Wrapped Bitcoin will now have a 40% collateral factor on Compound

Wrapped Bitcoin will now have a 40% collateral factor on Compound Wrapped Bitcoin will now have a 40% collateral factor on Compound

Photo by Oleksii S on Unsplash

A proposal by Alameda Research last week to increase the collateral for Wrapped Bitcoin (WBTC) to 40 percent was passed today after a governance poll on Compound Labs.

After implementation, users can use the ERC20 token backed 1:1 with Bitcoin to borrow other assets on the Compound platform.

WBTC confirmed the development early on July 12 via a tweet:

The governance has voted in favor of proposal 16

WBTC will have a 40% collateral factor on Compound https://t.co/kARLf4dOUk

— WBTC (@WrappedBTC) July 12, 2020

More exposure via BTC-pegged assets

Prior to the governance pool, WBTC was not available as a collateral option for users on Compound. However, the widespread use of ETH-based assets like DAI, USDC, and ETH saw users demand Bitcoin-based products for collateral usage.

At the time, users said Bitcoin has greater market liquidity than any other ETH-based asset and was subject to similar volatility. One major risk was that WBTC is “not trust-less and has a central point of failure.”

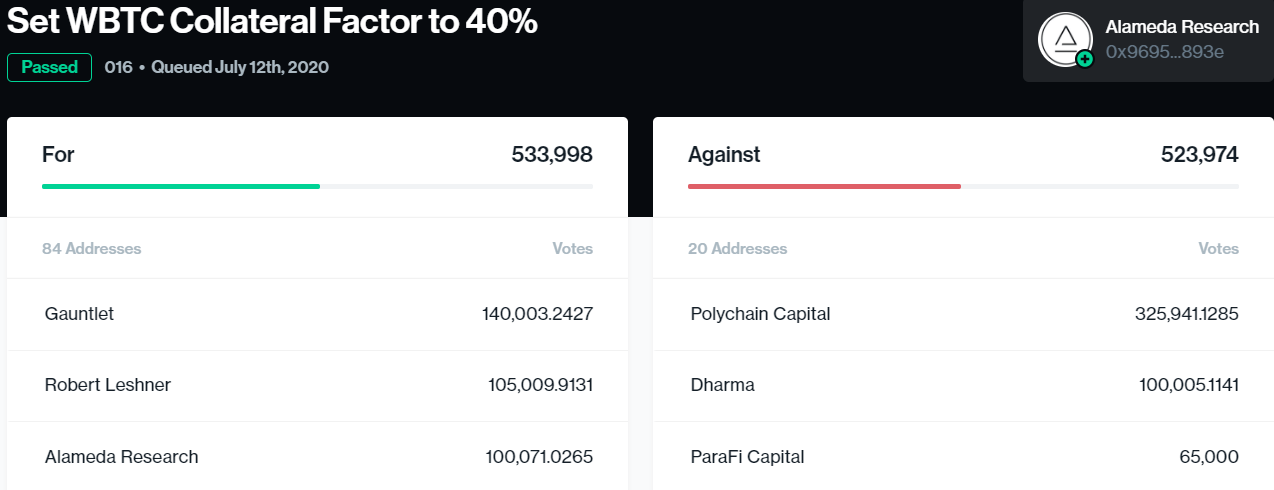

The proposal saw “for” and “against” members at loggerheads; with 533,998 votes for the former and 523,974 for the latter:

Polychain Capital accounted for 325, 941 “against” votes alone. They were followed by Dharma at 100,000 votes. Both firms are investors in Compound Labs but hold no special governance positions.

Compound founder Robert Leshner, Alameda Research, and Gauntlet Network were the biggest “for” voters by total governance votes.

Compound noted the proposal made “no changes beyond setting the Collateral Factor of WBTC to 40 percent.

Similar risks as DAI

Explaining the proposal on July 9, Alameda Research said the idea was floated previously but “the risk of large amounts of WBTC minting” caused most discussions to fall apart. However, the risk is believed to “be very low” upon further inspection.

That same risk is also present on USDC and DAI markets, noted Alameda Research, adding:

“We believe that adding more diversity to the set of usable collateral will decrease rather than increase the structural risk to the platform by moving some usage away from DAI and towards WBTC.”

Alameda Research said the change was justified and appropriate. In addition, it helps diversify the set of assets available to borrow on Compound. The proposal now sees more weightage for Bitcoin-based products than before.

The WBTC was earlier set for a collateral factor of 65 percent, but since reduced to 40 percent upon discussions with the community. Alameda Research still supports a change to the former but said it respects any community worries related to the specific proposal.

Meanwhile, Alameda and FTX founder Sam Bankman-Fried expressed his thoughts on the proposal’s success:

5) I remain excited about Compound, COMP, and the future of DeFi. Let's try to iron out the details and build products that can move the space–and the broader financial ecosystem–forward!

— SBF (@SBF_Alameda) July 12, 2020