Fifth consecutive weekly outflows point to crypto market fragility

Fifth consecutive weekly outflows point to crypto market fragility Fifth consecutive weekly outflows point to crypto market fragility

Crypto investment providers suffered $232 million of outflows over the past five weeks. Trading volume was also on the slide.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Analysis conducted by CoinShares highlighted that crypto markets saw a fifth consecutive week of outflows with the current week totaling a $32.1 million loss.

CoinShares sourced data from digital asset investment providers, such as Grayscale and ProShares, which cater to institutional and accredited investors.

Head of Research at CoinShares, James Butterfill, commented this was due to “poor sentiment focussed on BTC.”

Crypto markets suffer fifth consecutive weekly outflow

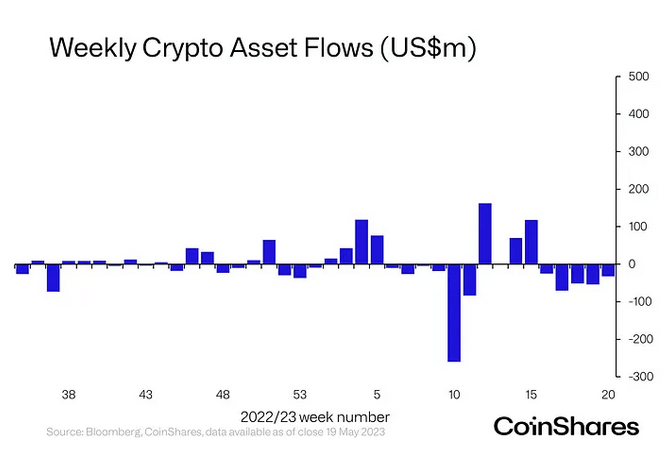

The chart below shows the consecutive crypto asset outflows from week 16. The total outflows during this period amounted to $232 million.

Since the start of 2023, there have been more outflow weeks than inflows, with week 10 (beginning Monday, March 6) representing the most significant weekly outflows this year, topping approximately $270 million during that period.

Early March was characterized by bank failures, which saw Silvergate, Signature Bank, and Silicon Valley Bank undone in the current high-interest rate environment.

After that period, the price of Bitcoin recovered, bouncing from a low of $22,390 to close the week starting March 13 at $28,140, going on to top $31,000 a month later. Analysts attributed this to a shift in market sentiment toward hard assets.

More recently, the narratives of U.S. regulatory hostility and uncertainty surrounding debates on the U.S. debt ceiling, have taken their toll on crypto assets in general.

Germany had the biggest outflows

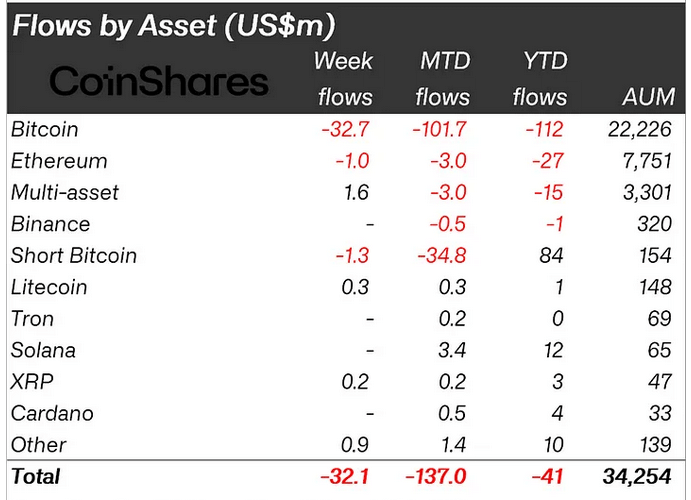

Flows by asset showed Bitcoin made up the most significant losses, coming in at $32.7 million during week 20. Ethereum and Short Bitcoin also suffered losses – albeit at significantly lower rates of $1 million and $1.3 million, respectively.

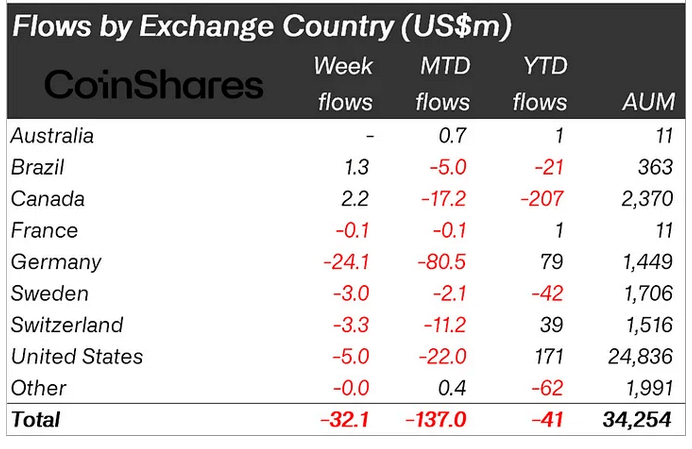

Further analysis by country showed Germany was responsible for the most outflows, accounting for 75% of the weekly drain. The U.S. followed this at $5 million, then Switzerland at $3.3 million.

CoinShares remarked that the outflow trend was tied with volumes also being materially down for both institutional investors and spot markets.

“Volumes totaled US$900m for the week, 40% below this year’s average. Volumes for the broader market on trusted exchanges hit their lowest level since late-2020 at US$20bn for the week.”

CryptoQuant

CryptoQuant