Why investors are optimistic after “painful” DeFi correction despite YFI plunge

Why investors are optimistic after “painful” DeFi correction despite YFI plunge Why investors are optimistic after “painful” DeFi correction despite YFI plunge

Photo by Gabor Monori on Unsplash

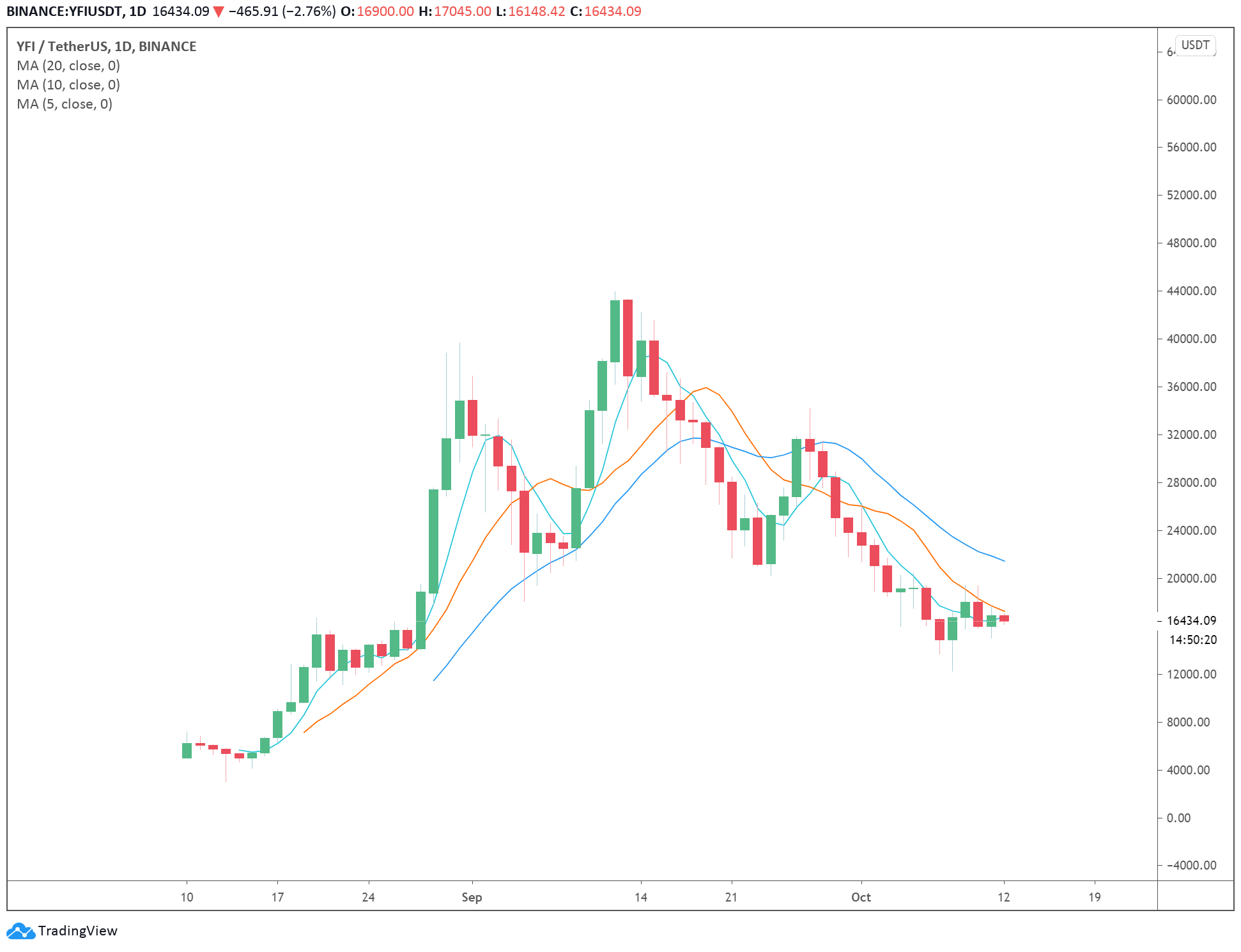

The prices of decentralized finance (DeFi) darlings Yearn.finance (YFI) and Uniswap (UNI) plummeted in the past week. Despite the DeFi marketwide correction, investors are positive that the pullback occurred.

In the past seven days, YFI and UNI declined by by 8.39% and 5.98% respectively. The stagnant short-term trend of the two assets come after a 40% to 60% drawdown since September.

Investor lays out three reasons the correction was important

Kelvin Koh, a partner at the Asia-based cryptocurrency investment firm Spartan Group, said the DeFi correction was important.

Before the market plunged, the DeFi space was rampant with projects offering extremely high yields that were unsustainable. As a result, there were many rugpulls, a term used to describe projects that essentially hit zero.

As the DeFi market recovers, unsustainable trends and projects would likely subside. The correction also shook weak hands, Koh explained, during a brutal and intense market drop. He said:

“I am glad we went through that big DeFi correction. As painful as it was, it accomplished a few things: 1. Washed out the weak hands 2. Gave us a sense of where value for DeFi assets are in a big drawdown 3. Hopefully killed off random food coins offering 10000% APY farming.”

The pullback was particularly “painful” because many major projects that were at the center of the recent DeFi cycle plummeted.

YFI, as an example, declined by more than 62% since September 2, from $43,996 to $16,330.

Many DeFi tokens dropped further as the price of Bitcoin surged above $11,000. Some attributed the trend to profits from the DeFi market cycling back into Bitcoin.

Others have been shorting YFI, UNI, and other DeFi tokens as a hedge as Bitcoin began to rally.

Most recently, Sam Bankman-Fried (SBF) confirmed on social media that he had shorted YFI with a 200 YFI position.

SBF, the CEO of FTX and Alameda Research, emphasized that his position did not cause YFI to crash.

But, there are likely more investors who were hedge shorting YFI because its funding rate on major futures platforms, like Binance, was consistently negative.

The confluence of an increasing number of investors shorting DeFi giants like YFI and the DeFi market’s correction led to overall market stagnance.

Is it too early for DeFi, like YFi, to take off?

The recent DeFi cycle mostly centered around yield farming, which requires significant technical knowledge.

Even carrying simple operations, such as investing in newly emerging DeFi protocols have been challenging to many. Unlike centralized exchanges, investors have to go through Metamask and Uniswap, which can be difficult to navigate.

Koh explained that family offices have been using funds to invest in DeFi. He said:

“Some of the family offices and HNWI are starting to get curious and they will get into the action via funds as it is too hard for them to do it themselves.”

The main roadblock in the next DeFi cycle remains to bring mainstream users on board. For now, it remains unclear if DeFi is simple and compelling enough to attract users from outside the cryptocurrency space.