Post-halving volatility triggers significant Bitcoin futures liquidations

Post-halving volatility triggers significant Bitcoin futures liquidations Onchain Highlights

DEFINITION: The sum liquidated volume (USD Value) from long positions in futures contracts.

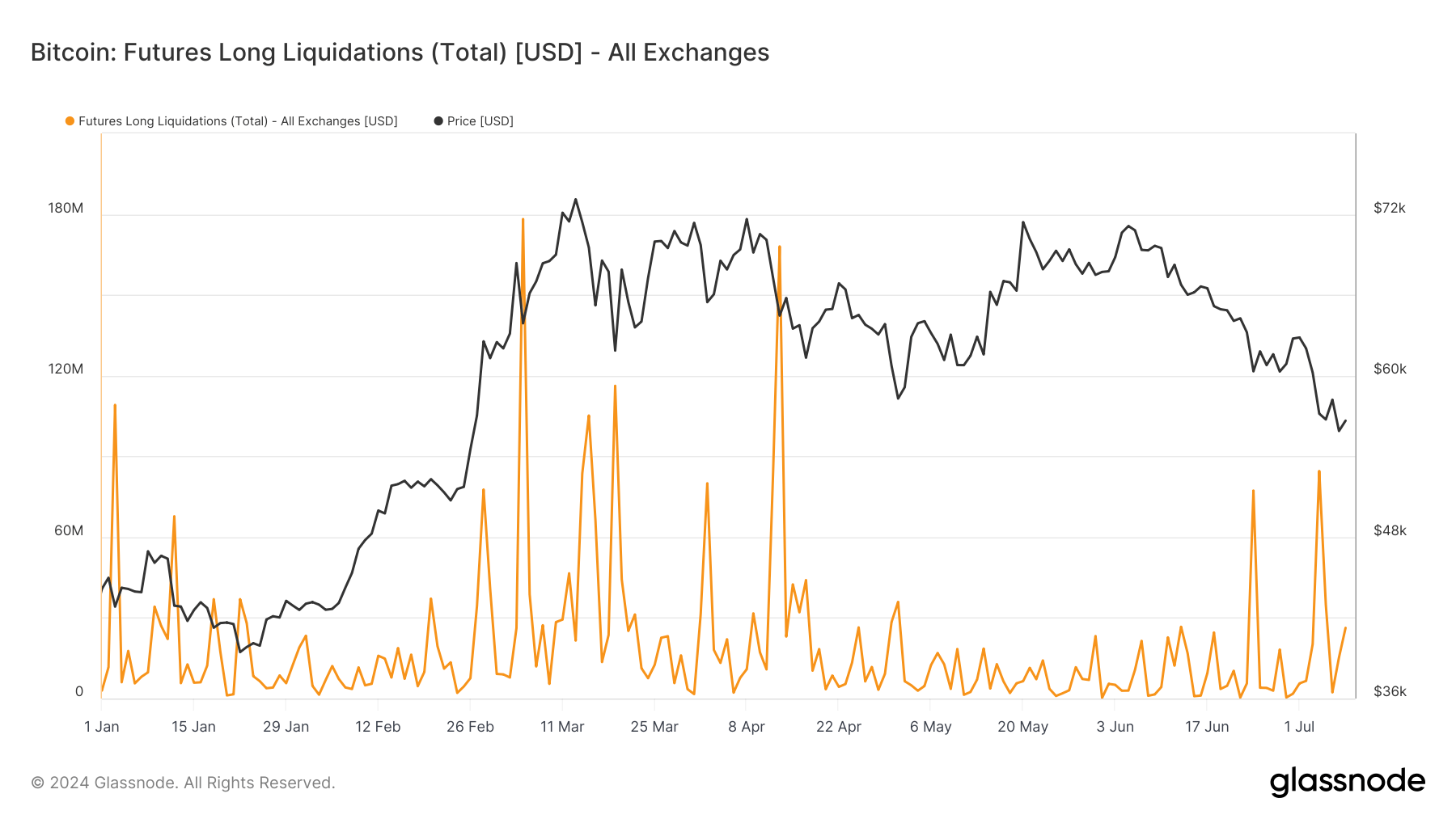

Over the past month, Bitcoin has experienced notable price fluctuations, with the price dropping from around $60,000 in mid-May to below $55,000 by early July. This period saw spikes in futures long liquidations, suggesting significant volatility in the market.

In early March, as Bitcoin’s price surged toward $70,000, liquidations also spiked exceeding — $180 million. This trend highlights the high-risk nature of leveraged trading during periods of rapid price movement.

