3 reasons Bitcoin spot volume reaching new yearly peak is highly optimistic

3 reasons Bitcoin spot volume reaching new yearly peak is highly optimistic 3 reasons Bitcoin spot volume reaching new yearly peak is highly optimistic

Photo by Andrews Art on Unsplash

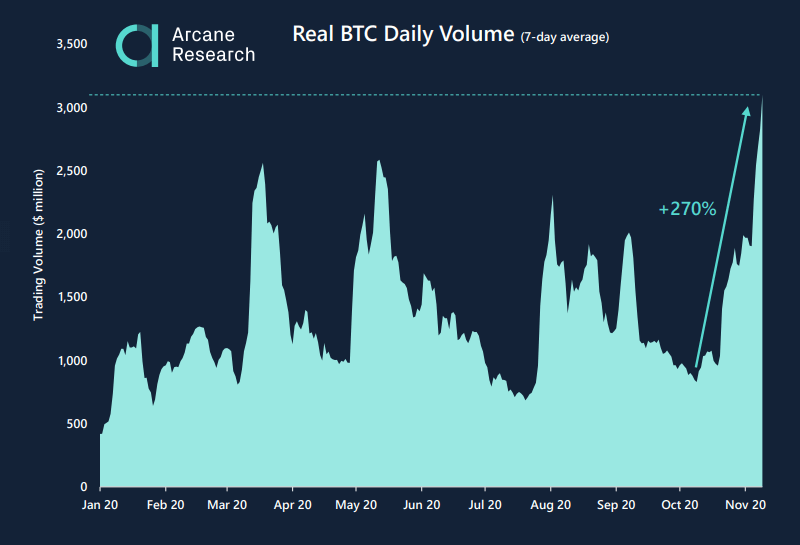

According to the data from Arcane Research, the spot volume of Bitcoin has reached a new yearly high. This figure is particularly optimistic for the short to medium term trend of BTC because it reflects the growth of real and verifiable trading volume.

Since late October of this year, the spot volume of Bitcoin rose by more than 270%. It coincides with BTC’s rally above $15,000 and the repeated retest of the $16,000 resistance.

Bitcoin’s spot volume rising is a highly positive trend for three key reasons. First, it shows genuine trading volume from retail traders. Second, it means the market is spot driven, not led by derivatives. Third, it allows for a more sustainable rally.

Genuine demand from retail traders

The term spot market refers to markets that allow crypto-to-crypto or crypto-to-fiat trades without additional leverage.

Usually, the spot market reflects real buyer demand from retail traders because it is harder to spoof the market without leverage.

Arcane Research analysts found that the spot market’s volume increased 270% in the past month. They wrote:

“Bitcoin continues to impress and almost touched $16,000 last week. The rest of the crypto market is also seeing massive returns at the moment and the market sentiment is at historical high levels. The bitcoin spot volume has increased more than 270% over the past month and is now at the highest level seen in 2020.”

