Despite industry objections, SEC’s Gensler continues to classify crypto as securities

Despite industry objections, SEC’s Gensler continues to classify crypto as securities Despite industry objections, SEC’s Gensler continues to classify crypto as securities

Gensler doubles down on crypto regulations amidst industry backlash and legal setbacks.

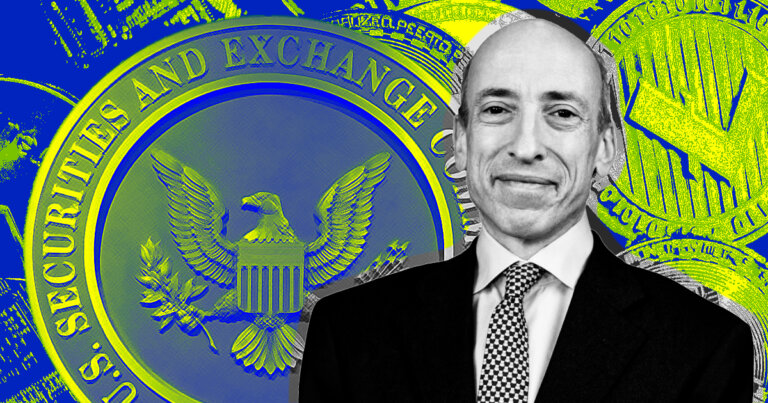

SEC.gov. Remixed by CryptoSlate

Securities and Exchange Commission (SEC) Chairman Gary Gensler remains steadfast that most cryptocurrencies fall under the agency’s securities regulations despite ongoing criticism from the crypto industry.

In written testimony on Sept. 12 for the Senate Banking Committee, Gensler reiterated the SEC’s strict stance that crypto trading platforms and intermediaries must register with the agency as exchanges, broker-dealers, and clearing agencies.

Gensler stated,

“There is nothing about the crypto asset securities markets that suggests that investors and issuers are less deserving of the protections of our securities laws,”

The SEC chair argued that because the 1930s securities laws define securities expansively to include “investment contracts,” most cryptocurrencies and crypto tokens meet the definition of securities subject to SEC regulation.

Gensler justified the SEC’s recent spate of enforcement actions against major crypto firms. He said,

“Given this industry’s wide-ranging noncompliance with securities laws, it’s not surprising we’ve seen many problems,”

However, the crypto industry has argued that sweeping regulations fail to account for the unique nature of digital assets.

Others have accused the SEC of overreach in attempting to stretch decades-old securities laws to emerging crypto finance models like decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) protocols.

However, Gensler’s strict regulatory approach faces ongoing legal challenges that may undermine the SEC’s ability to bring crypto firms into compliance. The recent court ruling in the Ripple case delivered a partial victory to the company, judging that some XRP token sales did not constitute unregistered securities.

Specifically, the judge determined retail sales and free distributions of XRP did not meet the legal test for securities. While declaring Ripple’s institutional sales were securities offerings, the nuanced ruling suggests crypto assets may not fit neatly into 1930s-era regulations. Some industry experts argue this shows gaps in the SEC’s conceptual approach to crypto finance. Nevertheless, Gensler expressed disappointment, and the SEC has since challenged the judge’s conclusions on retail XRP sales.

CryptoQuant

CryptoQuant