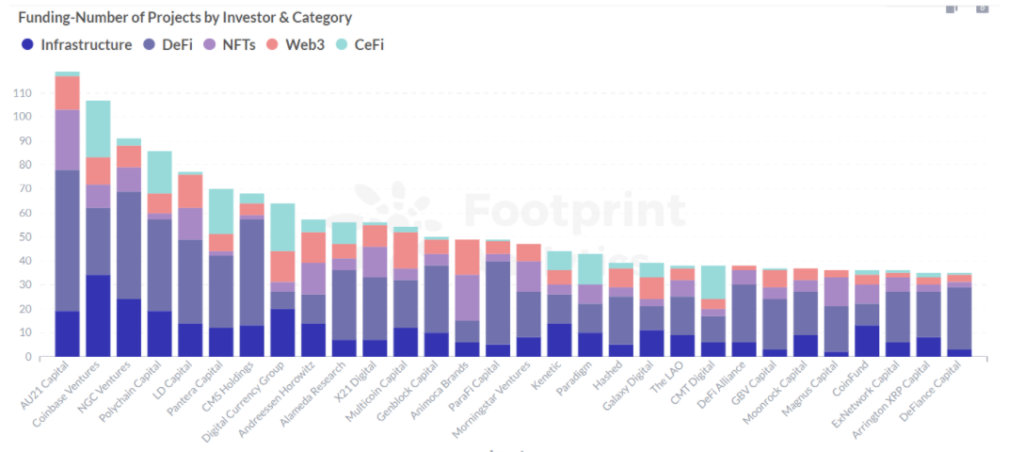

Different investment focus, AU21 having the highest number of investments

According to Footprint Analytics, AU21 Capital is currently the largest investor with 119 investments, which is a fund dedicated to supporting the most talented people in the blockchain space. Its main activities include early-stage venture capital, initial token offerings, and seed investments.

Summary

The crypto market has seen groundbreaking growth across all sectors this month, with BTC and ETH hitting all-time highs and DeFi setting new records, giving most investors and users a boost of confidence. Ethereum and BSC continue to play a vital role in decentralized finance, and Avalanche is not far behind. Solana and Terra are also continuously improving.

The decline of NFT monthly trading volume does not spell doom for NFTs, but indicated the market is waiting for a push to reignite activity.

November Key Events Review:

Policy and News:

- South Korean regulator announces ban on physical asset-based NFT app games

- Finland strengthens regulation of virtual currencies

- Nigerian payment app KurePay to suspend operations due to government crackdown on cryptocurrencies

- G20 meeting: Encouraging continued in-depth analysis of the potential role of central bank digital currencies in facilitating cross-border payments

- India may ban listing and trading of cryptocurrencies without government approval

- US senators to introduce encryption amendment to Biden’s infrastructure bill

- Asian Blockchain Gaming Consortium launched in Singapore

Fundraising:

- NFT sports platform SportsIcon closes $5.5 million seed funding round

- Blockade Games, a blockchain game developer, closes $5 million funding round

- Avocado Guild raises $18 million in Series A funding led by Animoca Brands

- DAO voting platform Snapshot Labs closes $4 million funding round

- Open Meta raises $4.5 million to formally create Open Meta DAO in 2022

- Web3 social layer builder Mem Protocol closes $3.1M in funding led by a16z

- Blockchain gaming infrastructure provider Forte closes $725 million Series B funding round led by Sea Capital and Kora Management

- Ethereum miner CoreWeave closes $50 million funding round from Magnetar Capital

- LD Capital establishes $100 million Metaverse ecosystem fund ‘Meta Fund’

Blockchains:

- DeFi Total Value Locked on the Avalanche chain reach a record high of $13 billion

- Stablecoin circulation on Etheruem tops $95 billion

- Moonbeam wins Polkadot’s second Parachain slot and increases its crowdfunding bonus by 50%

- Boba Network surpasses $1 billion in TVL, jumps to second in TVL for Layer2 solutions

- 56% of total newly produced ETH destroyed via base fee since Etheruem implementation of EIP-1559

- Bitcoin network difficulty raised to 22.67T for the ninth time in a row

- Total DeFi TVL the Solana chain exceeds $15 billion, a record high

NFTs:

- The total market value of metaverse-related crypto assets exceeds $48 billion

- The total market value of play-as-you-earn class NFT game passes tops $35 billion, a record high

- Total NFT on-chain sales top $15 billion, a record high

- The total market value of NFT passes exceeds $60 billion, including $30 billion in the “Play-to-Earn” category, a record high

- Google searches for NFT soar to record high

- Axie Infinity average player’s daily income slips below the Philippine minimum wage

- Digital artist Beeple’s Discord hacked, fake NFT airdrop causes users to lose around 38 ETH

- Beeple’s new NFT artwork sells for nearly $29 million in ETH, making it the second most expensive NFT ever

- NFT marketplace OpenSea reaches $10 billion in total trading volume

DeFi:

- DeFi platform Acala wins Polkadot first parachain slot

- Coinbase is considering supporting third-party DeFi apps on its platform

- Valkyrie launches $100 million “On-Chain DeFi Fund”

- Cream Finance to distribute over 1.45 million CREAMs to users affected by the attack

- Polkadot ecosystem DeFi project Parallel’s Auction Loan product TVL surpasses $300 million

- Ethereum Layer 2 Scaling Solution Optimism Completes EVM Equivalency Upgrade

- Uniswap V3 automated liquidity protocols do not yield better returns than regular LPs

- The total market value of Top 100 DeFi passes surpasses $170 billion, a record high

- Total network-wide DeFi TVL top $250 billion, a record high

- Funds stolen in DeFi attacks this year have reached $680 million

For more data developments and content from the DeFi ecosystem, click on the Footprint link for more project dashboards and analysis.

The above content is only a personal view, for reference and information only, and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CryptoQuant

CryptoQuant