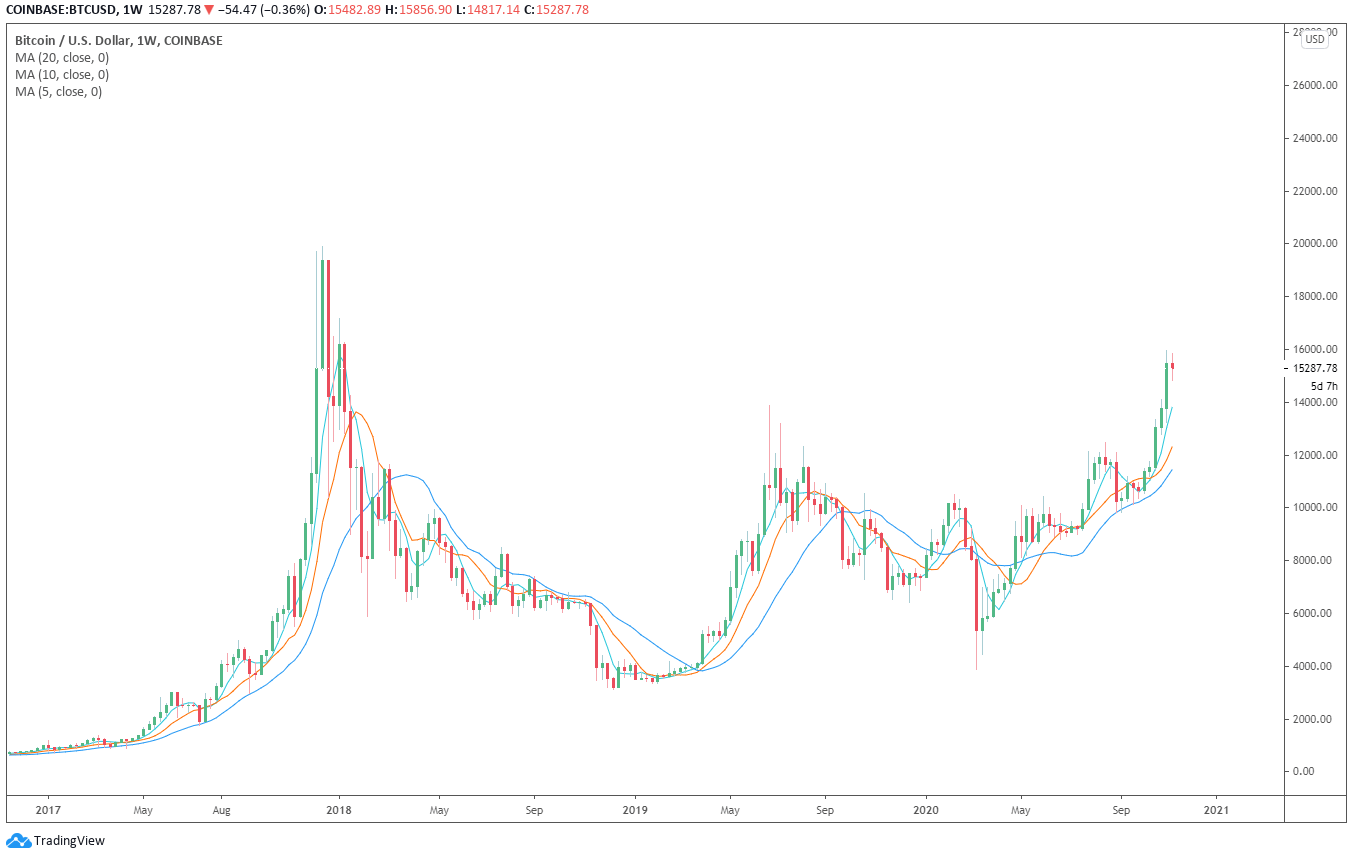

This is a spot-driven Bitcoin rally

The rapid growth of the spot market shows that the ongoing Bitcoin rally is driven by the spot market, not derivatives.

When derivatives, such as futures contracts, become the primary driver of a Bitcoin uptrend, it leaves BTC vulnerable to large pullbacks.

Large long squeezes could occur, causing cascading liquidations and massive volatility. But, when Bitcoin is led by the spot market, the probability of a sudden correction is lower.

A more sustainable upsurge is likely to happen

Atop the rising spot volume, even in the derivatives market, institution-tailored platforms are taking a larger market share.

Arcane Research said that the open interest on CME has been surging, reaching $1 billion. CME, along with platforms like Bakkt and LMAX Digital, tailor to institutional investors. Since institutions typically invest with a long-term investment thesis, this trend is beneficial for BTC over the medium to long term. The analysts said:

“The open interest on CME has surged lately and is nearing $1 billion. The number of large traders on CME has more than doubled this year. Another sign of increased institutional demand for bitcoin.”

The confluence of a spot market-driven Bitcoin rally, growing volume of CME, and the increasing retail demand could further strengthen the current momentum of BTC. It would also reduce the likelihood of major trend reversals in the foreseeable future, due to the overall market structure.

Bitcoin Market Data

At the time of press 11:48 am UTC on Nov. 11, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.61% over the past 24 hours. Bitcoin has a market capitalization of $290.4 billion with a 24-hour trading volume of $28.24 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 11:48 am UTC on Nov. 11, 2020, the total crypto market is valued at at $451.94 billion with a 24-hour volume of $111.06 billion. Bitcoin dominance is currently at 64.24%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant