Bitcoin’s short-term holder supply nears 2019 lows, hints at market consolidation

Bitcoin’s short-term holder supply nears 2019 lows, hints at market consolidation Onchain Highlights

DEFINITION:The total amount of circulating supply held by short term holders. Long- and Short-Term Holder supply is defined with respect to the entity’s averaged purchasing date with weights given by a logistic function centered at an age of 155 days and a transition width of 10 days.

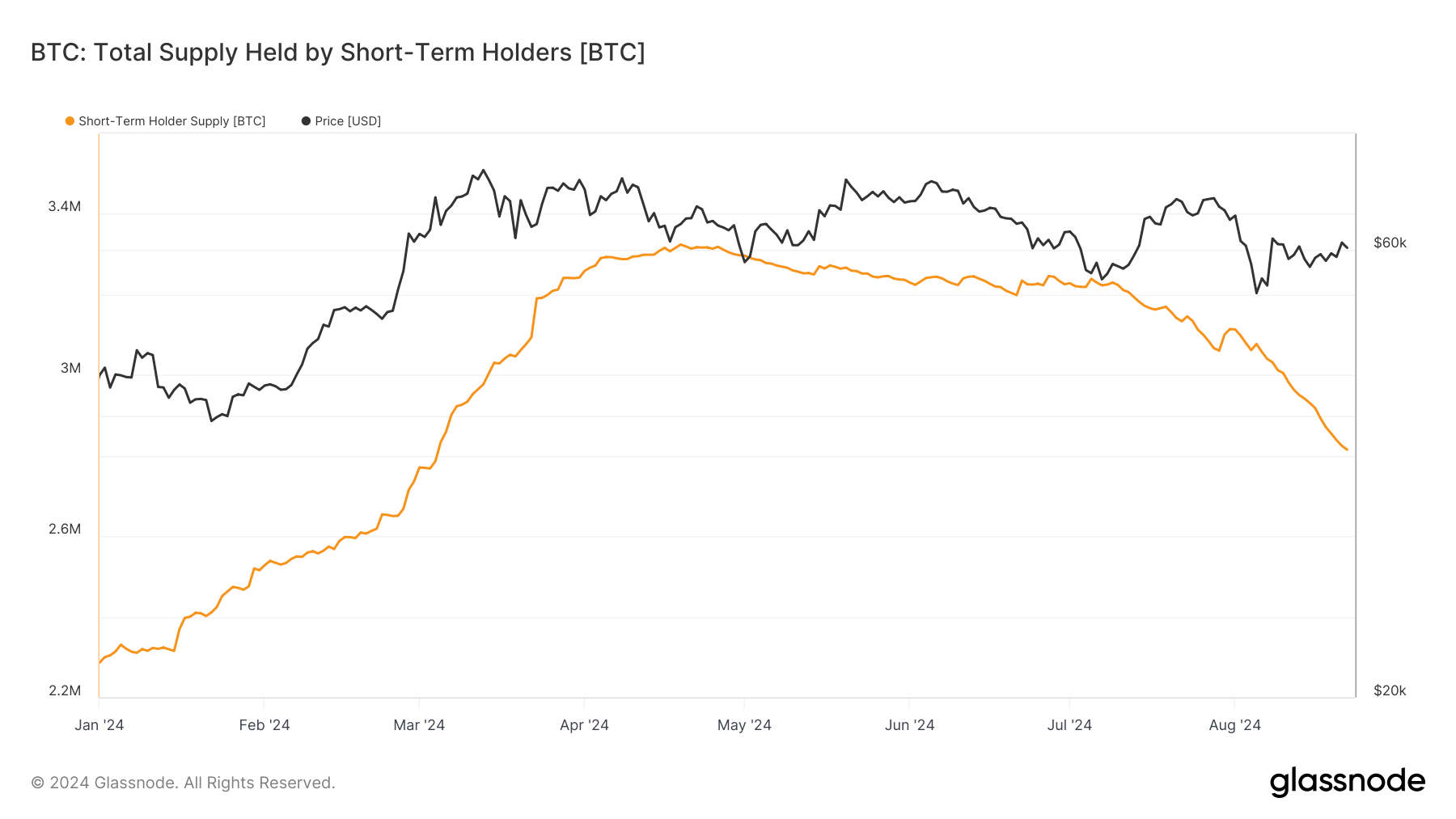

Bitcoin’s short-term holder supply has decreased markedly throughout 2024. The first chart illustrates a significant reduction from 3.3 million BTC in April to below 2.8 million BTC by late August. The chart shows that as the supply held by short-term holders decreased, Bitcoin’s price remained relatively stable, with only minor fluctuations.

