Ethereum accounts for 88% of crypto investment products’ $176 million inflow

Ethereum accounts for 88% of crypto investment products’ $176 million inflow Ethereum accounts for 88% of crypto investment products’ $176 million inflow

CoinShares stated that the crypto investment products experienced an increase in their trading volumes during the past week.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

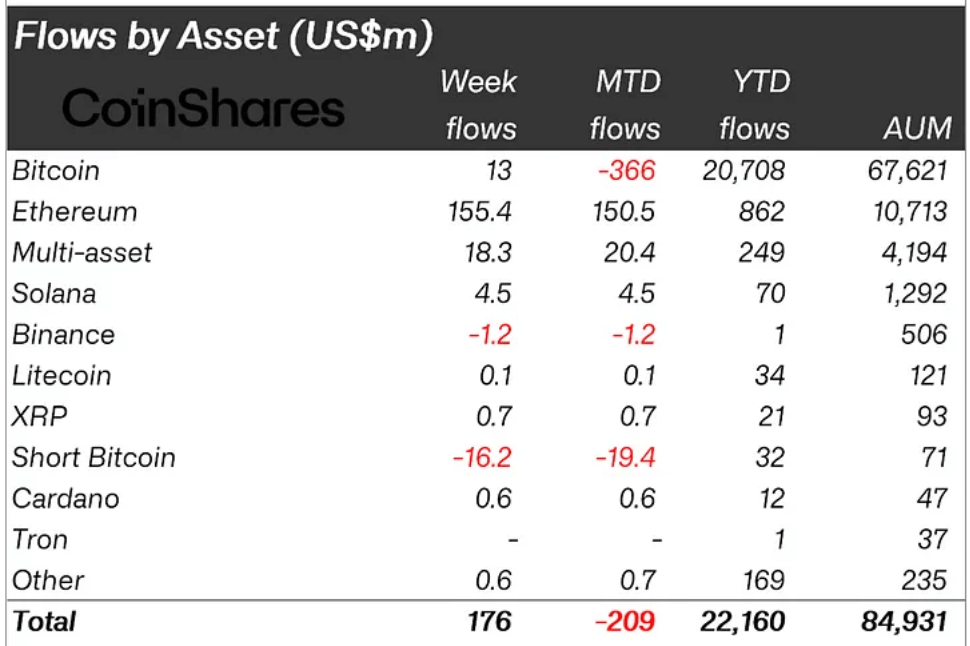

Crypto investment products experienced significant inflows of $176 million as investors capitalized on recent price dips, according to CoinShares‘ latest weekly report.

James Butterfill, the head of research at CoinShares, noted that the total assets under management (AUM) for crypto ETPs dipped to $75 billion amid the correction but have rebounded to $85 billion as of the latest report.

The trading volume for exchange-traded products (ETPs) surged to $19 billion during the period, exceeding this year’s weekly average of $14 billion.

Ethereum dominates

Ethereum saw the most substantial benefit from the market correction, with $155 million in inflows last week. This brings its year-to-date inflows to $862 million, the highest since 2021, mainly due to the recent launch of US spot-based ETFs.

Market experts have praised Ethereum ETFs’ performance since their launch in July. For context, Nate Geraci, president of ETF Store, pointed out that BlackRock’s iShares Ethereum ETF is now one of the top six ETF launches in 2024.

Geraci remarked:

“The iShares Ethereum ETF has attracted over $900 million in less than three weeks and is likely to hit $1 billion this week.”

Meanwhile, Bitcoin had a mixed performance last week. The flagship digital asset started the week with outflows but saw a trend reversal towards the end, as investors piled in $13 million to BTC-related investment products.

In contrast, short Bitcoin ETPs experienced their most significant outflows since May 2023, amounting to $16 million, or 23% of its AUM. This reduction in AUM for short positions reflects a significant investor withdrawal.

Other digital assets, including Solana, XRP, Cardano, and Litecoin, also saw modest inflows of about $6 million last week.

Interestingly, inflows were seen in all regions, indicating a broad positive sentiment toward the asset class following the recent price correction.

The US led with $89 million, followed by Switzerland with $20 million, Brazil with $19 million, and Canada with $12.6 million. However, the US remains the only country to experience net outflows month-to-date, totaling $306 million.

Farside Investors

Farside Investors