The number of crypto whales is rising. Here’s where they’re coming from

The number of crypto whales is rising. Here’s where they’re coming from The number of crypto whales is rising. Here’s where they’re coming from

Image by Three-shots from Pixabay

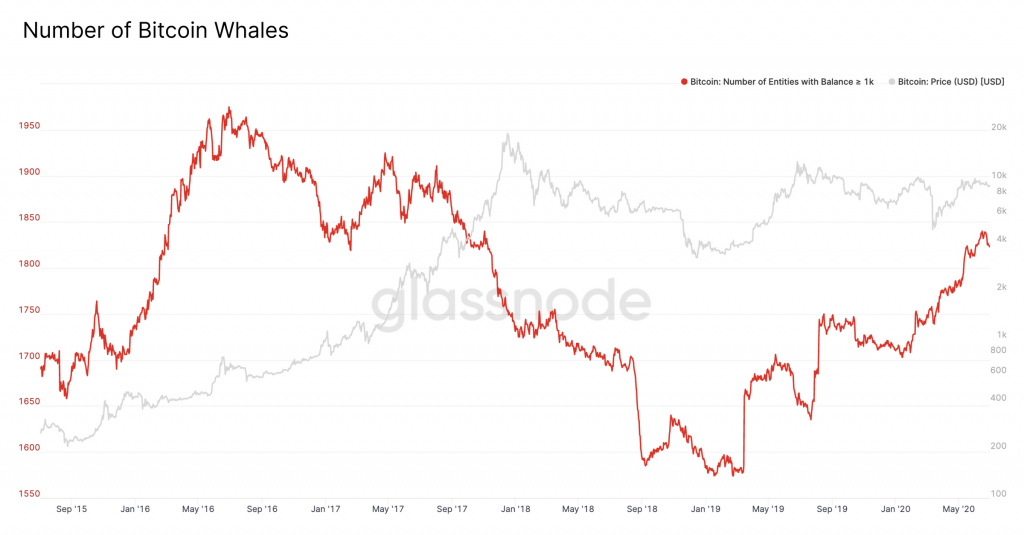

The number of Bitcoin whales has been rocketing higher since the start of 2019, pointing to an intense accumulation phase amongst these large investors who hold massive amounts of crypto.

The growth of this number seems to indicate that investors with access to large sums of capital do believe that the cryptocurrency’s long-term outlook is incredibly bright, as it is fast approaching its all-time highs that were set in May of 2018.

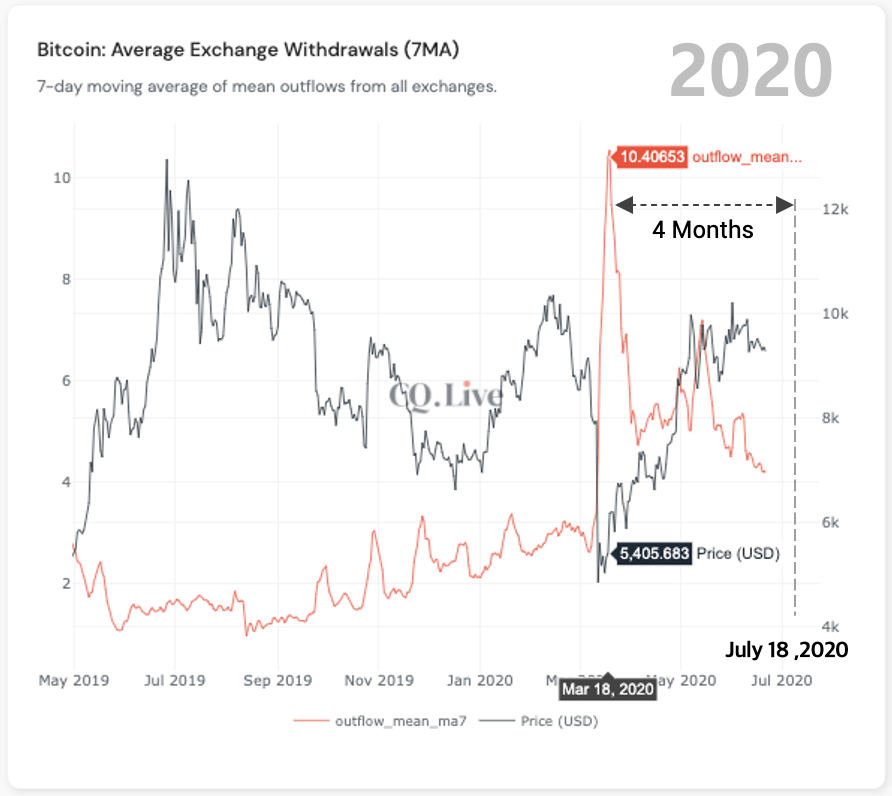

Data, however, indicates that this number is not growing due to new money entering the market, but rather due to these entities withdrawing BTC from exchanges.

Bitcoin whales now control 22% of the crypto’s circulating supply

The number of crypto whales – defined as entities holding more than 1,000 BTC – has been growing significantly as of late, also showing that the crypto market’s mid-term outlook remains bright.

Data from analytics platform Glassnode reveals this trend, with the below chart showing that the accumulation pattern first began in January of 2018 after sliding lower over a multi-year period.

The research firm explains:

“When we zoom out to view bitcoin’s full history, we see that the BTC balance held by whales peaked in early 2016, and then started decreasing consistently. Despite the increase in whale holdings this year, the balance of BTC held by whales is still well below the peak.”

At the present moment, whales wield approximately 22 percent of the total circulating Bitcoin supply.

Where are these whales coming from?

As for why this number is rising, Glassnode explains that it does not mark an influx of fresh capital into the market but is rather a result of these entities moving their crypto holdings away from exchange wallets and into cold storage.

This gives the appearance of there being more whales when in actuality it is just the result of funds shuffling between wallets.

“Much of the recent increase in the number of whales can be explained not by new money, but rather by existing wealthy entities withdrawing their BTC from exchanges.”

As CryptoSlate reported previously, crypto exchange outflows from whales tend to precede bull markets.

The report cites Ki Young Ju – the CEO of CryptoQuant – who noted that crypto bull markets tend to start four months after whale outflows from exchanges hit yearly highs.

“Buy BTC when whales send bitcoins out of the exchange. The BULL market usually starts four months after the exchange average withdrawal hits year-high…”

This means that the next few months could prove to be extremely positive for Bitcoin and the aggregated crypto market.

Farside Investors

Farside Investors