FTX US looking for strategic acquisitions after ‘notable growth’ in users

FTX US looking for strategic acquisitions after ‘notable growth’ in users FTX US looking for strategic acquisitions after ‘notable growth’ in users

FTX U.S. is targeting acquisitions and mergers that can help it secure more users and win regulatory licenses.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

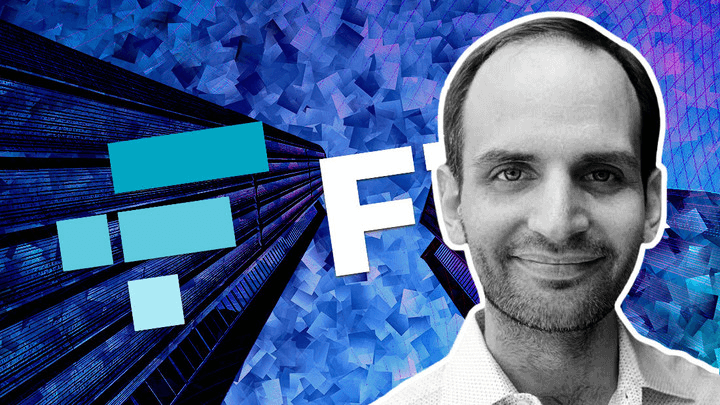

FTX US President Brett Harrison said the exchange is looking for strategic acquisition opportunities after seeing “notable growth” in users.

Harrison made the revelation at the World Economic Forum 2022 in Davos while discussing the exchange’s performance in 2021. Although the firm’s revenue numbers are not yet public, Harrison said FTX US saw “notable year-over-year growth in terms of user accounts.

He attributed this growth to the exchange’s increasing marketing efforts and an improved retail user experience. Other developments include launching a non-fungible token (NFT) marketplace and rolling out a stock trading interface.

Harrison said FTX US — valued at $8 billion — is unsure about disclosing plans for additional fundraising in 2022. However, he added that the company is in a good position in terms of capital and cash.

He further noted that the exchange aims to use these resources to strengthen its existing business, adequately fund its clearinghouse for its derivatives endeavors, and look around the market for potential merger and acquisition opportunities.

Regarding mergers and acquisitions, Harrison said FTX U.S. is targeting multiple sectors. Specifically, the firm is fishing for deals that will help expand its user base or win regulatory licensing.

FTX U.S. is planning to offer BTC and ETH futures

FTX US launched at the end of 2020, and its userbase has grown from 10,000 at the start of 2021 to 1.2 million users as of May. The exchange’s spot trading volume currently stands around $300 million.

Moreover, the company acquired LedgerX, which has the CFTC licenses required to run a futures exchange and clearinghouse in the U.S. Harrison added that FTX U.S. has already applied to offer Bitcoin (BTC) and Ethereum (ETH) futures to U.S customers.

According to him, the approval of this application would significantly boost the exchange’s potential profits. Explaining why FTX U.S. believes it can make a difference in the futures market, Harrison said FTX U.S plans to offer the first real-time 24/7 margin for futures. He further noted that talks with the CFTC have been positive thus far.

Praising the CFTC, Harrison said the regulator understands all the nuances of crypto trading. Moreover, Harrison said the watchdog understands all the innovations crypto players are trying to bring into the market.

CryptoQuant

CryptoQuant