Report: 83% of US retailers think ‘digital currencies’ will become legal tender in 10 years

Report: 83% of US retailers think ‘digital currencies’ will become legal tender in 10 years Report: 83% of US retailers think ‘digital currencies’ will become legal tender in 10 years

An overwhelming majority of Deloitte respondents believe that crypto payments would become prevalent in their industry within the next five years.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

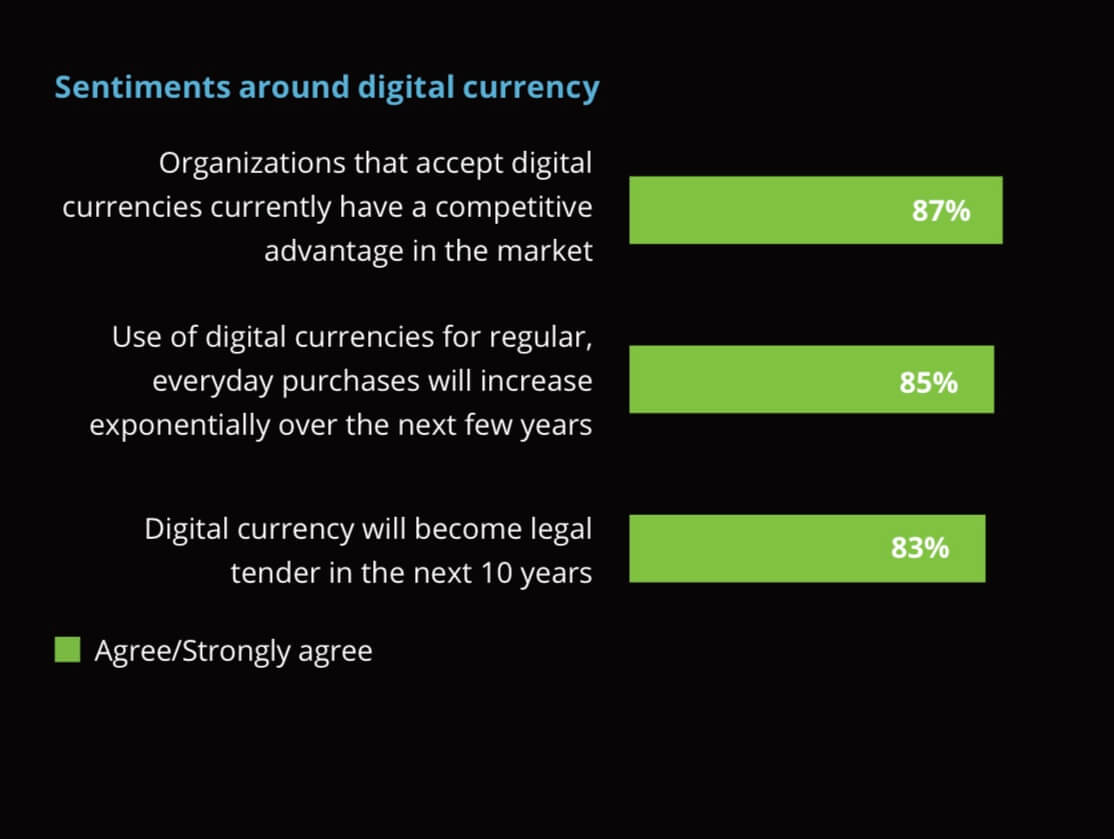

A new Deloitte survey has revealed that US retailers believe that crypto adoption among businesses will rise to a new high as 83% of them think ‘digital currencies’ will become a legal tender within the next ten years.

The report highlighted that 85% of the respondents expect crypto use for purchase to increase significantly over the same time frame.

To stay ahead of the curve, 75% of US retailers have begun plans to start accepting crypto or stablecoin payments within the next two years.

Over 50% of retailers with revenue above $500 million have allocated at least $1 million of their budgets to building payment infrastructures for crypto.