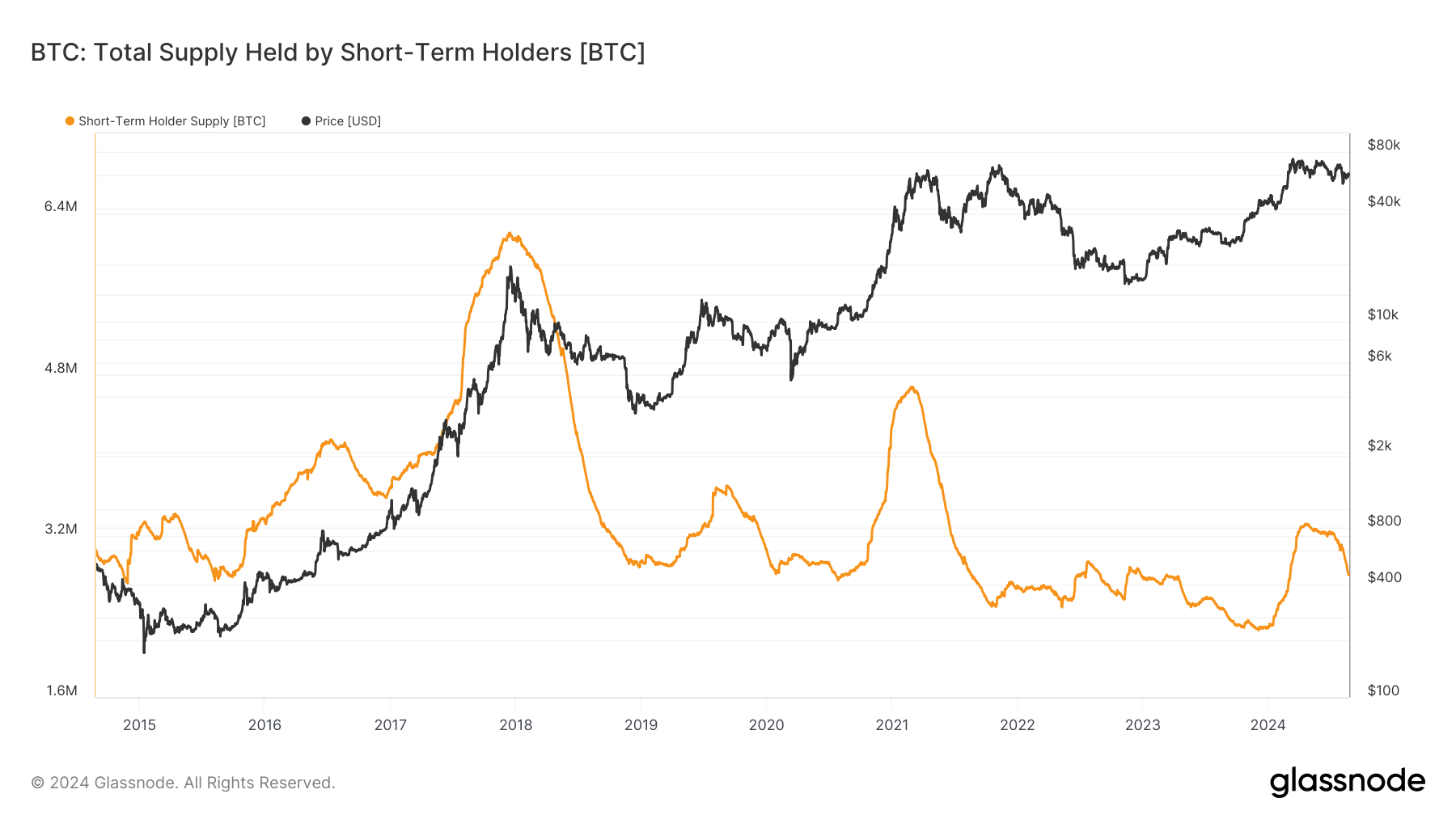

The second chart, offering a historical perspective, highlights that this level of short-term holder supply is approaching levels last seen during the 2019 and 2020 bear markets. This historical context may suggest that the current reduction could be an early indicator of a market consolidation phase, especially considering similar patterns observed in previous cycles. Bitcoin’s price resilience amid declining short-term supply indicates a potential accumulation by long-term holders.

CryptoQuant

CryptoQuant