Following the Bitcoin halving in April 2024, increased market volatility led to another surge in long liquidations, coinciding with a sharp decline in Bitcoin’s price.

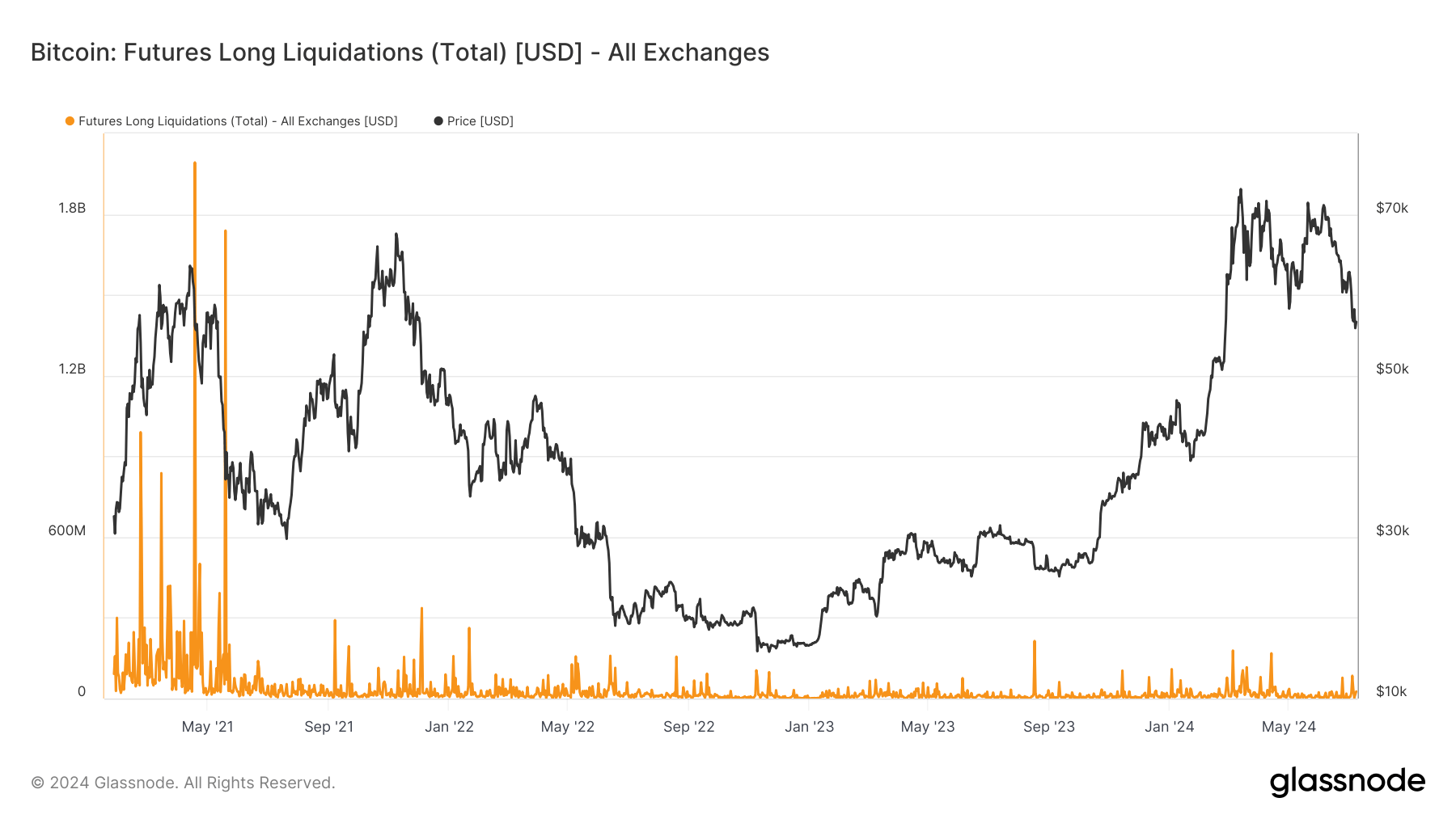

The current landscape shows a reduction in extreme liquidation events compared to 2021. During the previous bull run, Bitcoin’s volatile swings, particularly during the May crash, saw liquidations peak above $1.8 billion. This comparison indicates that while volatility persists, the market may have matured slightly, with somewhat reduced liquidation extremes.

CryptoQuant

CryptoQuant