On the other hand, 73% of retailers making between $10 million and $100 million annually are also investing between $100,000 to $1 million to build the necessary infrastructure for crypto payments.

Additionally, the survey revealed that 87% of retailers currently accepting crypto payments believe that they have a competitive advantage in the market presently.

The report is titled “Merchants Getting Ready For Crypto” and was prepared in partnership with PayPal. The report surveyed 2000 senior executives at diverse US retail organizations such as electronics, cosmetics, fashion, digital goods, foods, beverages, etc.

Consumer crypto interest is pushing businesses to act

Consumer interest in crypto is at the root of the merchants’ plans of adoption. 64% of the retailers claim that their consumers have shown significant interest in crypto payments, and around 83% expect this interest to rise.

Around 50% of the surveyed retailers believe that adopting crypto payments will help improve their consumer experience and expand their customer base. In addition, 40% hope that it will help create a better perception of their brand in the public’s minds.

Merchants identify challenges

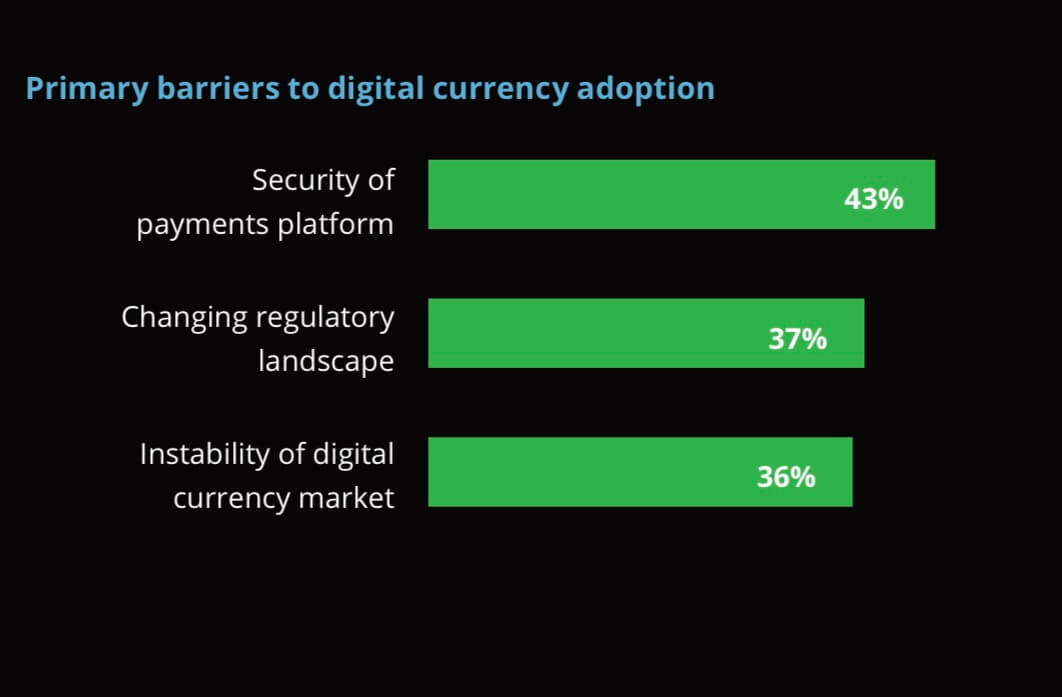

While the retailers have expressed high optimism and shown great belief in the crypto industry’s growth, they also have identified certain challenges that could hinder the adoption of the space.

According to the report, the volatile nature of the industry, alongside other issues like the security of payment systems and the need for regulatory clarity, could impede the adoption.

Another challenge identified is integrating crypto with the traditional financial system. However, that could change over time as a new US bill submitted by Senators Cynthia Lummis and Kirsten Gillibrand looks to incorporate crypto into the traditional financial system.

Farside Investors

Farside Investors

CoinGlass

CoinGlass