Bullish or bearish? Crypto analysts share views for the rest of 2021

Bullish or bearish? Crypto analysts share views for the rest of 2021 Bullish or bearish? Crypto analysts share views for the rest of 2021

After witnessing one of the most significant sell-offs in crypto history, the May 19 crash, most remain uncertain about the direction of the market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It appears that the cryptocurrency industry is positioned to continue its growth from a long-term perspective. However, sentiment for the near future may not be so positive.

A major move for Bitcoin has still to materialize, as the price has hovered between roughly the $30,000 and $40,000 range for the last weeks. Several cryptocurrency experts are still undecided about the direction of the market, however, several technical indicators show that bearish times are ahead of us and that a V-shaped recovery is unlikely to play out in the charts.

The Death Cross is here

In order to know if we really are in a bear market, some argue we must look at two important indicators. First, Bitcoin must be below the 21 week EMA (exponential moving average), which it has been for the last month. And secondly, it must have a death cross, which just so happened to occur three days ago.

The aforementioned indicator, grimly named the death cross, takes place when the 50-day moving average crosses below the 200-day moving average which indicates a shift from a bullish to bearish momentum.

NFT silent crash

The Non-Fungible Tokens (NFTs) silent crash was another major red flag, suggesting an upcoming substantial market correction. The crash went largely unnoticed because the NFT market was highly illiquid, as prices take a long time to adjust.

Hence the crash was “silent”, and many investors failed to realize that NFT hype started dying off as early as the beginning of April. We asked Carlos Prada, co-founder of NF3, a NFT agency for artists and buyers, where the NFT market is headed. He remarked:

“At first glance, the NFT and cryptocurrency speculative market seem to be highly correlated. However, NFTs are becoming a new industry of their own, a new way to lift artists, organize new forms of charity endeavours and more. As so, there is much more than the usual speculation when it comes to the NFT market. On the other hand, speculators still hold weight for now, but in the end, the NFT market is bound to expand no matter how bearish the crypto market is”

At the time of writing, and even though sales have continued to plummet, NFTs are seeing a resurgence. Several new initiatives from several big players such as CNN, Fox, Instagram, and even the US Space Force are working with this technology which means that the NFT bubble may have “popped”, but the sector is still primed for expansion

NFT sales and active wallets fell by more than 40% in the past month but new layer-2 infrastructure are preparing the sector for the next surge. Moreover, we are also seeing physical NFT art galleries popping up all over, like in Miami and Dallas, Texas, a sign that the craze has not died off completely.

Short-lived relief rally

There is a saying among the crypto community stating that good news doesn’t lead to positive price action in a bear market, and bad news has little to no impact during a bull market.

The positive price action brought about by Elon Musk’s latest tweet was short-lived. On June 14, the price of Bitcoin surged 11% after Musk announced Tesla would accept the cryptocurrency as a payment method again once 50% of the energy used in the network came from renewable sources. Unfortunately, the positive momentum was unsustainable as Bitcoin failed to go above or even maintain $40,000 levels.

We asked Umar Malik, professional trader and crypto-asset manager at Malik Capital LLC if there are any technical indicators that suggest that we are still in a bull market, or might return to one very soon. Malik noted:

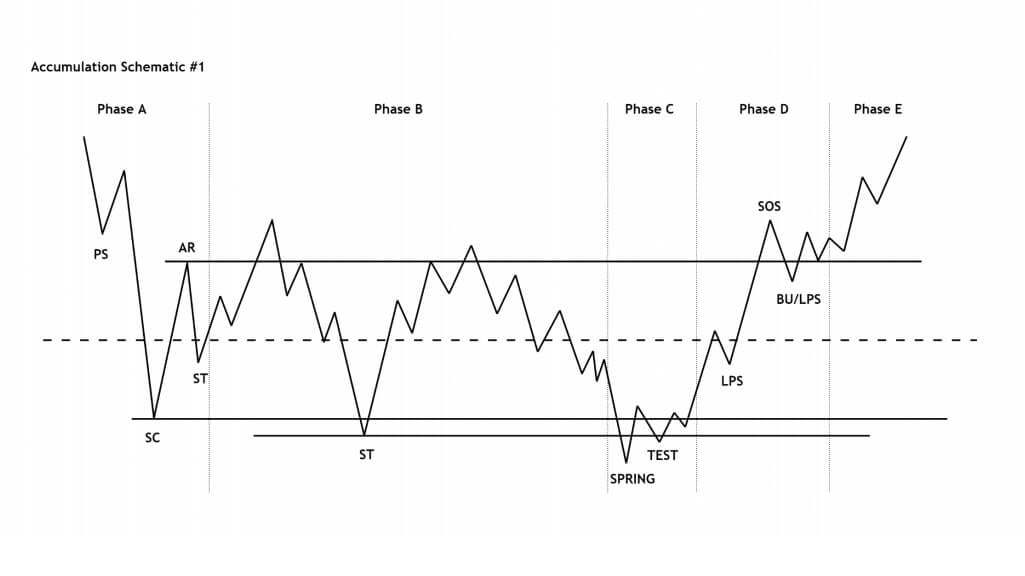

“If we take the Wyckoff Accumulation pattern we can see that we’re in phase C more likely we’re entering in Phase C, if you look at the “Spring” it goes below the previous lows, hopefully it will close above again. Phace C it’s to shake out the last “weak-hands”. In the immediate short term everything seems extremely bullish, we just have to zoom out and get the bigger picture. A lot of retail investors made the market very “volatile” and “weak”. Bitcoin is following the same trajectory as the Wyckoff pattern.”

Other bearish news also took a toll on the market. A wave of selling swept across several markets, not just crypto, as Jerome Powell, the US Federal Reserve chairman, stated that interest rates might rise in 2023. In addition, the US Dollar is showing signs of strength, which historically has hurt crypto, and there is now a significant threat to Bitcoin adoption in El Salvador.

El Salvador fakeout

The news of El Salvador becoming the first country in history to adopt Bitcoin as a legal tender sent shockwaves in the crypto world. However, it may all have been too good to be true, as political opposition is now filing a lawsuit alleging that Bitcoin adoption is unconstitutional and could be harmful to El Salvador.

The World Bank has also rejected El Salvador’s request for help on the transition to Bitcoin. It was somehow to be expected though, as Bitcoin presents a genuine and dangerous threat to the banking establishment.

Unfortunately, this might discourage other Latin American countries who had recently express interest in also adopting Bitcoin. Third-world countries tend to be heavily dependant on the World Bank and its monetary policies and defiance could bring great financial downsides.

The World Bank cited environmental and transparency concerns as the reasons behind the refusal. It seems that, as of late, heavy scrutiny has fallen over Bitcoin and the pollution inherent to the functioning of its network. However, the Bitcoin network offers immense value and reports suggest that it uses significantly less energy than the banking industry.

As if that wasn’t enough pressure for miners, the industry will also need to adapt to upcoming geopolitical restrictions. We asked Francois-Xavier Copé, Co-founder and managing partner at First Bridge Ventures, if the World Bank rejection could spell doom for other countries who were showing interest in Bitcoin adoption as a currency. He said:

“Yes! Developing countries rely too much on the WB and international creditors to be in a position to defy it. Developed countries are too dependent on QE and easing monetary policies to allow Bitcoin to threaten that order”

China’s crackdown on miners

Bitcoin mining has historically been synonymous with China and its coal mines, which is why the recent efforts from the Chinese government to shut down miners are causing such turmoil in the market.

After an announcement last month from that state, it seems that China is now speeding up its effort to target and ban miners from operating on its territory. As a result, several of the largest bitcoin mining provinces were forced to close their facilities this week. Sources claim that 90% of mining operations in the country are now offline. Whit Gibbs, Co-founder and CEO at Compass Mining told CryptoSlate:

“As Chinese Miners look to move their hardware to new facilities abroad, there is tremendous opportunity for new nations to emerge as mining hubs. Although most of the hashrate will find it’s home in North America, I also foresee a good amount going to Kazakhstan, Russian, and parts of South America where electricity and operational expenses are cheaper than North America.”

