Why this fund manager expects a major pullback in stocks and Bitcoin soon

Why this fund manager expects a major pullback in stocks and Bitcoin soon Why this fund manager expects a major pullback in stocks and Bitcoin soon

Economic uncertainty is high as David Tice reminds us that money printing has consequences.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Principal at Moran Tice Capital Management, David Tice, said right now is a dangerous time for both stock and Bitcoin investors.

Tice sold his investment management firm, Prudent Bear Funds, in 2008, during the last major financial downturn. As such, some credit him with a knack for sensing trouble in the markets.

Now, in what makes for an uncomfortable read, Tice sounds the alarm by calling this a “dangerous market.”

Tice says meltdown is coming

Pointing to macroeconomic headwinds, Tice believes a market meltdown is unavoidable at this point. In supporting his position, Tice talks about the massive overvaluation of assets and unprecedented levels of debt.

“The market is very overpriced in terms of future earnings. We are adding debt like we’ve never seen.”

In particular, Tice raises concerns over tech stocks, especially the FAANG stocks, saying rising costs are putting pressure on companies in this sector.

“A lot of money has been thrown at Alphabet and Microsoft, Apple and Facebook, Twitter, etc.,” noted Tice. “Costs are going up in that sector.”

Although Tice began the year as a Bitcoin bull, this soon changed after BTC hit $60,000. Since then, he’s turned bearish on the leading cryptocurrency, calling it “long in the tooth.”

Also, with increasingly negative sentiment from central banks, Tice urges cryptocurrency hodlers to exercise caution.

“However, when it got to $60,000 we felt like that was long in the tooth… Lately, there’s been a lot more uproar from central bankers, Bank for International Settlements [and] the Bank of England have made profound negative statements. I think it’s very dangerous to hold today.”

Bitcoin is sinking, or is it?

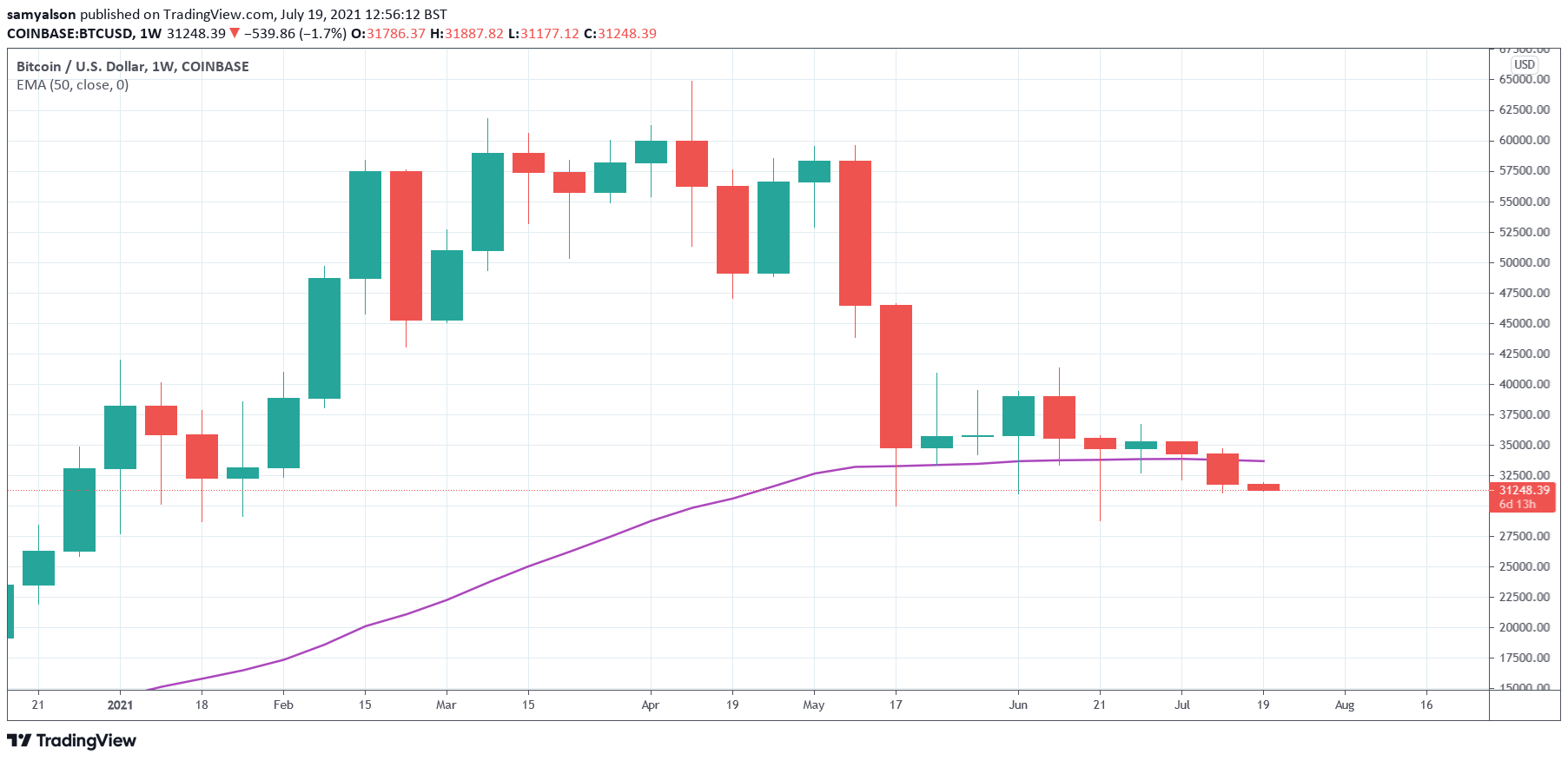

Bitcoin is 52% down from its local top 15 weeks ago. A lot has happened in that time, but the overall attitude has been of fear and uncertainty throughout this period.

This situation is helped by Bitcoin closing last week at its lowest level in 2021 to date. Similarly, this led to the loss of the 50 exponential moving average.

Despite that, and Tice’s bearish notice above, some analysts hold hope that the next few weeks will mark a turnaround for Bitcoin and the rest of the crypto markets.

At present, several indicators suggest bulls could be on the verge of making a return. This includes the return of Bitcoin whales, who, this month, began accumulating once again.

? #Bitcoin's whale addresses holding between 100 to 10k $BTC kicked off July with a 60k $BTC accumulation apike, the highest daily spike of 2021. These addresses hold 9.12M coins combined after holding 100k less $BTC just 6 weeks ago. https://t.co/RmbojWllGv pic.twitter.com/9Mp65UfGyV

— Santiment (@santimentfeed) July 4, 2021

Plus, Bitcoin on crypto exchanges continues to fall, indicating sellers are exhausted, and the exchange supply is dwindling. All of which suggest a short squeeze is on the cards.

All the same, we still find ourselves in a precarious situation. Based on March 2020’s “covid crash,” regardless of whale accumulation or decreasing exchange supply, an economic meltdown would likely crash the Bitcoin price.

Farside Investors

Farside Investors

CoinGlass

CoinGlass