Bitcoin mining difficulty reaches historic highs—and analysts say it’s bullish

Bitcoin mining difficulty reaches historic highs—and analysts say it’s bullish Bitcoin mining difficulty reaches historic highs—and analysts say it’s bullish

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

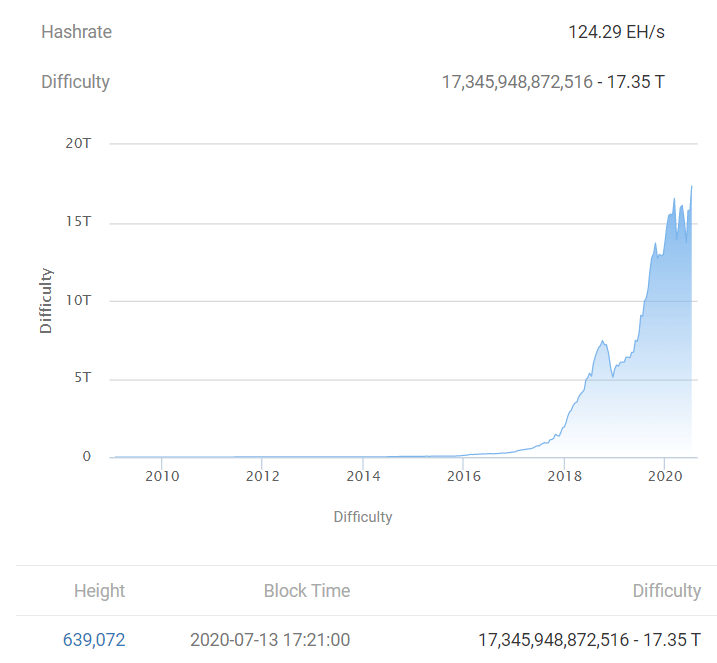

Bitcoin’s mining difficulty saw a 10 percent upward adjustment today, causing hash rates to reach a historic all-time high of 17 trillion.

Changes in mining difficulty alter the environment for Bitcoin miners, causing many to either leave the business or purchase better rigs to continue.

The activity has set off a proprietary indicator used by an algorithmic trader; it’s signaling a bull market ahead.

Bitcoin difficulty at ATHs

Data on BTC.com shows Bitcoin hash rate difficulty has crossed 17 Trillion. The metric comes less than two months after Bitcoin’s halving event on May 12:

Monday’s difficulty adjustment was around 9.87 percent. Analysts say this might cause widespread miner capitulation and see “weaker” miners leave the network.

Post-halving, the network downward adjusted on two occasions. Smaller miners continued their business, and overall activity was not affected. But a 14 percent upward adjust in June—one of the highest ever—meant hash rates reached a record high.

However, there are no fears of a miner centralization as such. As CryptoSlate reported previously, Bitcoin’s most dominant miners have no incentive to launch a 51% attack on the network—even as they increasingly become “stronger.”

While yesterday’s adjustment is a record level, for now, Bitcoin blocks adjust every 2016 blocks (about two weeks). The network may see a downward adjustment if miners are not able to process blocks quickly.

Higher hash rates mean higher costs for miners; who sell BTC at higher prices to keep their rigs running. The downward price pressure loosely correlates with falling hashing prices.

“A great bull run”

Meanwhile, one analyst is touting the start of a “great bull run.”

Charles Edwards, an algorithmic trader, tweeted yesterday the proprietary hash ribbon indicator had set off and indicated higher prices ahead:

#Bitcoin Hash Ribbons "Buy" signal just confirmed.

The post-Halving signal is particularly special.

It will probably be a very long time until the next occurs.…and so the great bull run begins.https://t.co/l90SDYs8kC

— Charles Edwards (@caprioleio) July 13, 2020

Edwards’ indicator similarly popped off in April this year, with Bitcoin surging from low-$7000s to over $10,000 in the following weeks.

But it’s not all fun and no work:

However, this may be the most high risk signal to date.

Why?

– All Halvings have had another capitulation

– Miners are running at break even today

– Global recession = tighter liquidity = credit crunchIn 2020 there is a greater probability of more miners defaulting.

— Charles Edwards (@caprioleio) April 25, 2020

He said in April that “all prior halvings had another capitulation within 3 months after the [event].”

“If considering Bitcoin accumulation for long-term positions which will be held for at least 1 year, “dollar-cost averaging” (buying in increments over the next 30 days) should be a good strategy,” concluded the Capriole asset manager at the time.

As per Edwards’ blog, the long-only Hash Ribbon calculates miner capitulation and sentiment to identify entry opportunities in Bitcoin.

CryptoQuant

CryptoQuant