The Chinese government had also censored crypto exchanges from search engines and now ordered Alibaba Cloud, China’s largest cloud service provider, to cancel domains belonging to cryptocurrency and mining companies.

Although this is potentially devastating, it could be healthy in the long term. The migration of Bitcoin mining operations from China to other countries could make the network more decentralized and less dependant on fossil fuel energy. Gibbs continued:

“Fortunately Bitcoin Mining is resilient by design, so you can count on Miners adapting to any changes which come our way! The heavy centralization of bitcoin’s hashrate in China has been cause for concern over the years. Now with these nationwide mining bans, this threat to Bitcoin is seemingly coming to an end. Longterm this Chinese Miner exodus is bullish for Bitcoin’s network security. Short term it’s bullish because the decrease in hashrate may lead to another period of extreme profitability for all the Miners around the world with machines plugged in.”

A case for the bulls: it will be different this time

Although many people will look at Bitcoin and say that this bull run did not have a typical market cycle top, the same can not be said about the total cryptocurrency market cap. If we consider altcoins, the total crypto market cap graph clearly shows a well-defined blow-off top, followed by a considerable correction.

Some suggest the crash was planned and orchestrated by whales. However, there was plenty of evidence showing that things were overheated. As Bitcoin struggled to put in substantial new all-time highs, the market became fatigued and resembled a Wycoff distribution almost to perfection. The massive influx of new and inexperienced investors into the space also acted as a timing bomb, triggering the potential for colossal sell-offs.

A period of consolidation may be upon us for the following months. However, this may be a short-lived bear market. Some analysts point out that the characteristics of the current market cycle share a lot of similarities with the 2013/2014 cycle, where there was a double peak separated by roughly a year. If that would be the case, the current run might just belong to a larger super cycle. Jonathan Hobbs, CFA and author of the Digital Assets book, said:

“A double top cycle similar to what we saw in 2013 is just one possibility. But I only see that happening if bitcoin holds the $30,000 level for the next few months. If we break below $30,000 on the daily chart, I see us going much further down. At this point, market sentiment would be crushed and my guess is that we would go into a longer crypto winter. When investors lose money buying in a bull run, it takes a long time for those financial scars to heal and for new money to enter the market.

Hobbs continued:

“Also, remember that we have already had two peaks since the bottom of the last bear market. In 2019 Bitcoin rallied over 300 percent off its lows. And since the Corona crash it has rallied about 1,600 percent. Am I bullish on bitcoin over the next 5 to 10 years? Yes. Fundamentally there are plenty of reasons to dollar cost average into bitcoin – especially longer-term. But as a trader, if I look at the bitcoin chart right now and pretend that it is a chart of a different asset, I have to be bearish and assume that the downtrend continues until proven otherwise.”

Institutions are also in this time, and they are known for their diamond hands. If this theory proves itself correct, we should see less volatility in the price of Bitcoin. There is also a growing interest in digital assets from both institutions and regular people, so banks are making efforts to make Bitcoin investing available to their customers.

While the recent stabilization might not yet be over, bulls have firmly held the $30,000 level so far and data suggest this might be an excellent time to buy Bitcoin.

This post is a free example of the types of content we show to our CryptoSlate Edge subscribers. For more information, please click here.

Bitcoin Market Data

At the time of press 1:25 pm UTC on Jun. 25, 2021, Bitcoin is ranked #1 by market cap and the price is down 1.6% over the past 24 hours. Bitcoin has a market capitalization of $627.22 billion with a 24-hour trading volume of $35.07 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:25 pm UTC on Jun. 25, 2021, the total crypto market is valued at at $1.34 trillion with a 24-hour volume of $82.63 billion. Bitcoin dominance is currently at 46.90%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant